We have recently seen a lot of negativity around the world when it comes to economic numbers and of course financial markets. With that being the case it’s not a huge surprise that the Japanese yen has rallied quite a bit. It is considered the world’s premier safety currency, so why wouldn’t it?

The last day of May was brutal when it comes to stock markets, as Donald Trump suggested that the Mexicans were going to be levied with tariffs until the migrant problem was solved. Quite frankly, I don’t think that the market cares about that as much as it does that we have yet another issue when it comes to potential economic pressures. With that, it makes sense that we not only fell on Friday, but we closed at the very bottom of the candle stick for the weekly chart.

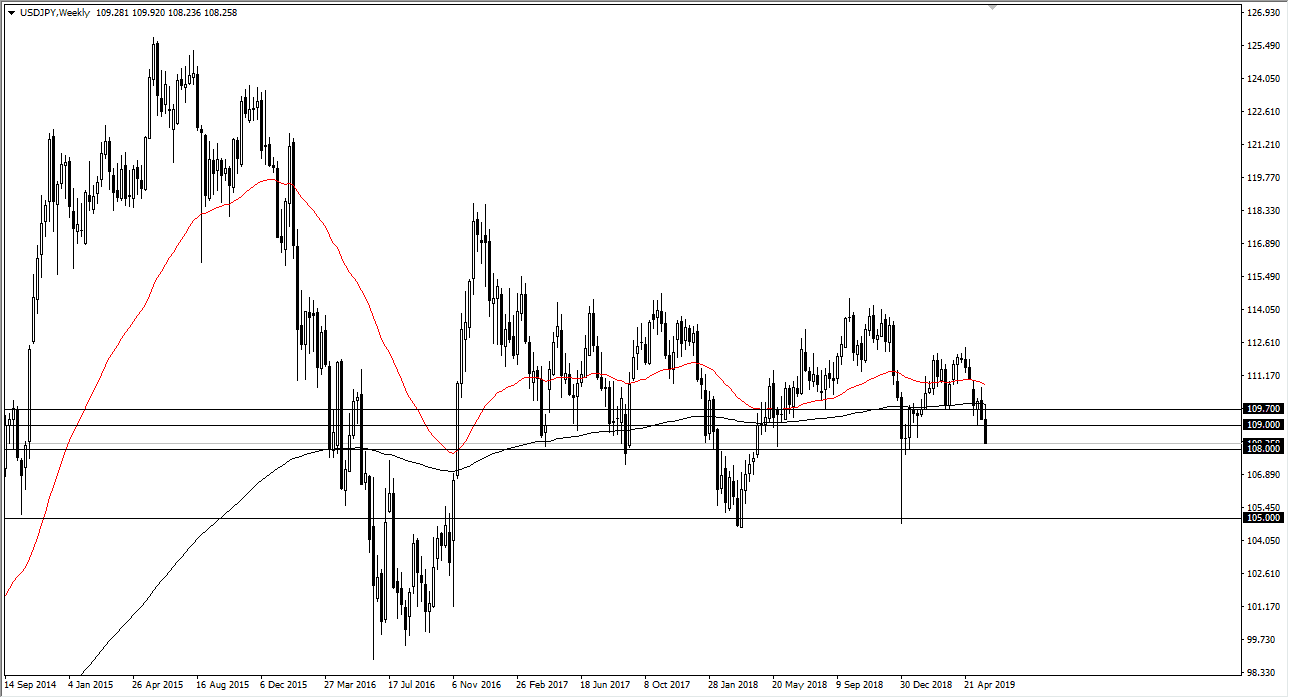

The ¥108 level is an area that has caused support in the past, and now that we are getting close to that level, it’ll be interesting to see whether or not we can break down through there. If we do break down below the ¥108 level, it will open up the trap door down to the ¥105 level. I fully believe that it’s likely to happen this month, and that it is likely that rallies offer nice selling opportunities as I believe the Japanese yen will continue to attract a lot of money.

I don’t necessarily believe that we will break down below the ¥105 level during the month of June, but if we did that would be an absolutely catastrophic turn of events for anything risk related. At that point, you would not only be short of this market, but you would probably be short in the stock markets, commodity markets, and just about anything else that could represent global growth. I anticipate this will probably be an ugly month.