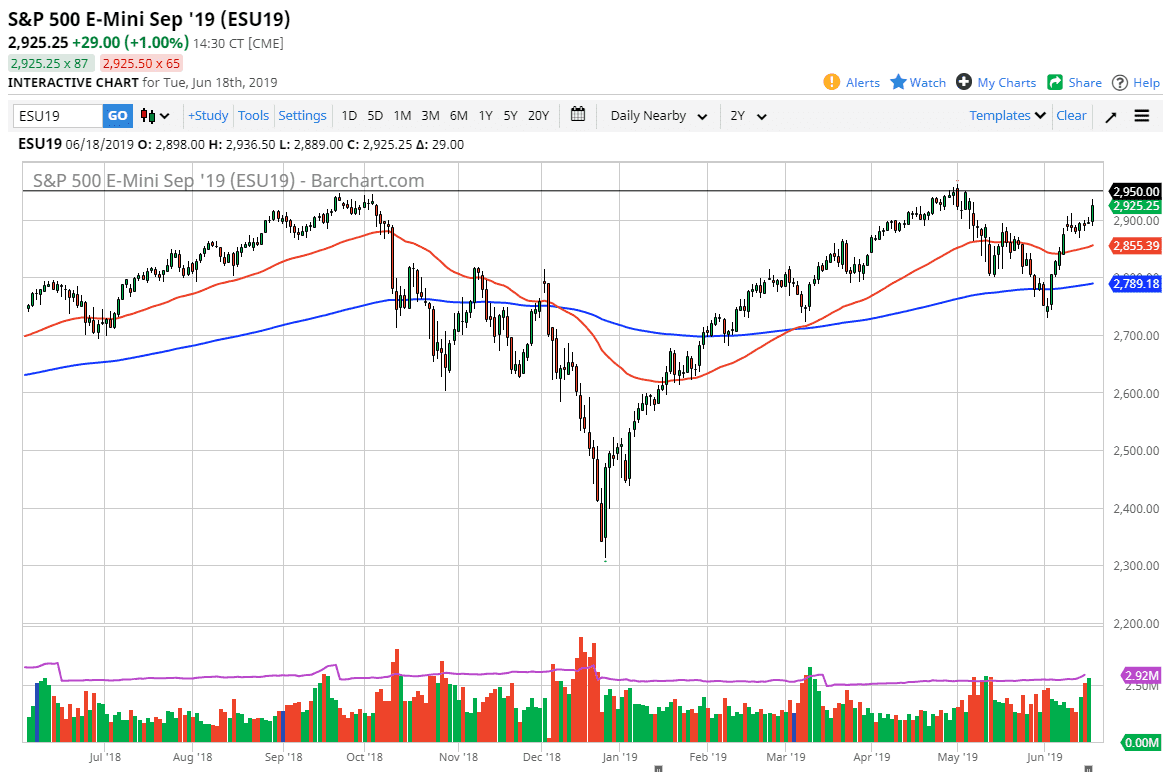

S&P 500

The S&P 500 has rallied significantly during the trading session on Tuesday, as the ECB has signaled its willingness to add more liquidity to the market and of course engaging in quantitative easing. That being the case, traders started to buy stock market indices in the futures markets, as is likely to put more pressure on the Federal Reserve to be dovish on Wednesday. Looking at the charts, the 2950 level above is massive resistance, so it’s going to take something rather substantial to break above there. In fact, it’s going to take an extraordinarily dovish statement or perhaps even an actual rate cut. If we do pull back from here though, I would expect a significant amount of support at the 50 day EMA. If we break down below the 2850 handle, then the market unwinds rather drastically.

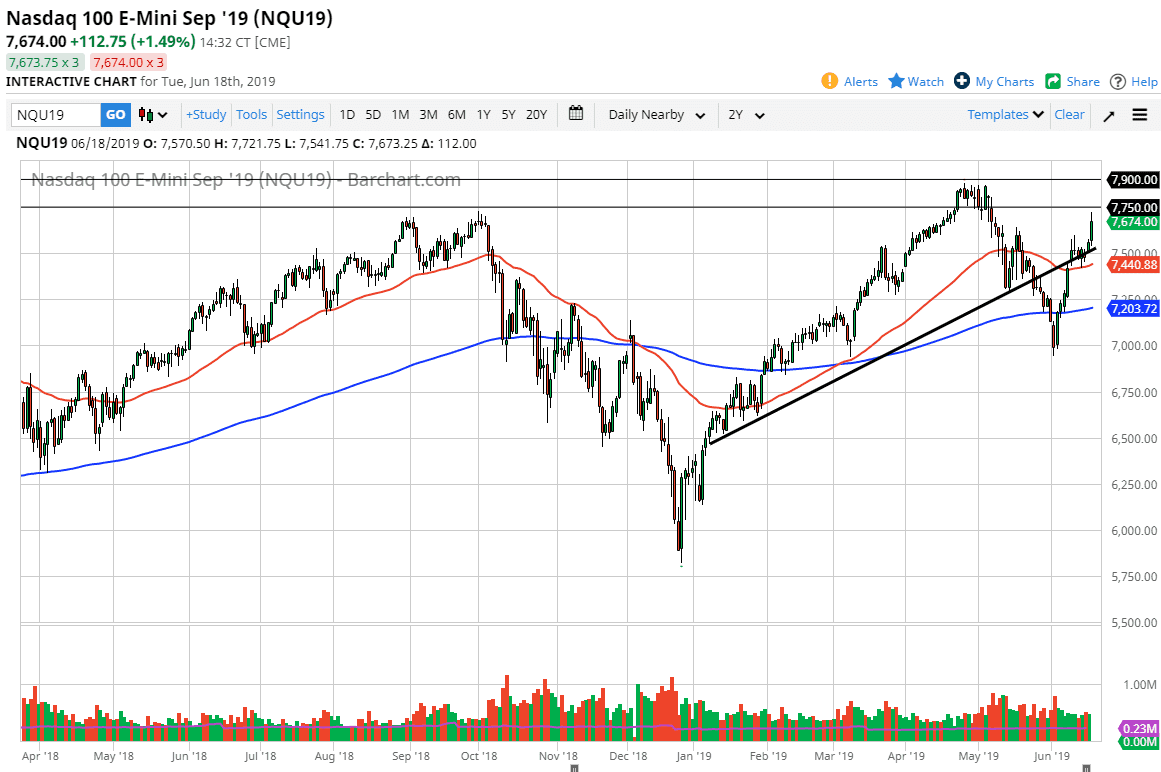

NASDAQ 100

The NASDAQ 100 was also bullish during the day, testing the 7750 level before pulling back. That is an area that has been important previously, and I think is the beginning of a resistance barrier that will be difficult to overcome. I suspect that there are buyers underneath though, especially near the 7500 level. If we break down below there, then it’s likely that the market could break down significantly to the 7250 handle.

The thing about this market is that it will be very sensitive to whatever the Federal Reserve says, so at this point it’s very likely that we are going to wait to see how the market reacts to the noise in the headlines due to the Federal Reserve and it makes sense that the market is probably best traded after the daily close, as it gives us an opportunity to trade this market appropriately. It will be extraordinarily noisy between now and then, so I suspect that it’s best to leave it alone.