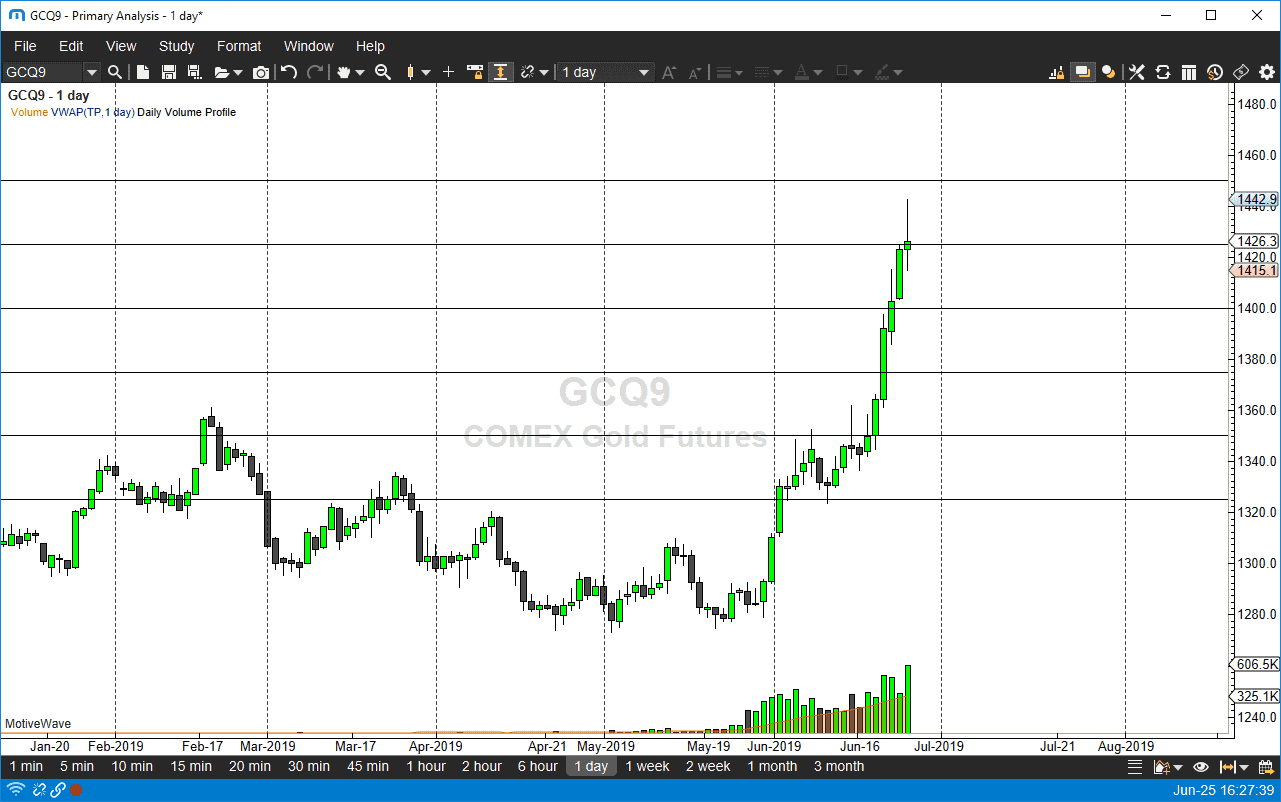

Gold markets went back and forth during erratic trading on Tuesday, as the market continues to try to defy gravity. At this point, the $1425 level looks like it is finally offering enough resistance to keep the market down just a bit, and perhaps turn things around so that we can form some type of value to start buying. The $1400 level underneath is a large, round, psychologically significant figure. That’s an area that is important based on that, and the fact that historically has mattered as well.

At this point only the true foolhardy are out there trying to buy this market, because you have to wonder who will be left to start to pick it up from here. We would need to see some type of major shock to the system to see Gold go higher from here, at least not without some type of major pullback. If we do pull back from here, it’s likely that we will find buyers eventually, because we know that the Federal Reserve is stepping away from a hawkish stance, and that of course is very negative for the dollar, which typically is good for gold. Beyond that, the ECB is also doing the same thing, so it’s very likely that the precious metals markets continue to take off from here. However, nothing can go in the same direction forever, as most of you out there who trade in Bitcoin couple of years ago found out. This is the same situation, although the fundamentals are still good for gold.

Pullbacks at this point offer value, and it’s very likely that we need to see a significant pullback, possibly even as low as $1350. Somewhere between here and there we should see a nice supportive bounce that we can take advantage of.