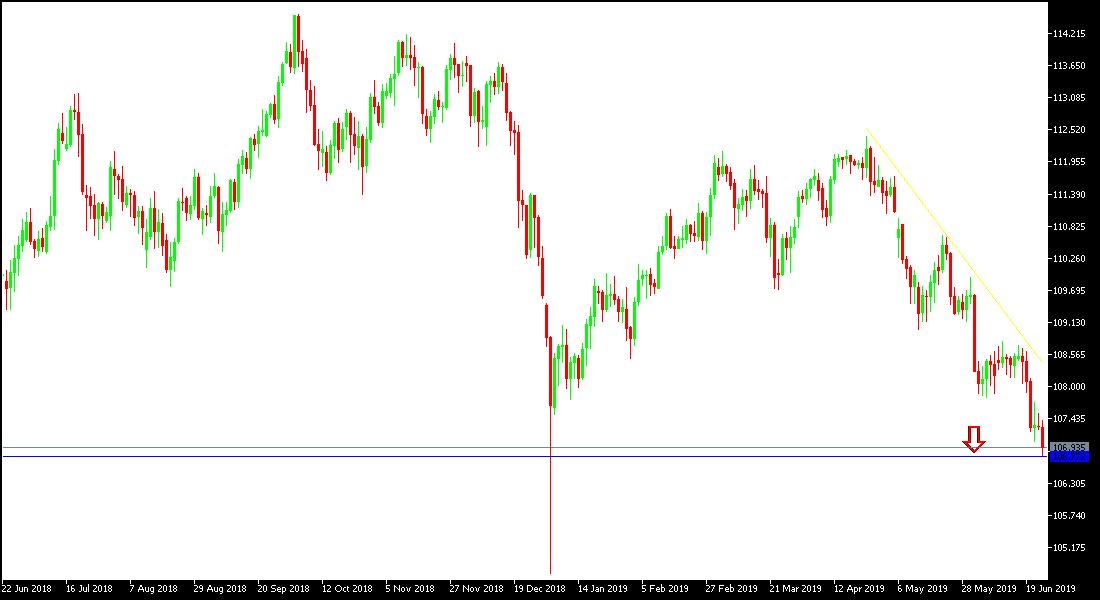

A stronger bearish momentum ahead for the USD/JPY pair, and therefore, tested support level of 106.77, the lowest in more than five months ahead of Powell's comments. The bearish momentum has strengthened since the pair abandoned the psychological 110.00 resistance level. Overall, the Japanese yen will remain in a winning position until the outcome of the meeting between the US president and the Chinese president by the end of the week. The series of negative results of the US economic data continues to confirm the slowdown of the US economy and thus increase the expectations of the near date of the US interest rate cut.

The US Federal Reserve recently confirmed the possibility of a US interest rate cut if the US economy continues to slow down, but did not specify a date or what economic developments that will support the earliest date. Thus, the US dollar has fallen sharply against major currencies. The central bank of Japan still maintains its monetary policy with its negative rates and expects no change in policy as long as the global trade war is in place, which has strongly affected the Japanese economy.

The safe havens conflict between the dollar and the yen will favor of the Japanese currency. In general, the pair's attempts for upward correction will not succeed without moving towards the psychological resistance level of 110.00, otherwise it will remain more likely to move downwards.

The weakness of inflation levels and recent US job numbers have added pressure on the US dollar as it supports expectations of US interest rate cut by the US Federal Reserve to face a slowdown in the US economy. Japanese yen gains are still stronger against other major currencies as one of the safest safe havens with no strong signs of a near-end to the US-China trade dispute which threatens the future of the global economy.

The Federal Reserve Board kept the interest rate unchanged as expected, pointing out that it is unlikely to raise or lower interest rates in the coming months amid signs of renewed economic health while at the same time inflation is still unusually low.

Technically: As we had previously predicted, the stability of the USD / JPY below the 110.00 level will increase the bearish momentum of the pair, and the pair has reached the levels we expected in the previous technical analysis which is closest to the next psychological support at 107.00 and then the following support levels will be 106.45 and 105.80 respectively These levels confirm the strength of the downward trend. On the upside, the nearest resistance levels are 108.00, 108.70 and 109.55, respectively. We still prefer to buy the pair from every bearish bounce.

In today's economic data, the economic calendar today will focus on the announcement of US consumer confidence, new home sales and comments by Federal Reserve Governor Jerome Powell. The pair will monitor with caution and interest the renewed global geopolitical concerns, and all about Trump's internal and external policy.