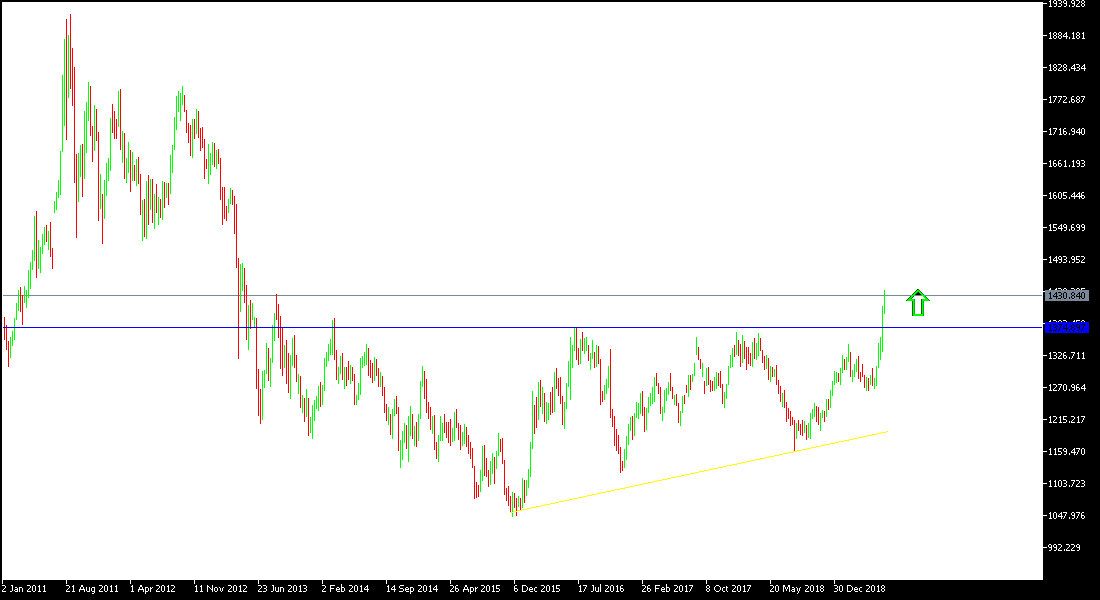

Continuing global trade and political tensions along with the falling US dollar means further gains for gold prices, which reached the resistance level of $ 1439 an ounce in early trading on Tuesday, the highest in six years and is stable around $ 1431 at the time of writing. We also expected the yellow metal to hold to the psychological peak at $ 1400, which would increase purchases. Its gains will have an important date this week between US President Trump and Chinese President Xi to determine the future of their trade war, which clearly contributes to slowing world economic growth and has helped pressure central banks to ease monetary policy. The agreement between the two parties means more risk appetite and therefore gold giving up its recent gains.

We have confirmed in recent technical analyses that US interest rate signals will support the decline of the US dollar and further gold gains, which actually happened after the Federal Reserve announced its monetary policy. The bank stressed the possibility of a US interest rate cut, did not set a date and left it linked to economic developments. The recent performance of the gold price confirms our expectations that buying from each bearish level will be the best strategy for dealing with the yellow metal. Gold continues to gain stronger momentum as investors are increasingly concerned about the failure of the US-China trade dispute.

Weak US job numbers and inflation will increase pressure on the US Federal Reserve. The price of the yellow metal is still moving within the ascending channel supported by the move above the psychological resistance at $ 1300.

In the last meeting, the Federal Reserve Board kept the interest rate unchanged as expected and indicated it was unlikely to raise or lower interest rates in the coming months amid signs of renewed economic health while at the same time inflation was still unusually low. The bank's policy statement highlighted its continued failure so far to raise inflation to the bank's target. The statement may have raised expectations that a change in the next Fed interest rate is a rate cut to stimulate inflation or growth.

Technically: Gold prices today confirm the strength of the bullish move around and above the psychological peak at $1400, and therefore the nearest levels of resistance might be 1415, 1425 and 1433 respectively, which were already reached as we expected and now resistance levels became 1438, 1449 and 1460 as the following goals, and we should not forget to confirm that the Gold is in an oversold areas and therefore any profit-taking is expected at any time. On the downside, the nearest support levels for gold today are 1428, 1410 and 1390, respectively. We still prefer to buy gold from every bearish bounce.

In terms of economic data: the yellow metal will have all its focus on the US dollar level after the announcement of US data and Powell's statements. Gold will also be affected by investors' risk appetite. Gold is one of the most important safe havens.