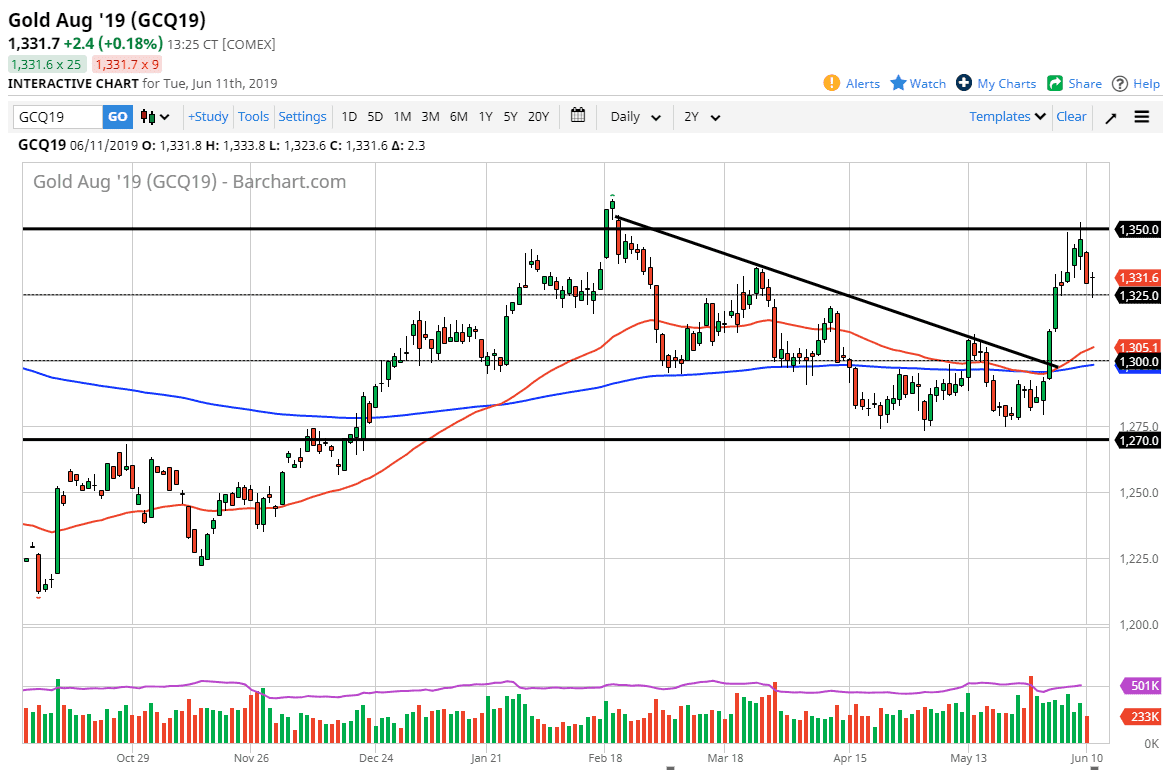

Gold markets initially fell during the trading session on Tuesday, reaching down towards the $1325 level, which of course has been important a couple of times in the past. As a general, I find that the Gold markets react to every $25, and this is a continuation of that scene. Ultimately, I believe that the market turning around and forming a hammer like we have suggests that we are going to continue to go higher, at least in the short term. However, if we were to break down below that candlestick, it would be rather ugly.

The best way I think you can look at this market is that we are in a $25 consolidation phase. If we break down to the bottom of the candle stick and lower from the Tuesday session, we will more than likely go looking towards the $1300 level. Alternately, if we break above the top of the candle stick from Friday, then it’s very likely that we go looking towards the $1375 level. In general, I think that’s probably the easiest way to play this market, simply wait for it to make its move.

The other way to play this market is to look at it as a short-term range that you can trade in both directions. Overall, this is a market that I think will continue to be tight because the US dollar is all over the place, and we do have a bit of a boost due to the Federal Reserve stepping to the side when it comes to quantitative tightening. Ultimately, we also have a lot of risk appetite going back and forth, so that of course throws around gold quite wildly as well. Either way, this is going to be a very difficult market.