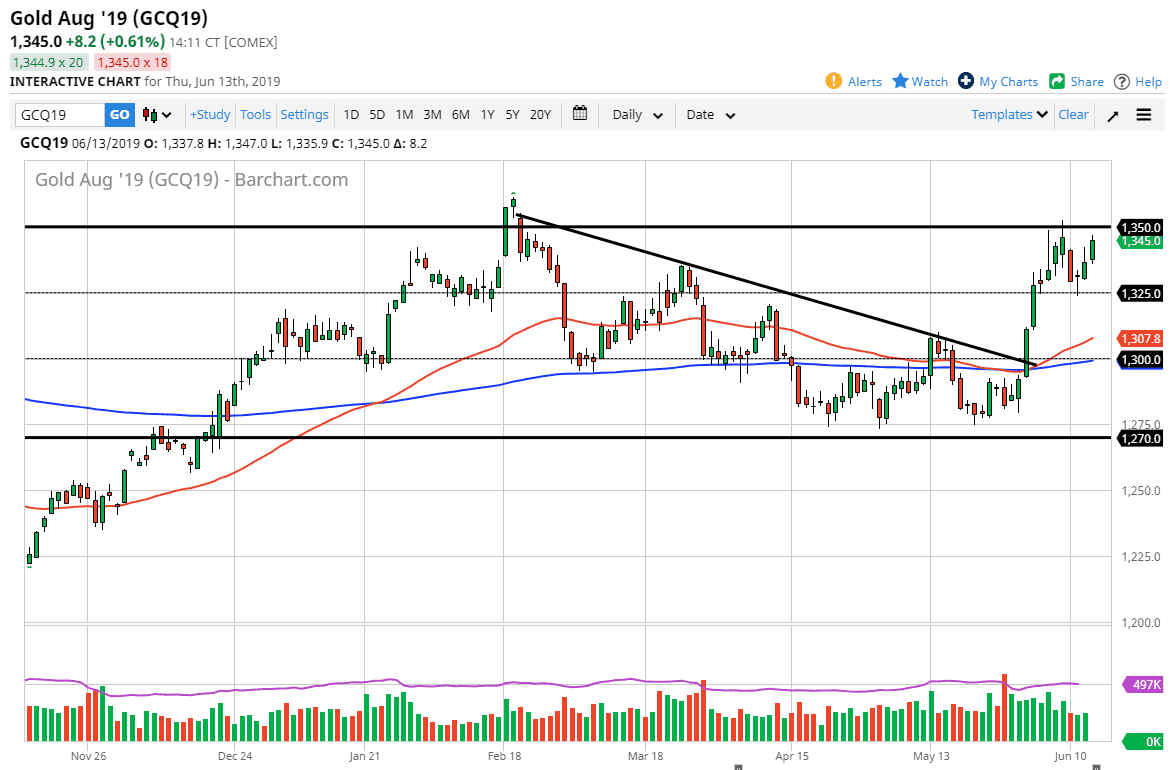

Gold markets rallied during the trading session on Thursday, reaching towards the upside and the massive gap that kicked off this week. I still see a lot of resistance above at the $1350 level, so it’s very likely that we will see a bit of selling pressure just above. Ultimately, this is a market that has seen that area act as important resistance previously, and therefore wouldn’t be a surprise to see it push the sellers back again.

If we do break above there, the market then could go as high as $1375 rather quickly, and therefore find more selling pressure. Looking at the recent consolidation, we are within a $25 range, so until we break either above the $1350 level or breaking down below the $1325 level, it’s very likely short-term trading will lead the way. Keep in mind that the market will be very sensitive to risk appetite and various global situations. The US/China trade situation has been a bit of a problem and we did see a bit of a boost during the trading session on Thursday after a couple of crude oil tankers were attacked. Ultimately though, at the end of the day the $1350 level will be crucial.

If we do break to the downside, the 50 day EMA is found near the $1307 level, and I think that is an area where we could start to show signs of support again. However, I think that this market will continue to be a day by day basis, and we should probably see more short-term back and forth trading in the $25 increments. Keep an eye on gold, it will probably move right along with risk appetite. However, the biggest thing that I can leave you with is keep your position size small.