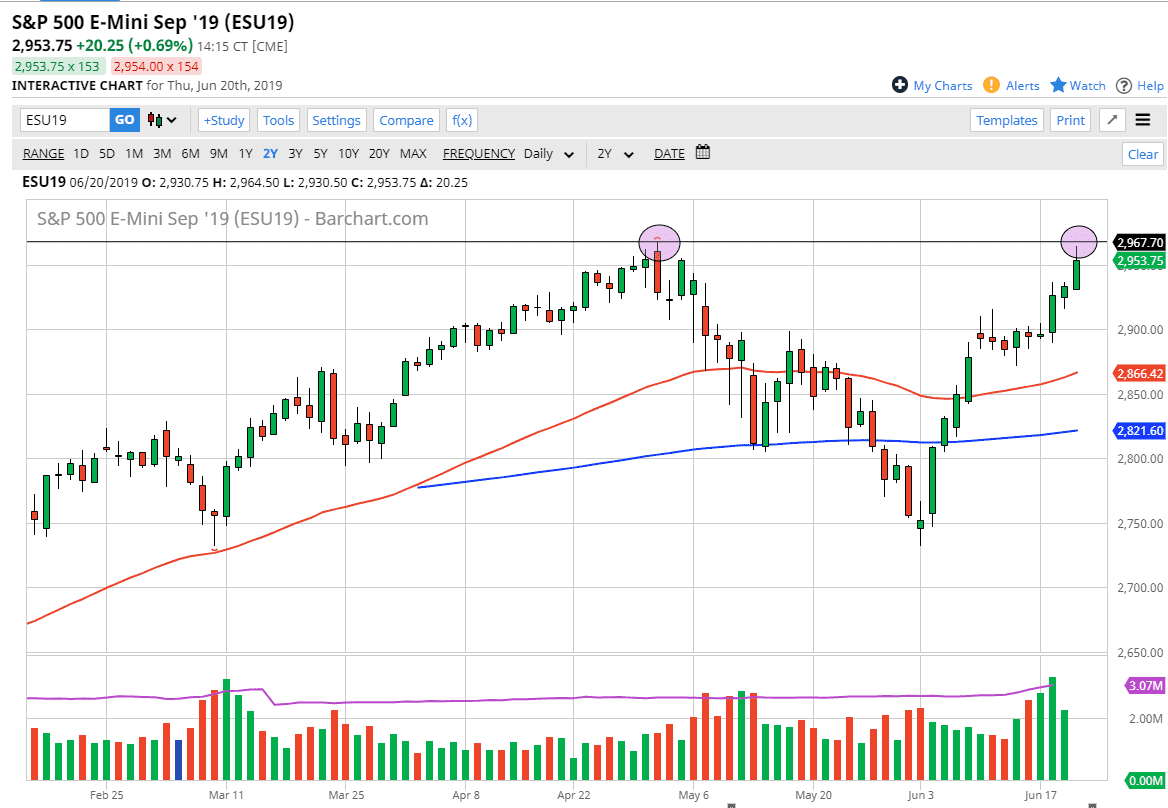

S&P 500

The S&P 500 rallied significantly during the trading session on Thursday as the markets continue to see bullish pressure due to the idea of a softening Federal Reserve. However, we could not break out to a fresh, new high and that does make me wonder a bit about the result. That being said, it is a bullish candle stick, so I’m not quite ready to give up on the idea of breaking out. Having said that, the market needs to spend at least an hour above the line on the chart to convince me. A pullback could make some sense though, as perhaps we need to build up more momentum to go to the upside as it has been an extraordinarily volatile three days. Beyond that, the 2900 level underneath is massive support, that extends down to the 2880 handle, so I think there would be buyers there.

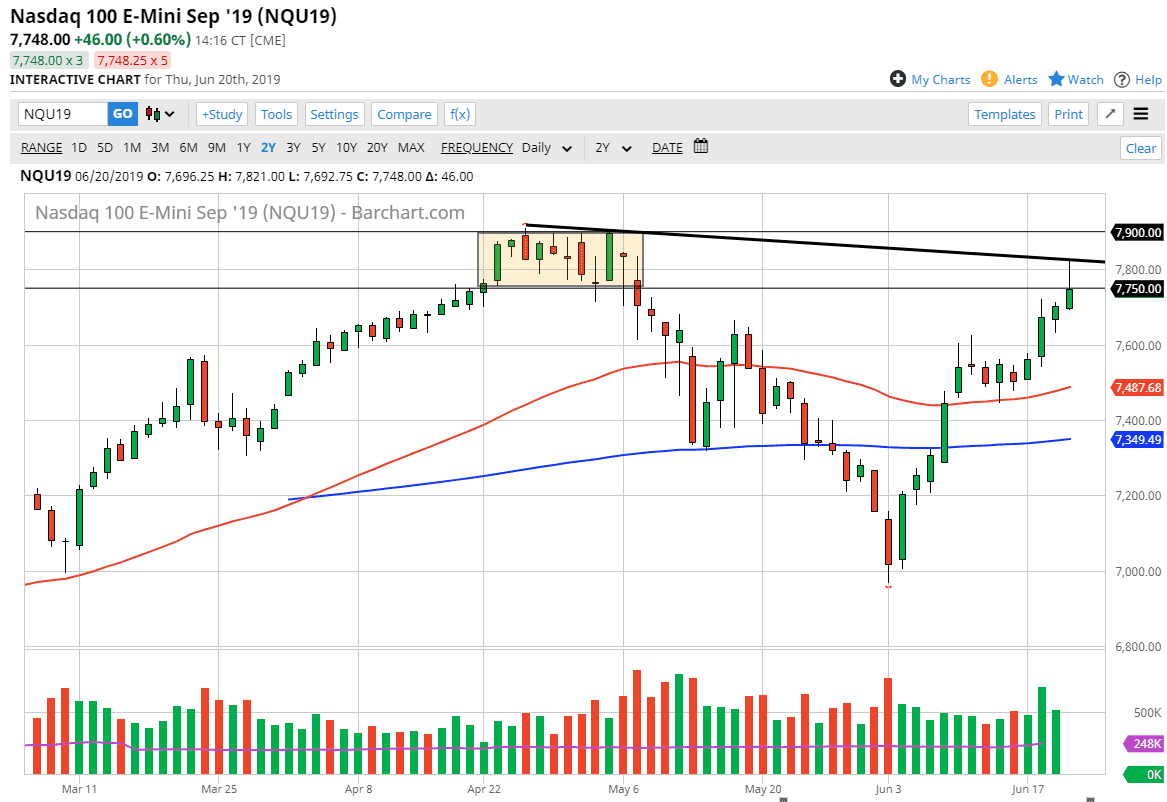

NASDAQ 100

The NASDAQ 100 as part of the reason I’m a little bit tentative when it comes to the S&P 500. As you can see, we broke above the 7750 level, digging into a major consolidation area from previous trading that extends to the 7900 level. Beyond that, you can make an argument for a downtrend line that we touched during the day, and I think that the NASDAQ 100 could be a little bit of a leading indicator. It certainly looks as if we are ready to pull back from here, and if we do we could fall as low as 7600.

The markets have gone straight up for some time on the idea of a federal rate cut or at least a dovish pivot, and we have got that now. So the question at this point will be “what’s the next catalyst higher?” I think the market will be searching for that for a while so therefore a little bit of a pullback makes sense.