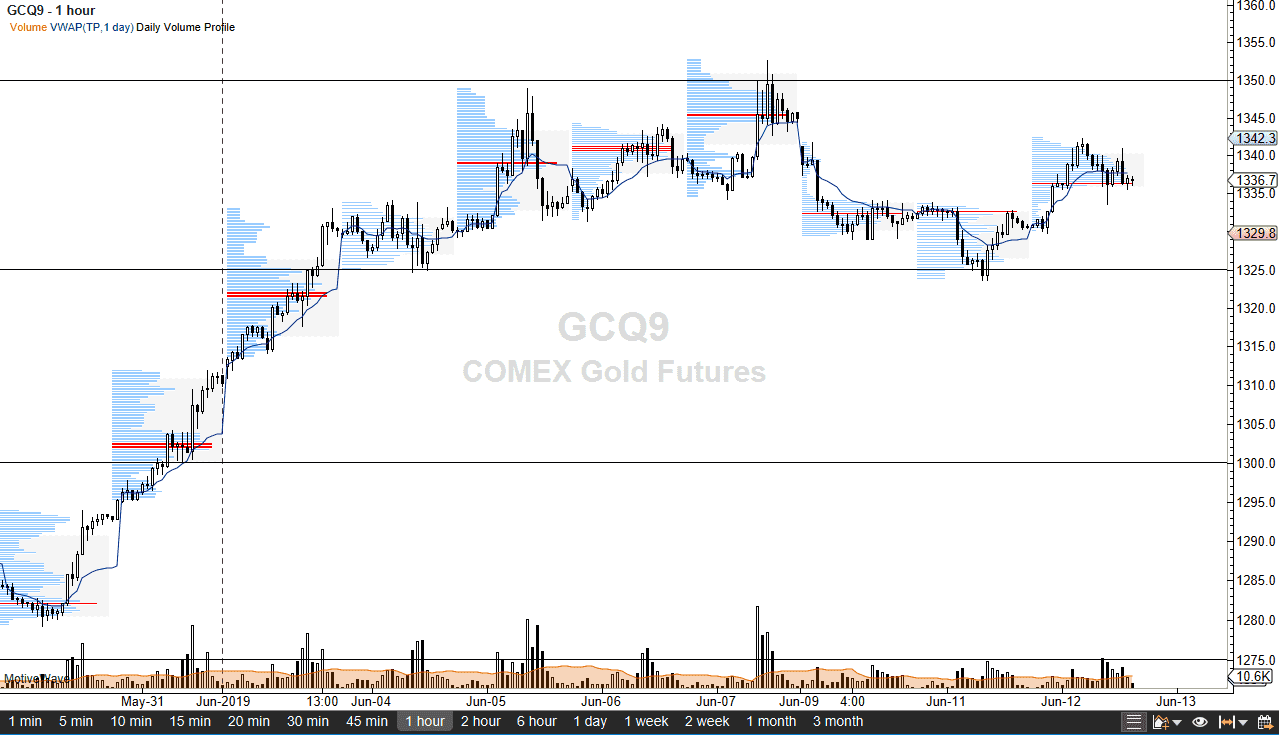

The attached chart is the hourly timeframe, which is much shorter than I typically show you here at Daily Forex. In general, I will take a look at the daily charts but at this point I think what we are looking at is a market that is ready to bounce around between major figures, with the $1350 level above, and the $1325 level below. This is a $25 range, something that we see quite a bit in the gold market. As I record this, the market is essentially right in the middle of it, so it’s going to be difficult to get overly excited at this point. There are several questions to ask right now, but as I look at this market it’s obvious that we did run into a significant amount of noise above.

The Wednesday session essentially proved very little, as we started at the lows of the day, rallied about 10 or $12, only to turn around and fall about half that distance. At this point, it looks like we are simply just going to see the market continue to rotate in this area. As we are in the middle of this $25 range, I’m not overly compelled to trade one direction or the other. However, it’s very likely that signs of exhaustion closer to the $1350 level will continue to be a nice selling opportunity.

On the other side of the coin, if we break down below the $1333 level, then we break down and go looking towards the $1300 level. The market is very orderly and does in fact tend to follow these $25 increments, but we do see the occasional breach. Having said all that, the market has recently gone sideways after a nice run higher, so once we break out of this $25 range he will decide whether we are entering a distribution phase, meaning that we break down from here, or is it more accumulation meaning that we break out to the upside. At this point it’s a bit of a coin toss.