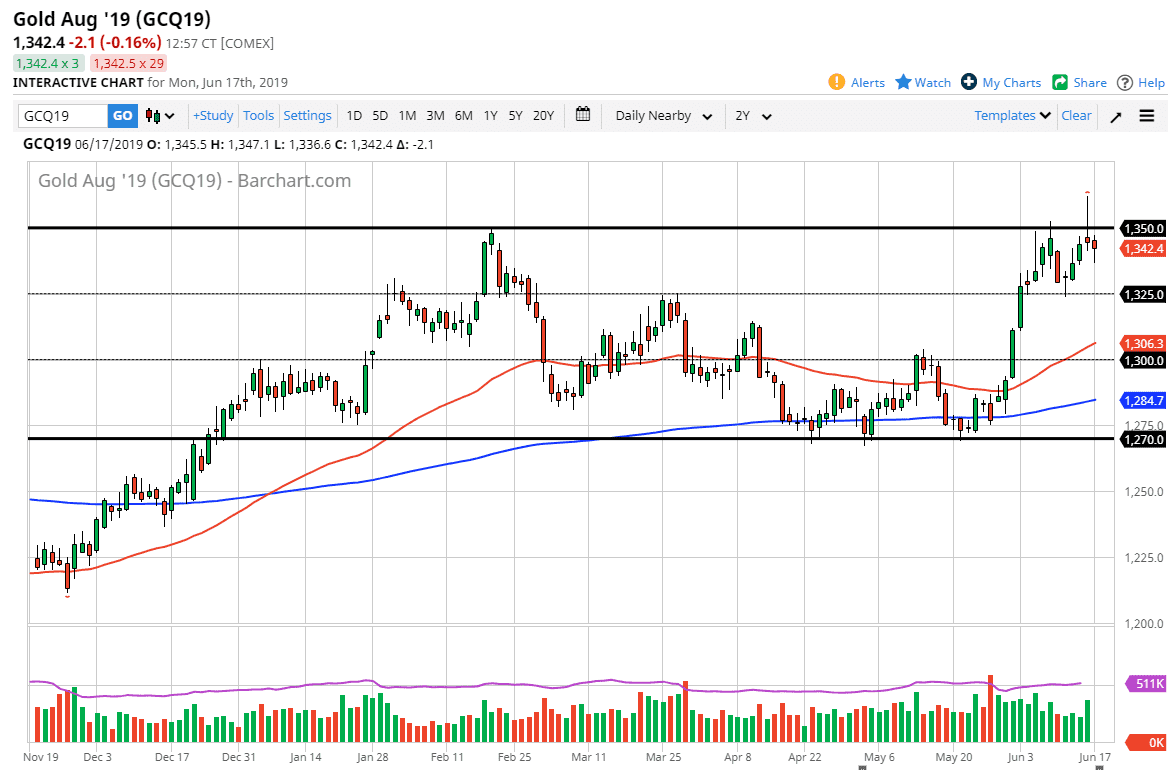

Gold markets fell during the trading session on Monday but have recovered as we got later into the session. That being said, the market has been very bullish for quite some time, and it shows that the resiliency has come back as we ended up forming a bit of a hammer. However, I think that the next 24 to 36 hours will cause quite a bit of choppiness as we await the FOMC Statement.

All things being equal to very likely that after the Wednesday announcement we will finally get some clarity when it comes to gold. In the short term I would expect the market to simply bounce around just below the $1350 level. I think at this point it’s probably best to avoid this market until we get the statement, once we do there are couple of levels that we should be paying attention to.

The daily chart closing above the $1350 level could send this market much higher, perhaps towards the $1375 level, and especially so if that happens after the statement Wednesday afternoon New York time. However, if we turn around and break down below the $1325 level after that statement, it opens the door for a move down to the $1300 level underneath. Expect a lot of noise, but at this point I believe that Gold is going to move solely upon the Fed and not so much based upon risk appetite as it has done somewhat in the past.

Expect a lot of choppiness and volatility between now and then, but I would expect to see some type of resolution to this by the time markets close on Wednesday as tension has been building. If the Federal Reserve seems a bit more dovish than anticipated, it’s very likely that Gold will finally make the breakout it’s been hinting at for some time. However, if the Federal Reserve sounds more hawkish than expected, Gold will probably slam straight down.