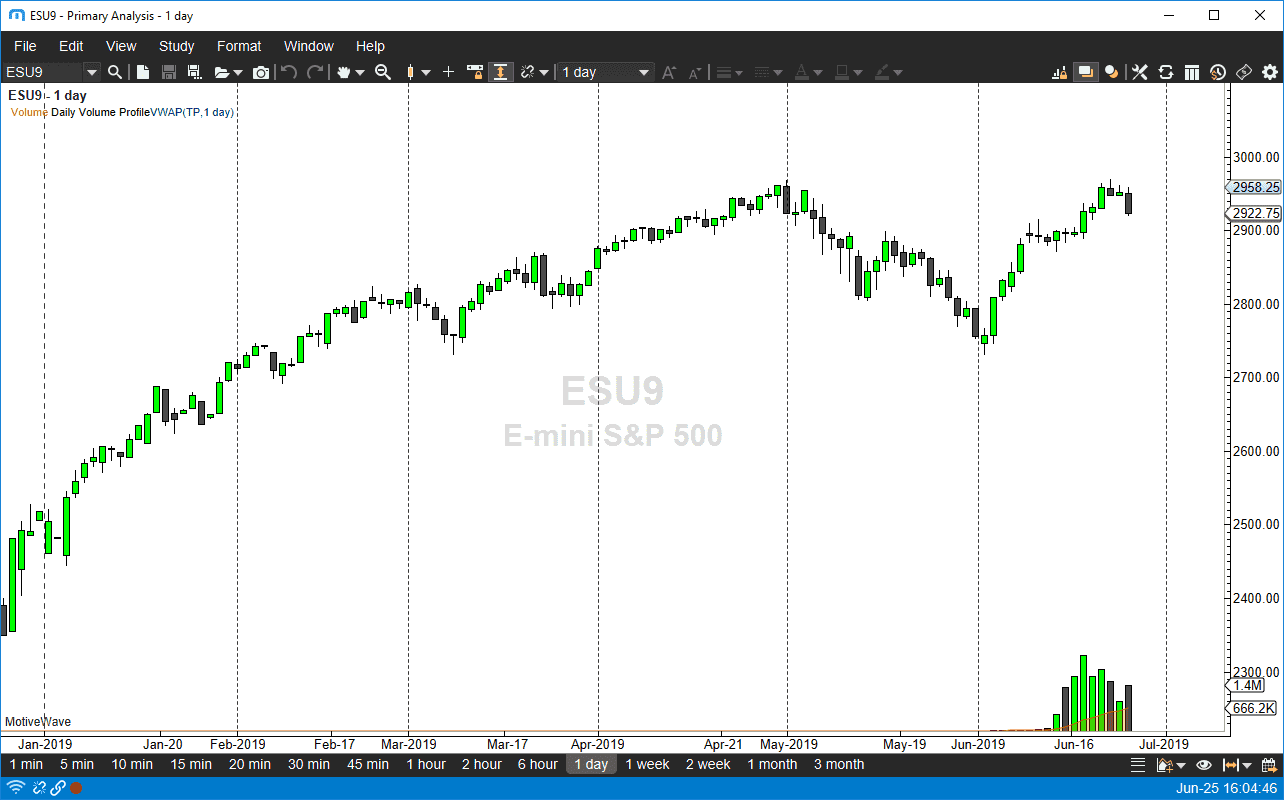

S&P 500

The S&P 500 broke down significantly during the trading session on Tuesday, showing quite a bit of negativity. After forming a couple of shooting stars this should not have been a huge surprise, as traders are starting to recognize that the United States and China will not get some type of agreement going this weekend, which is kind of ironic considering that I thought it was obvious. Nonetheless, we closed at the bottom of the range so it’s very likely we continue to go lower. At this point, it’s very likely that the 2900 level should offer support down to the 2880 level. I suspect that’s where were going next. I would be a seller of rallies on short-term charts, but that’s about it. Longer-term we are still in and uptrend so you should keep that in mind.

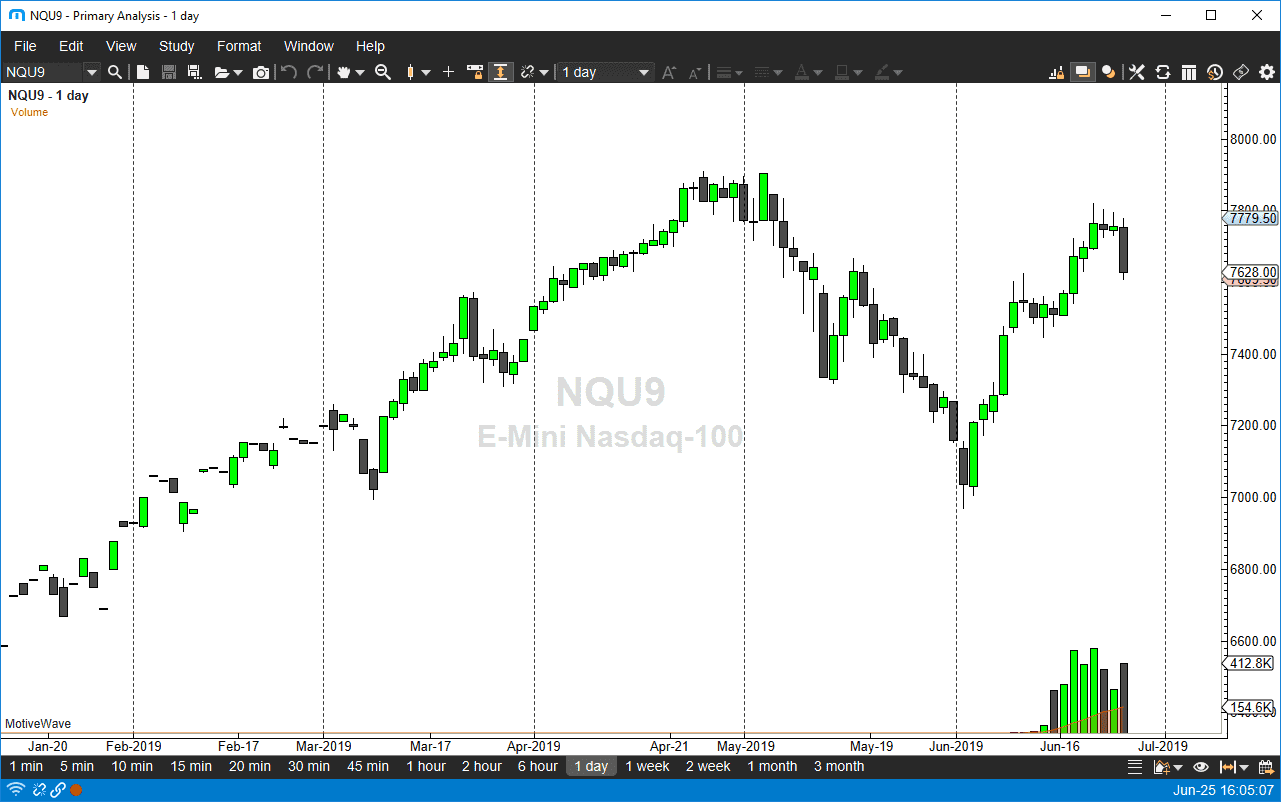

NASDAQ 100

The NASDAQ 100 initially tried to rally during the trading session on Tuesday but we have seen lower highs and therefore it looks likely that we are going to go a bit higher and then find sellers again. It makes sense, because the United States and China have a long way to go before we will have some type of an agreement, and the NASDAQ 100 is very sensitive to that exact situation. Beyond that, it’s very likely that traders have not missed out on the fact that the market has been lagging behind the S&P 500 as well. At this point, I suspect the next couple of days could be a bit soft. There should be significant support at the 7500 level as well. At this point, it looks very likely to be rocky and erratic, but I suspect the sellers are starting to make their presence known.