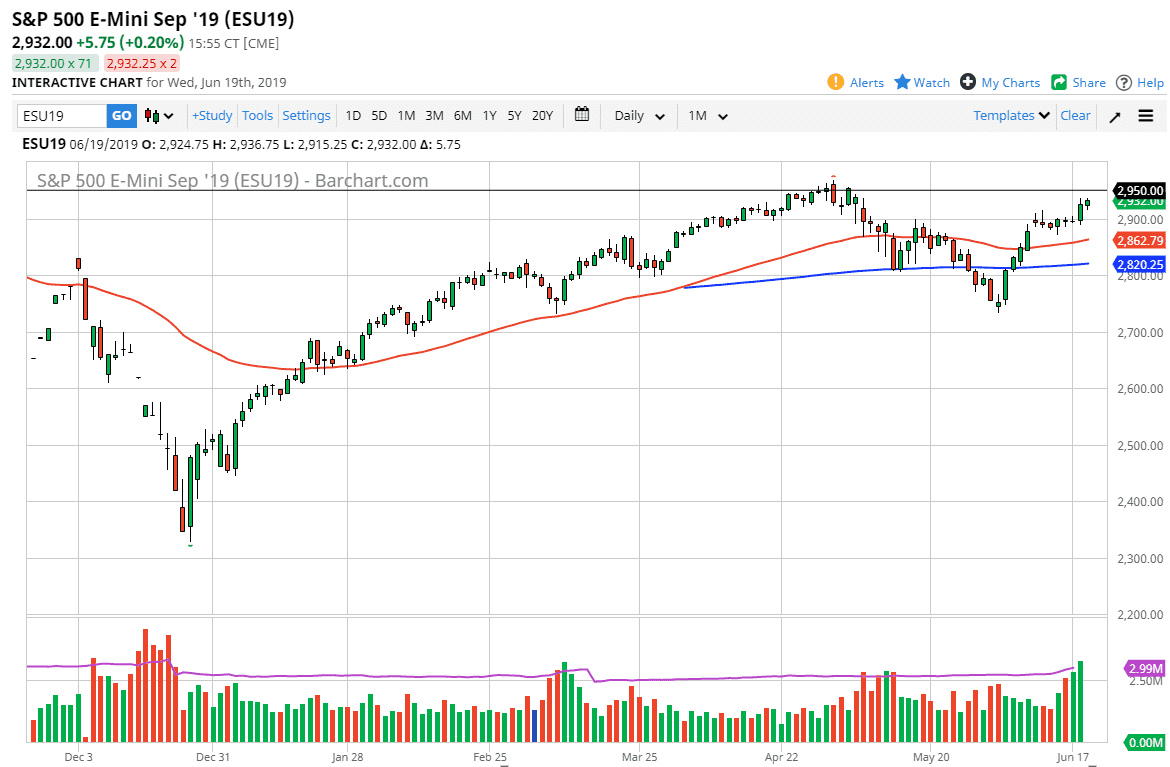

S&P 500

The S&P 500 did very little during the trading session after the Federal Reserve statement, as it was dovish, but didn’t necessarily guarantee anything. The 2950 level above is going to be significant resistance, and at this point I think we will probably test that high. At this point, if we can break above there and more importantly close above there meaningfully, perhaps above the 2960, then the market could go much higher. That being said, there is an even more important level for my money down at the 2880 level, which extends to the 2900 level. It should be noted that utilities have been making all-time highs, which is not a good sign for a bullish market. Ultimately, this is a market that looks very dangerous, but you simply cannot short this market. If you want to be bullish, you are better off looking for short-term pullbacks.

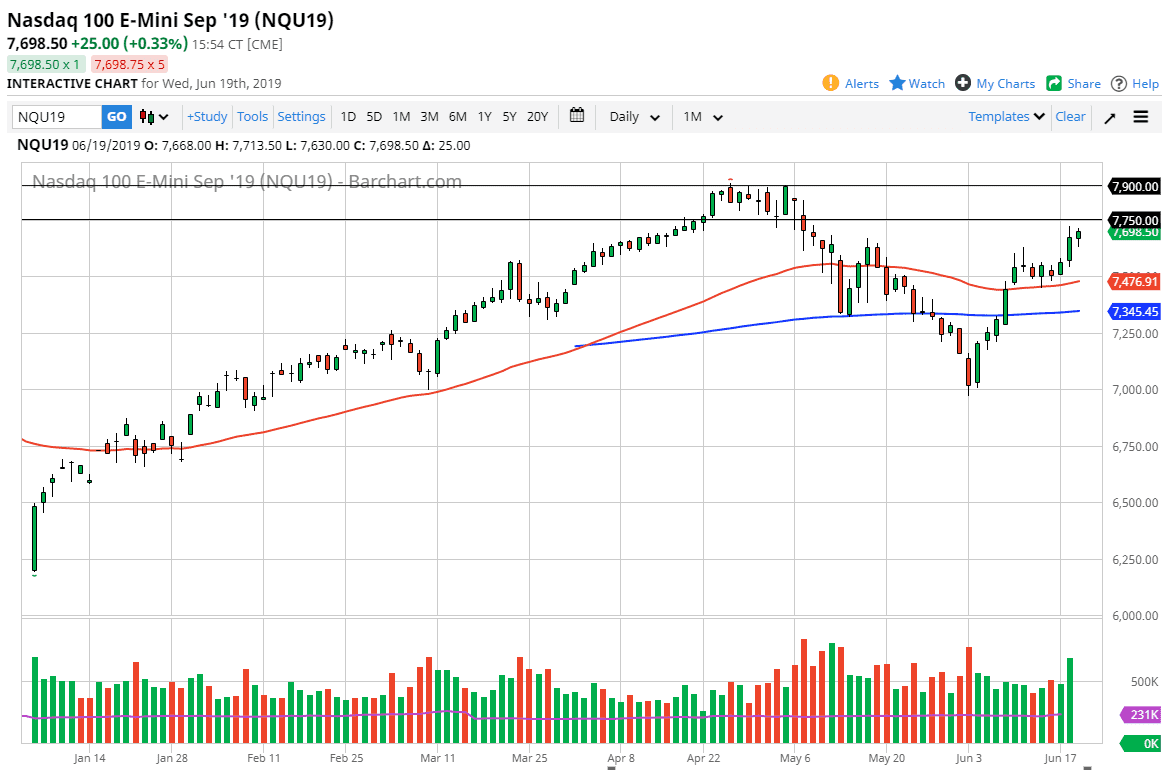

NASDAQ 100

The NASDAQ 100 initially fell during the trading session but then gained a bit but failed to break above the range for the previous session. That’s not necessarily bullish, but it isn’t necessarily bearish either. The market has priced in so much good news out of the Federal Reserve already that it’s difficult to imagine a scenario where we can shoot straight up in the air. A break above the 7750 level could offer a move towards the 7900 level, but obviously the easy money has already been made. I think at this point we are more than likely going to see short-term pullbacks that offer values, and this has become even more of a stock pickers type of scenario than what we have seen recently, and that of course is saying something. Cautiously bullish is probably the best way to look at this market, with an eye on value in the form of pullbacks.