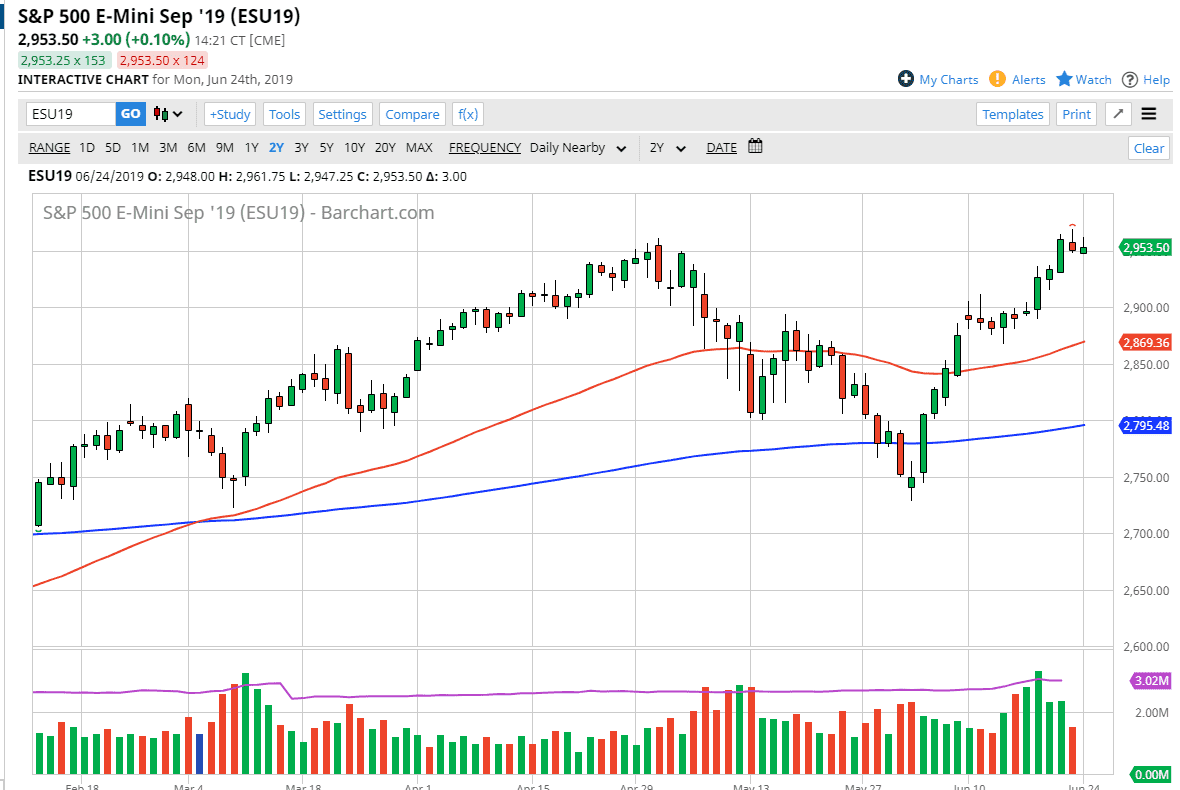

S&P 500

The S&P 500 rallied a bit during the trading session on Monday as traders came back from the weekend. At this point, the market looks very likely to continue to struggle, because we are forming two shooting stars in a row. That’s never a good sign but that doesn’t necessarily mean that we are going to fall apart either. At this point, a break down below the lows of Monday could send this market looking towards the 2925 handle, and then possibly the 2900 level underneath. The 2900 level is supportive all the way down to the 2880 level, an area where I would expect to see a lot of buyers to jump back in. That being said, the market is getting “toppy” at this point, as we are at all-time highs and have had a straight shot to the upside.

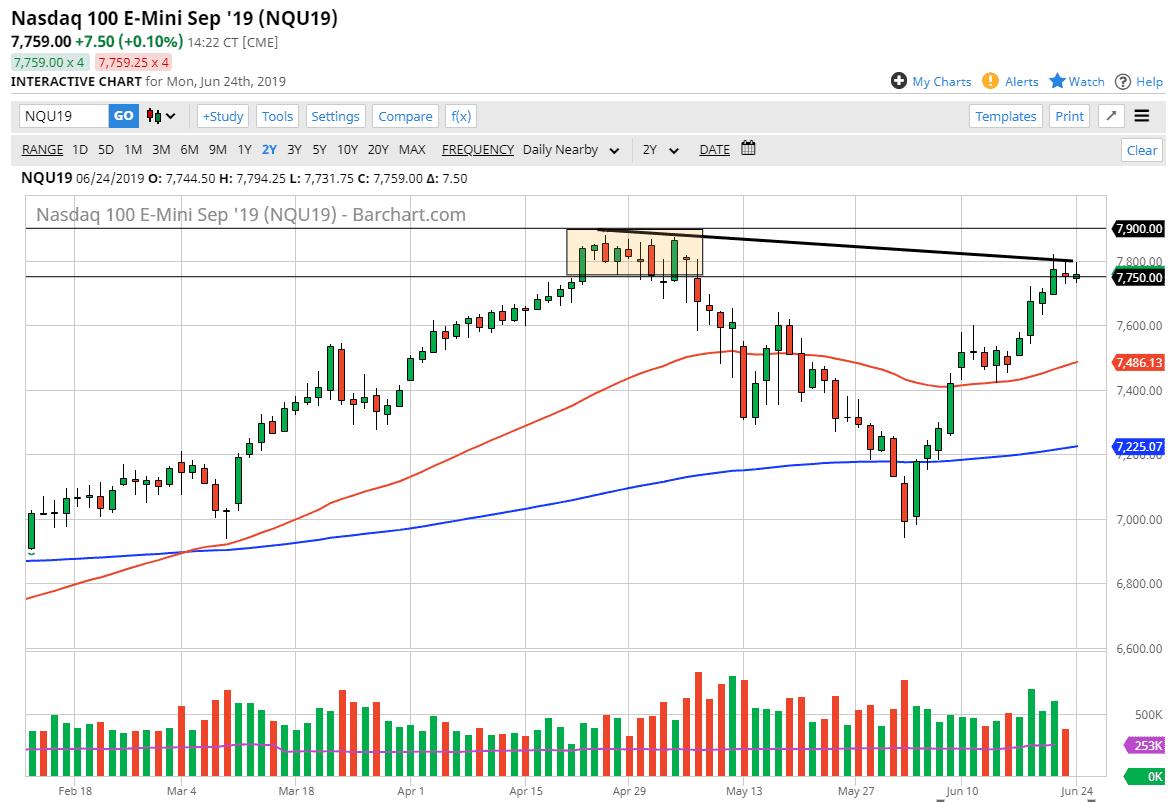

NASDAQ 100

Another thing that makes me worry about the S&P 500 is the fact that the S&P 500 is at all-time highs while the Russell and the NASDAQ 100 both have failed to get anywhere near it. In fact, the NASDAQ 100 has touched a downward trend line again during the day on Monday and failed. Looking at this chart, it seems that the 7750 level is an area of interest, but it’s obvious that the 7800 level is massive resistance. If we can break above there, then the market needs to clear the 7900 level to completely break out of both downtrend line resistance and horizontal resistance.

At this point, the market could very well pull back to the 7600 level, and at this point I think that there could be buyers at that point. If we break down below the 7600 level, this thing could accelerate to the downside. The NASDAQ 100 is extraordinarily sensitive to the US/China trade situation, so keep that in mind.