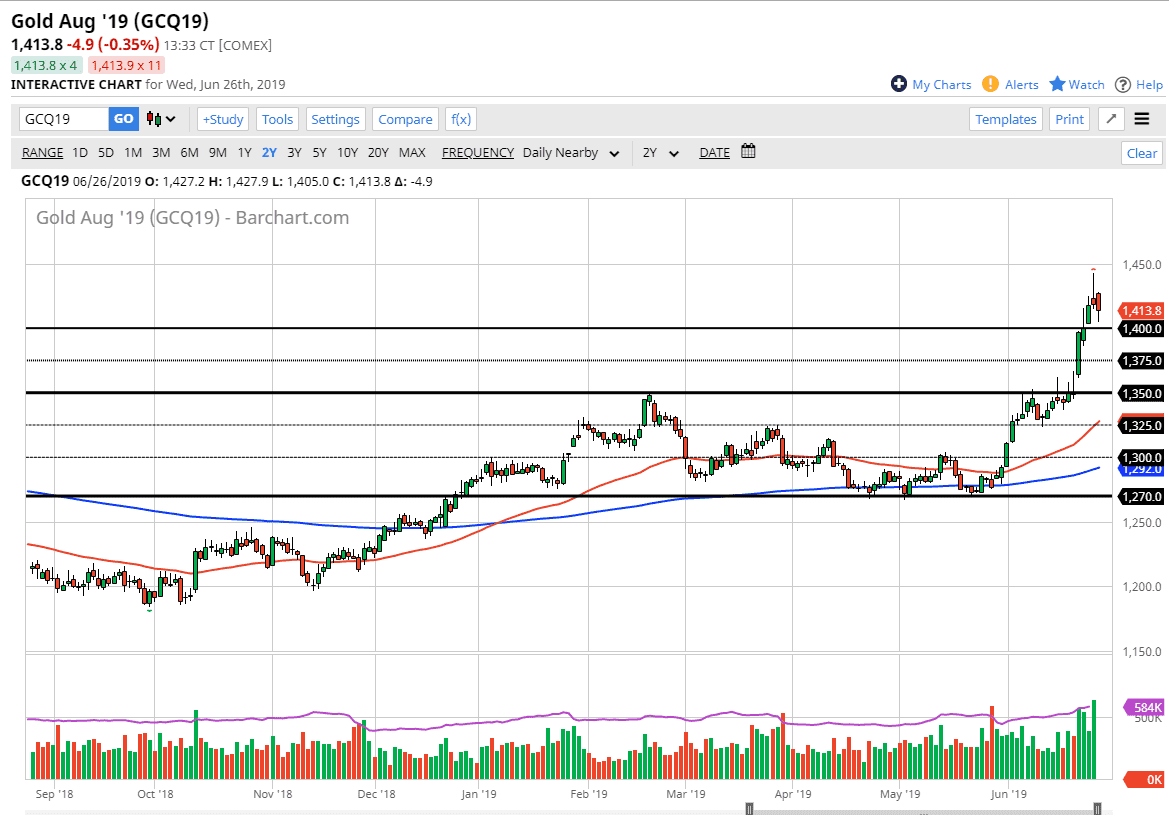

Gold markets fell a bit during the trading session on Wednesday as we are starting to take a break from what had been an overbought situation. Over the last 24 hours we have pulled back roughly $40, which of course is a significant move but when looked at through the prism of the longer-term charts, you can see that it is a relatively small move.

It should be noticed that the $1400 level has offered support, as it had offered resistance in the past. The question now is whether or not we can break down below there, or if we will simply bounce? I suspect at this point you probably need to find more value so I would love to see this market break down below the $1400 level, not to sell it but rather to pick up more value. It’s obvious that Gold is in and uptrend, but it’s also obvious that we had gotten ahead of ourselves.

I anticipate that if we can break down below the $1400 level we could go as low as $1350. Not only is it a major level but it is also roughly 50% of the initial move higher. The shooting star during the day on Tuesday was of course a very bearish sign but at this point I think what we are getting ready to see is a return to sanity. While I do believe the Gold goes much higher, the fact that we had risen $75 in a week was probably a bit too much.

I have no interest in selling this market, and I look at each $25 increment as a potential buying opportunity based upon the daily candle stick. So far, we have not had a buying signal fire off, so this is why I believe the $1400 level could down a bit.