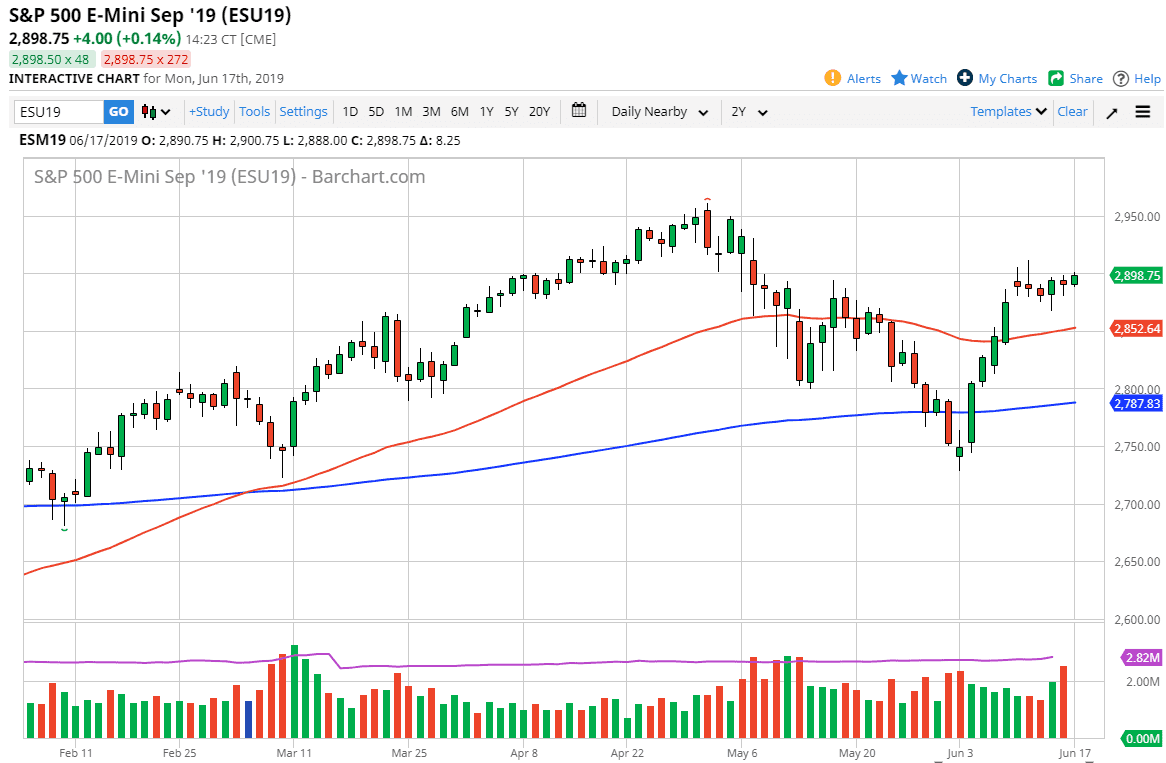

S&P 500

The S&P 500 has done very little during the trading session, simply grinding towards the 2900 level as we have started to roll over contracts. If that’s going to be a major influence, it will play second fiddle to the idea of the Federal Reserve Statement on Wednesday. After all, we are starting to wonder whether or not the Federal Reserve will come in and bail the markets out with interest rate cuts, and that of course will be a major influence as to where things go after that. Between now and then I would expect a lot of nothing, but it certainly looks as if the market is currently expecting some type of push higher.

We had recently gapped higher, pulled back to fill that gap, and then turned around to rally again. At this point, if we can break above the Tuesday highs from last week, the market could very well go much higher. Quite frankly, this is all about the Federal Reserve and almost nothing to do with the market at this point.

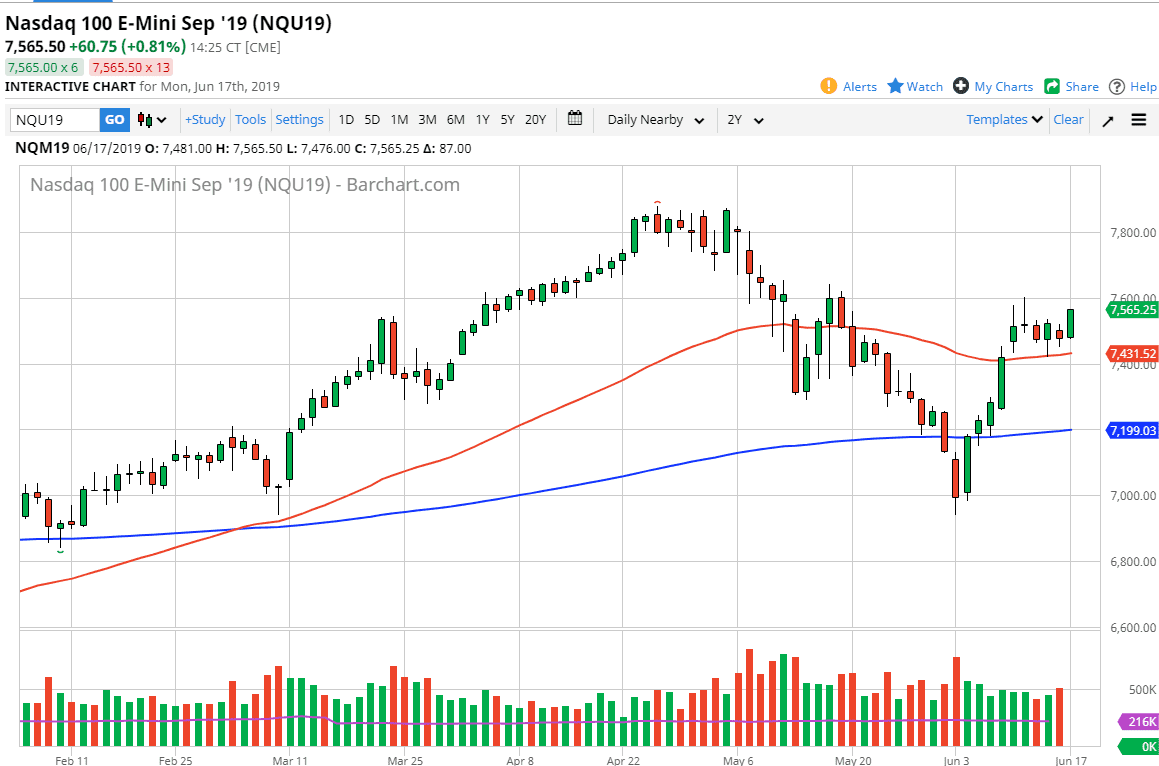

NASDAQ 100

The NASDAQ 100 had a much better day than the S&P 500 but still hasn’t broken out to the upside. Part of this would have been due to Netflix and Facebook doing relatively well, as they are both highly influential. If we can break above the 7600 level, the market is likely to go much higher, but in the short term it looks like we are going to see buyers on dips, as the 50 day EMA is just below and offering support.

The candle stick is relatively bullish, so of course it’s very likely to show signs of strength. Ultimately, if we can break above the 7600 level, then we will probably go looking towards the 7800 level next. To the downside, the 7400 level should offer plenty of support.