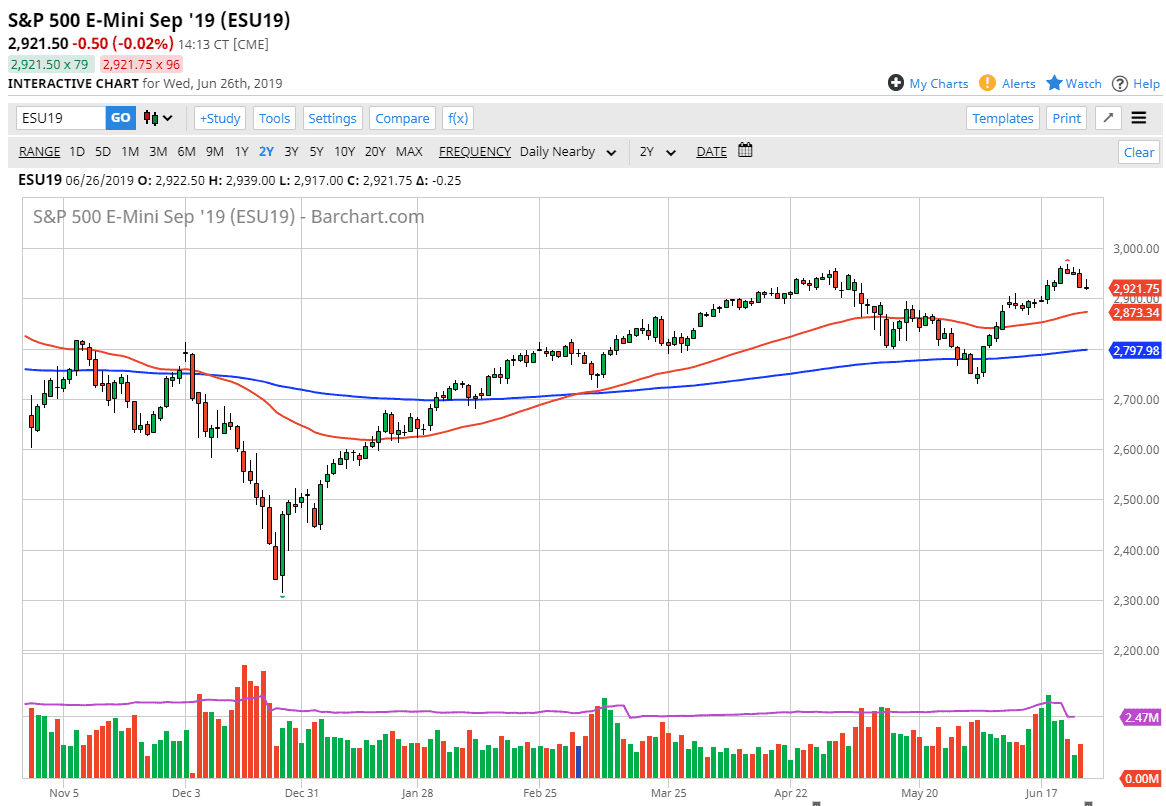

S&P 500

The S&P 500 initially tried to rally during the trading session on Wednesday but gave back all of the gains. By doing so we have formed an inverted hammer, which is the beer a negative sign. If we break down below the bottom of the daily candle stick it’s likely that we will go looking towards the 2900 level underneath, offering an opportunity to short this market into the major support level. The alternate of course is that we break above the top of the candle stick for the day, which would be very bullish. At this point it’s very unlikely that the market is ready to continue going higher based upon what we have seen over the last 48 hours. Ultimately, the real question is whether or not we can break down below the 2880 handle, which is the bottom of the 2900 support barrier. A break down below there could unwind this market quite significantly.

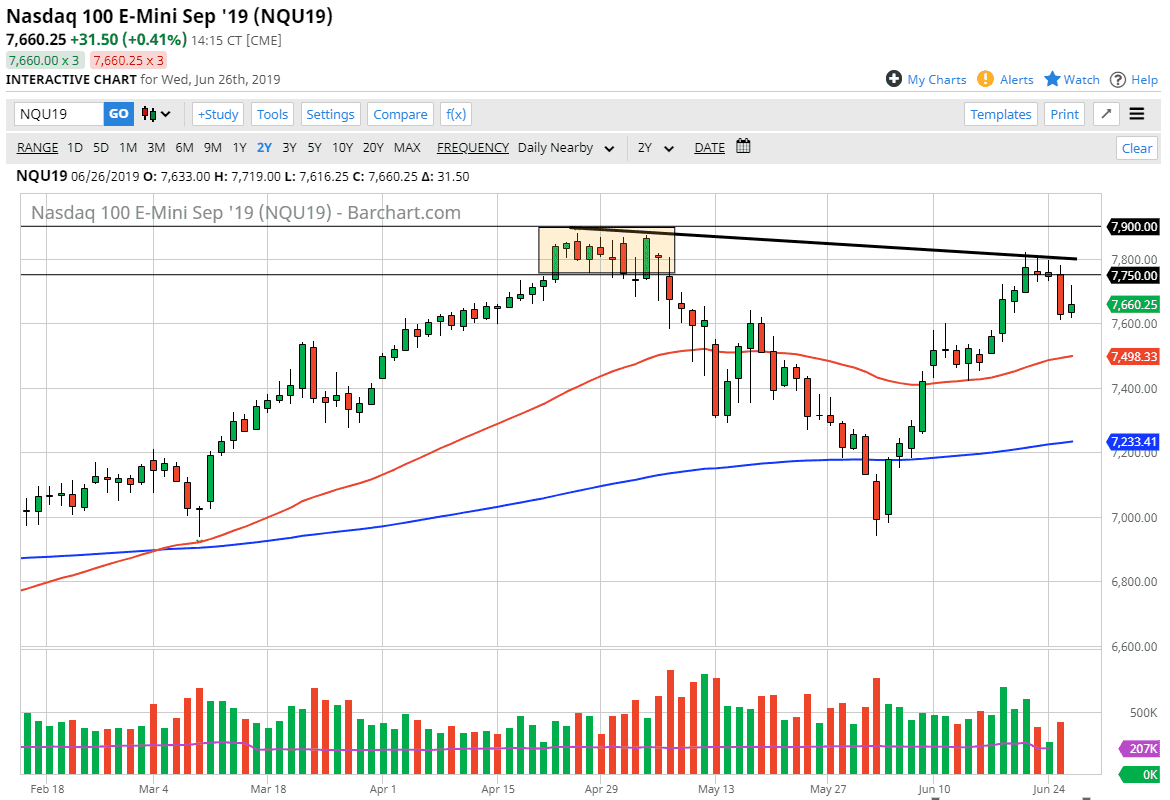

NASDAQ 100

The NASDAQ 100 tried to rally as well but gave back the gains also. The 7600 level looks very likely to be support, so we can break down below there I think we will unwind another 100 points or so. To the upside, we would need to clear the downtrend line that I have marked on the chart, something that doesn’t look very likely to happen in the short term. The US/China trade relations debacle will probably continue to weigh upon this market, as it looks extraordinarily vulnerable at this point. We will get quite a few more answers this weekend at the G 20 in Osaka, Japan as the United States and China will meet face-to-face for the first time in ages. However, I wouldn’t expect too much out of that.