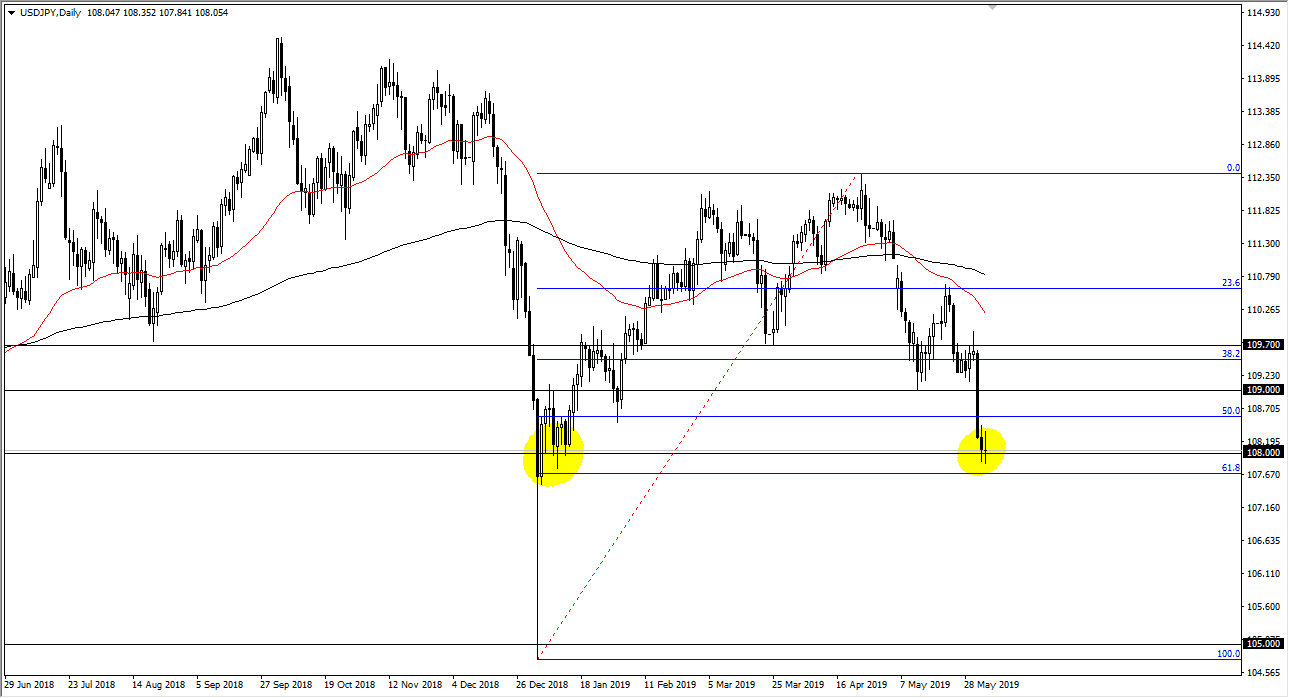

USD/JPY

The US dollar has gone back and forth against the Japanese yen during the trading session on Tuesday, as we have seen a lot of volatility in this market. After all, we are at pretty significant support and extreme lows, so I think we may be trying to stabilize and perhaps attract a lot of value hunting. The 61.8% Fibonacci retracement level underneath also offer support, so I think there’s a lot of confluence here that could send this market to the upside.

However, if we break down below the 61.8% Fibonacci retracement level, it opens up the door for complete wipeout of the move that sent this market higher. If that’s going to be the case, the market probably goes down to the ¥105 level. In the short term though, I believe that it’s very likely that we break above to the upside and try to reach towards the ¥109 level. Remember, it tends to take the same attitude as the S&P 500.

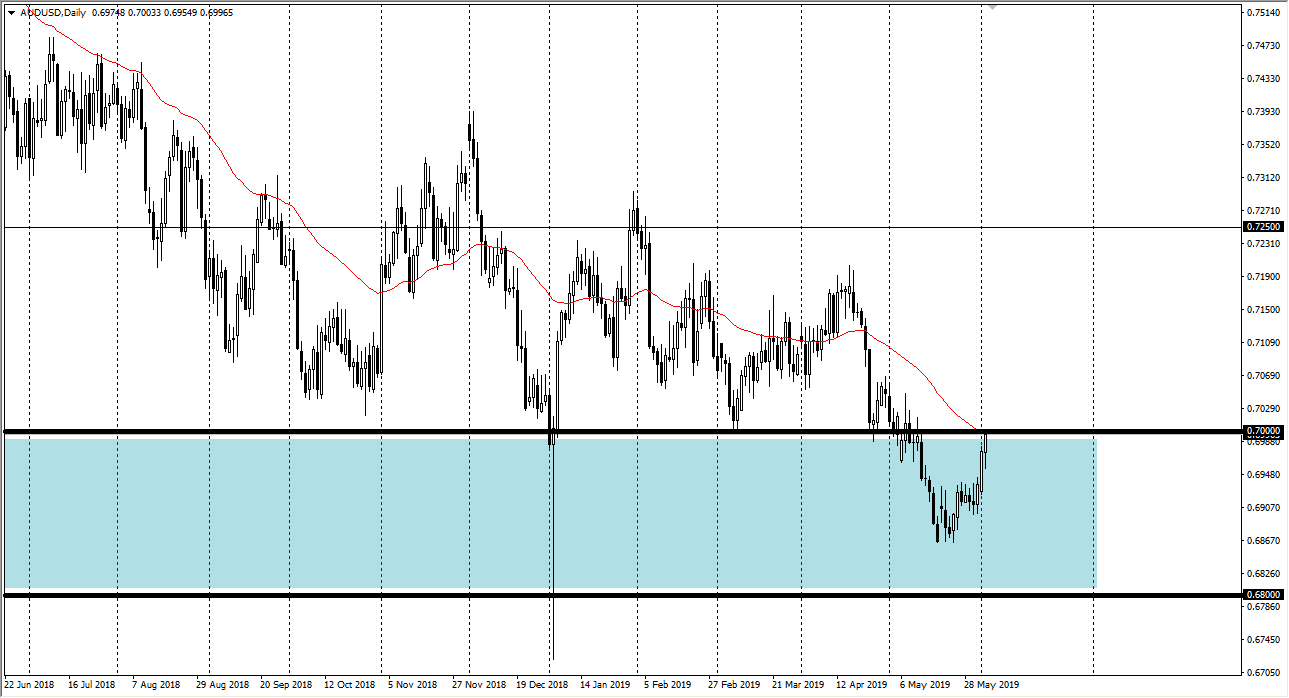

AUD/USD

The Australian dollar initially fell during the day on Tuesday but found enough bullish pressure to turn things around and go looking towards the 0.70 level as Jerome Powell suggested that the Federal Reserve was willing to cut rates to keep the global growth going. If that’s going to be the case, it could be negative for the greenback. That sent the US dollar lower, and the Australian dollar towards the 50 day EMA.

However, I anticipate that it will be a struggle to continue going higher, at least not until we clear the 0.7050 level. In the meantime, I would look for exhaustive candles that could be sold. In the short term it’s probably best to leave this market alone though, but I will revisit this pair again in 24 hours.