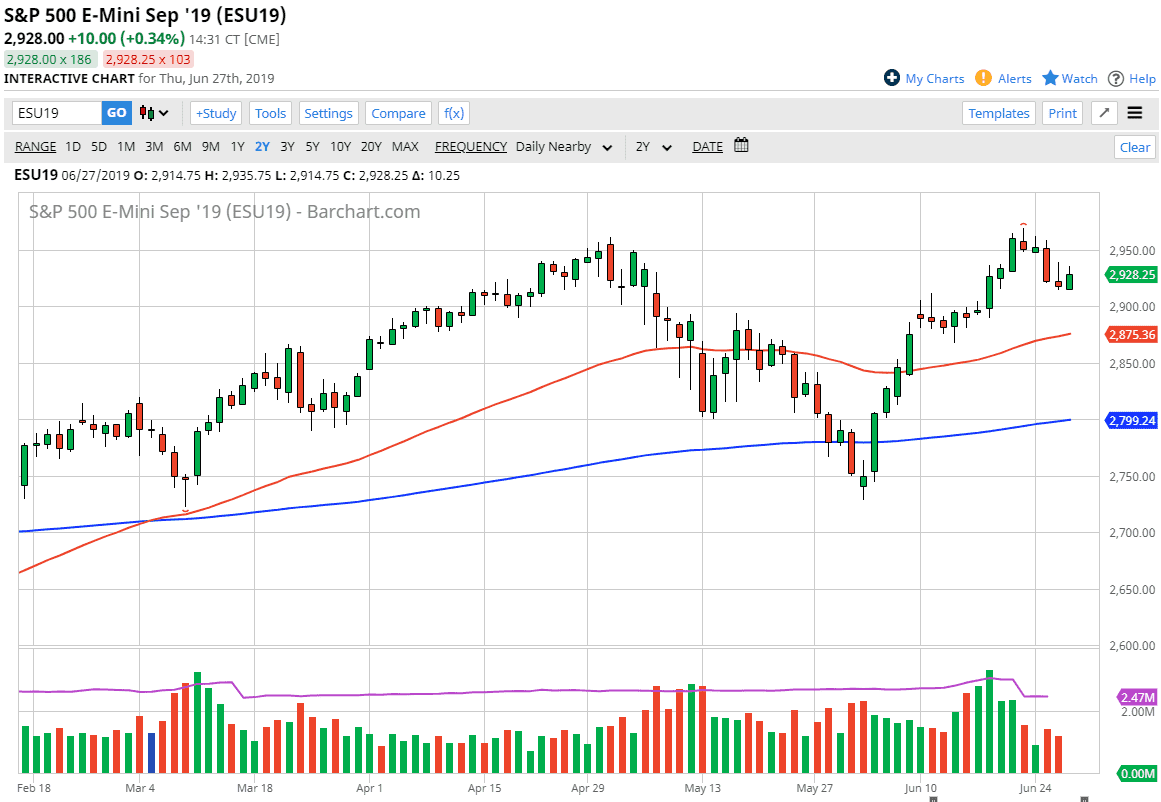

S&P 500

The S&P 500 rallied a bit during the trading session on Thursday, as we continue to bounce back and forth. The G 20 is this week and of course, so it makes sense that there will be a significant amount of volatility going into that, as we await to see what happens between the Americans and the Chinese. At this point, I think it’s very unlikely that we will get some type of resolution, but the market hopes maternal I suppose. At this point, there is a lot of support underneath at the 2900 level, so I suspect that you probably won’t break down below there either. Today could be rather choppy and sideways, but I suspect at the end of the day you are probably better off simply waiting to see what happens on Monday, as the meeting will have massive implications on whether or not there’s any optimism about the US and China getting it together.

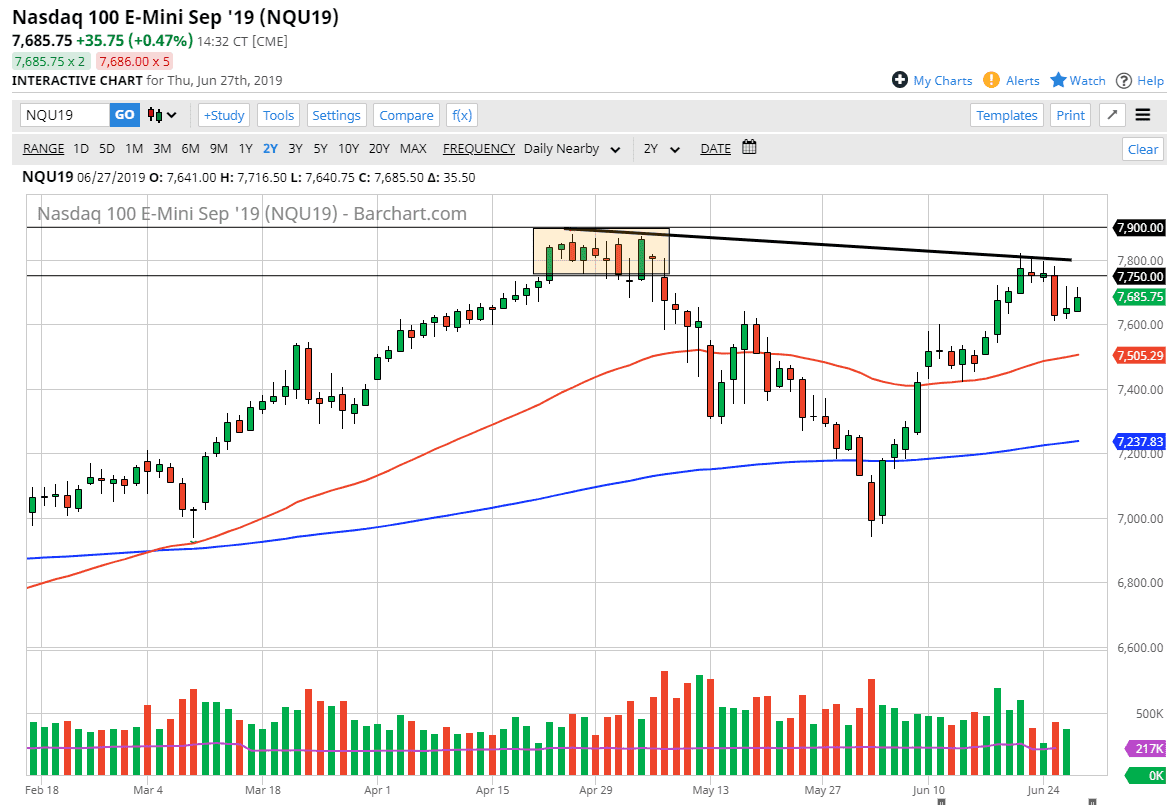

NASDAQ 100

The NASDAQ 100 also rallied during the session, reaching towards the top of the shooting star shaped candle stick from the previous session. However, we have not been able to break above there and quite frankly I don’t think we will between now and Monday. I suspect that short-term rallies will probably be selling opportunities, but really not great sell signals for larger positions. This is a market that needs to see what happens between the Americans and the Chinese, as this index is so sensitive to transpacific trade. Ultimately, we will have to see how this opens up on Monday morning but if we did break down below the 7600 level, the market probably goes down to the red 50 day EMA. On the upside, if we were to somehow break above the 7800 level that would be very bullish.