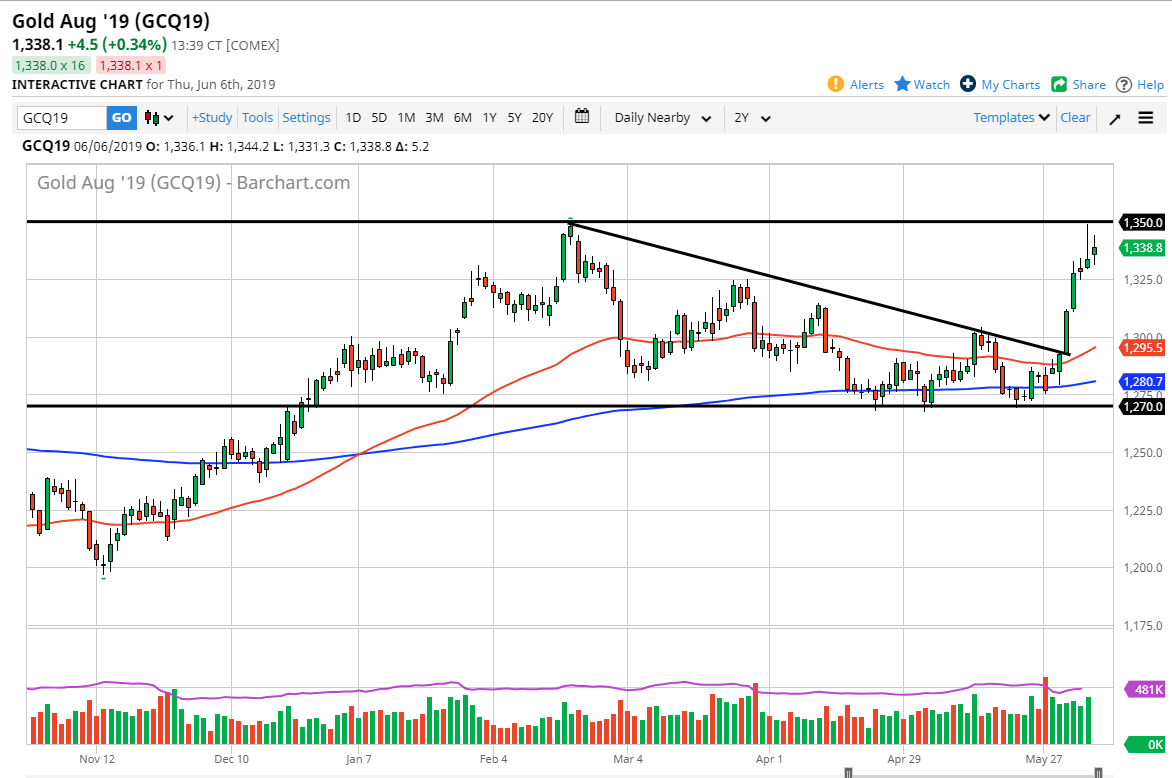

Gold markets went back and forth during trading on Thursday, grinding away yet again. However, we are running out of momentum as you would expect, being just below a major level. The $1350 level has caused resistance in the past, and of course the shooting star that we formed during the trading session on Wednesday will have only reinforced that concept.

With gold struggling here, it makes sense that perhaps we get a bit of a pullback. Beyond that, we had gotten so far ahead of ourselves that I think a bit of profit taking is most certainly in order. The $1350 level had caused the lot of resistance previously, and that’s where we started falling to drift down towards the $1270 level underneath. Bouncing from there back to this area in such a short term type of move suggests that we may be over bought. Ultimately, this is a market that has been overdone, so I think that the fact that we are heading into the jobs number makes a lot of sense and perhaps even gives us an opportunity or an excuse to rollover.

If we do break above the $1350 level, then it’s likely that we go to the $1400 level next. I would not be a buyer until that happens, and would probably even wait for some type of daily close above that level to start putting money to work. This is a major area that of course has been important more than once, and therefore I think there will be a lot of hesitancy to just simply jump straight in.

With all of that in mind, it simply makes more sense that we drift lower from here, and perhaps trying to break below the $1325 level on our way down to the $1300 level.