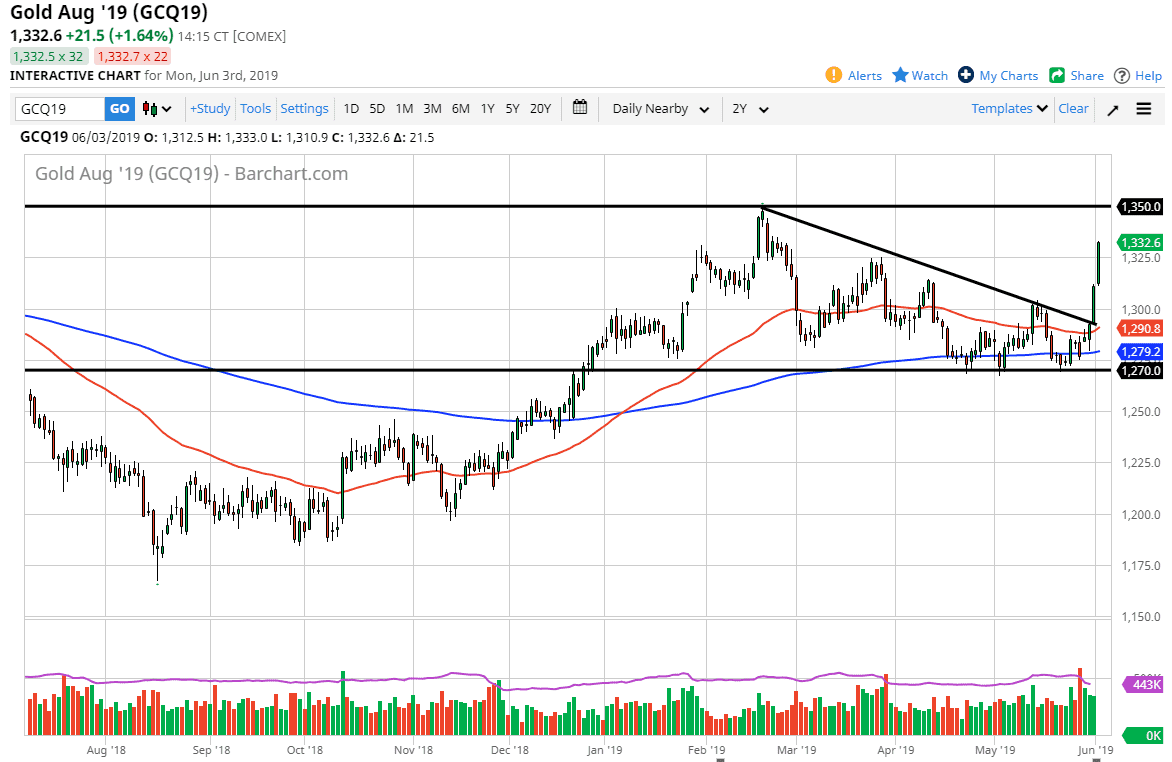

Gold markets rallied rather significantly during the day on Monday, breaking significantly higher as we continue to see a lot of “risk off” trading around the world. Traders are piling into gold in order to take some risk off, but at this point in time we are getting relatively close to resistance that will probably continue to keep a lot of sellers interested. The market has recently broken through a major downtrend line, and now has had a bit of a “beach ball held underwater effect” come into play. In other words, it’s almost like a beach ball that has been held under the waterline, once it gets released, it shoot straight up in the air.

However, this type of inertia can only last so long. While we could go higher, I suspect that the $1350 level above should offer a significant amount of resistance. Somewhere between here and there should be an exhaustive candle that will signify that we are going to get a bit of a pullback. That pullback will probably end up being a buying opportunity based upon value, as this type of move typically has follow-through.

At the same time, if we can break above the $1350 level, that should send this market another $25 higher, perhaps even $50 if there is no panic out there. To the downside, I anticipate that the $13 level underneath will probably be massive support, as it is a large, round, psychologically significant figure, and of course is the scene of that downtrend line. But frankly, I have no interest in shorting Gold but I do recognize that we have gotten far ahead of ourselves at this point in time. The fact that we are closing at the top of the candle stick suggests there are still plenty of buyers out there.