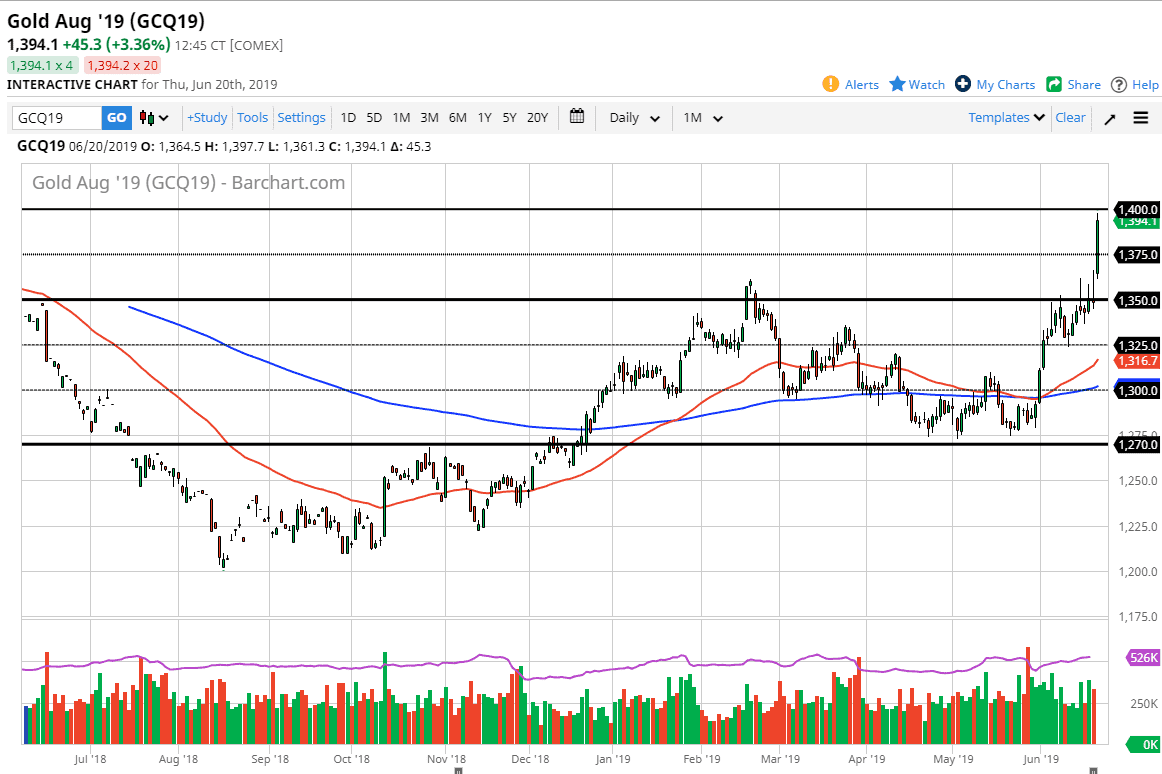

The Gold markets gapped higher at the open on Thursday, and then shot towards the $1400 level. This is a market that continues to be very noisy, but as the Federal Reserve has stepped away from any hint of dovish behavior, it makes sense to the US dollar will probably fall, especially against the gold market.

Adding more fuel to the fire is the fact that the European Central Bank is looking to ease its monetary policy as well, so with that being the case it’s very likely that the currency markets around the world will continue to be volatile, and we will start to see a bit of a “race to the bottom” when it comes to fiat currency. This puts a lot of upward pressure on precious metals, and gold will certainly be a beneficiary of that.

If we can break above the $1400 level, then it’s very likely that we will continue to go in $25 increments to the upside. However, I think we are a bit overbought, so at this point I think that a pullback is probably necessary. The $1350 level underneath is a bit of a “floor”, and I think the bottom of the short-term uptrend that we are starting to see. I don’t like the idea of trying to short this market, so look at these pullbacks as a buying opportunity and what is obviously a major uptrend.

We have gotten a bit ahead of ourselves, so I think that this pullback will be looked at with favor, and that should continue to be thought of as the main driver of this market along with central bank policy. It’s very likely that we will see $1500 sometime this summer in this market. I have no interest in shorting at this point.