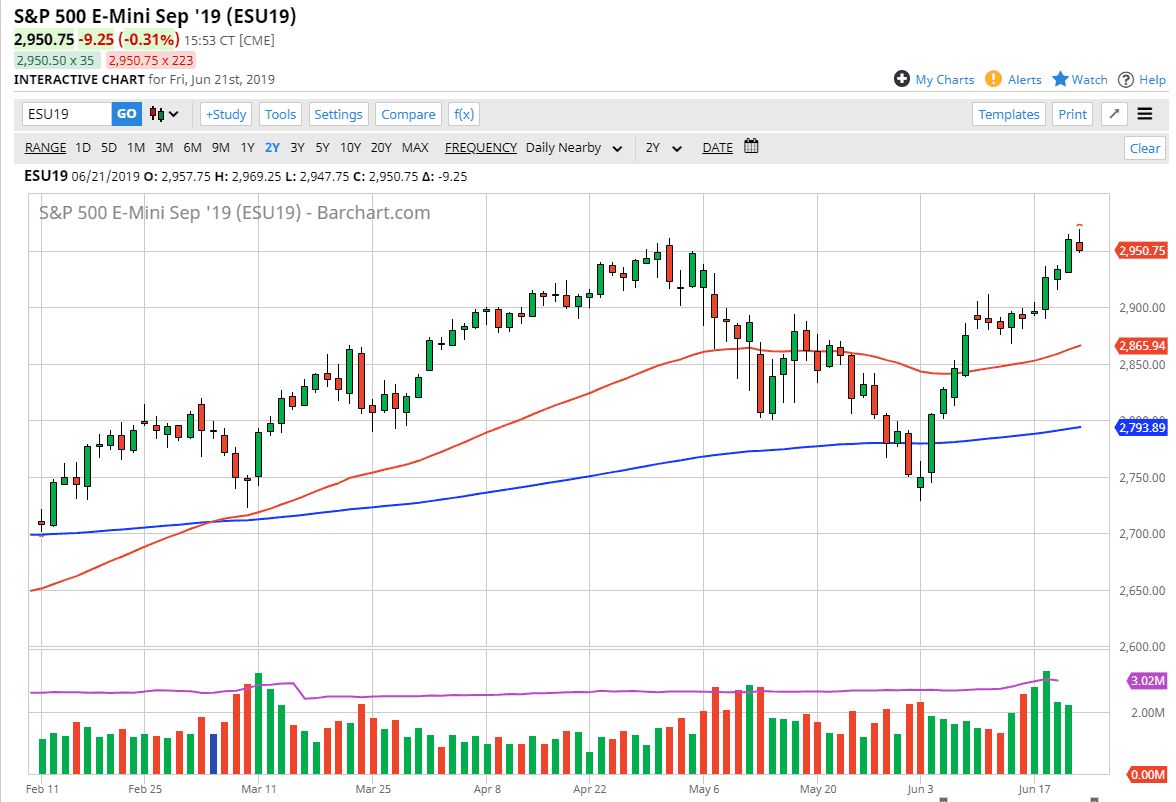

S&P 500

The S&P 500 rallied quite nicely during the trading session initially but then turned around of form a shooting star. The market is closing at the 2950 level, so it will be interesting to see how this plays out. If we break down below the candle stick, we could get a bit of a pullback, as we desperately need some value for people to get involved. If we break above the top of the shooting star that would be a very bullish sign but we have gotten so far overextended that I think we need about a 50 point drop to attract a lot of fresh money. We are heading towards earnings season so that of course will have its say, but we also have the nonsense going on at the G 20 in Osaka, so a US/China trade headline could come into play as well.

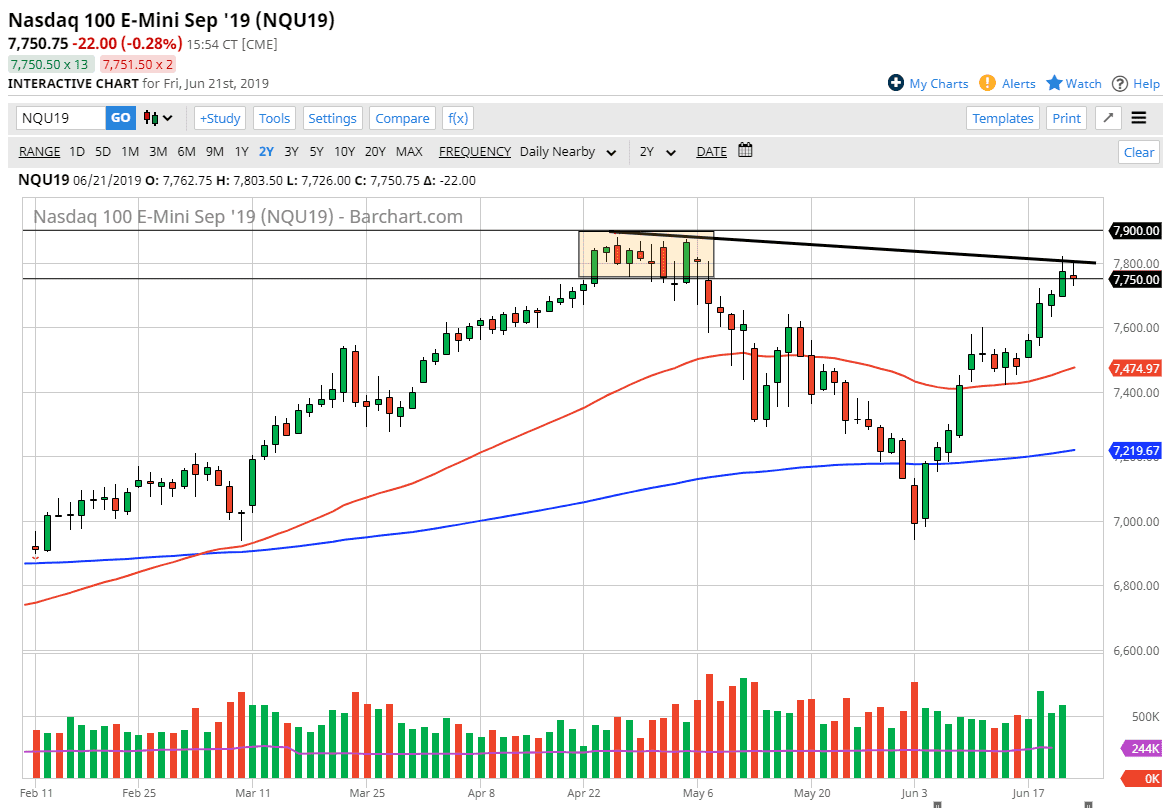

NASDAQ 100

If the US/China situation worsens, the NASDAQ 100 will be clobbered. One thing that I do find interesting is that the S&P 500 did reach a fresh, new high, while the NASDAQ 100 has not. In fact, I can make an argument for a down trending line just above so I think it’s only a matter time before this market breaks down. If it does, we could very easily drop down to the 7650 level, followed by the 7600 level. Alternately, if we can break above the downtrend line that I have marked on the chart, extensively the 7800 level, then I think the market goes looking towards the 7900 level.

As technology companies are so sensitive to the US/China trade situation, this will probably be based upon headlines coming out of POTUS or China, more than anything else at this point. I would not become aggressively short, but I do recognize that the NASDAQ 100 is not behaving very healthy.