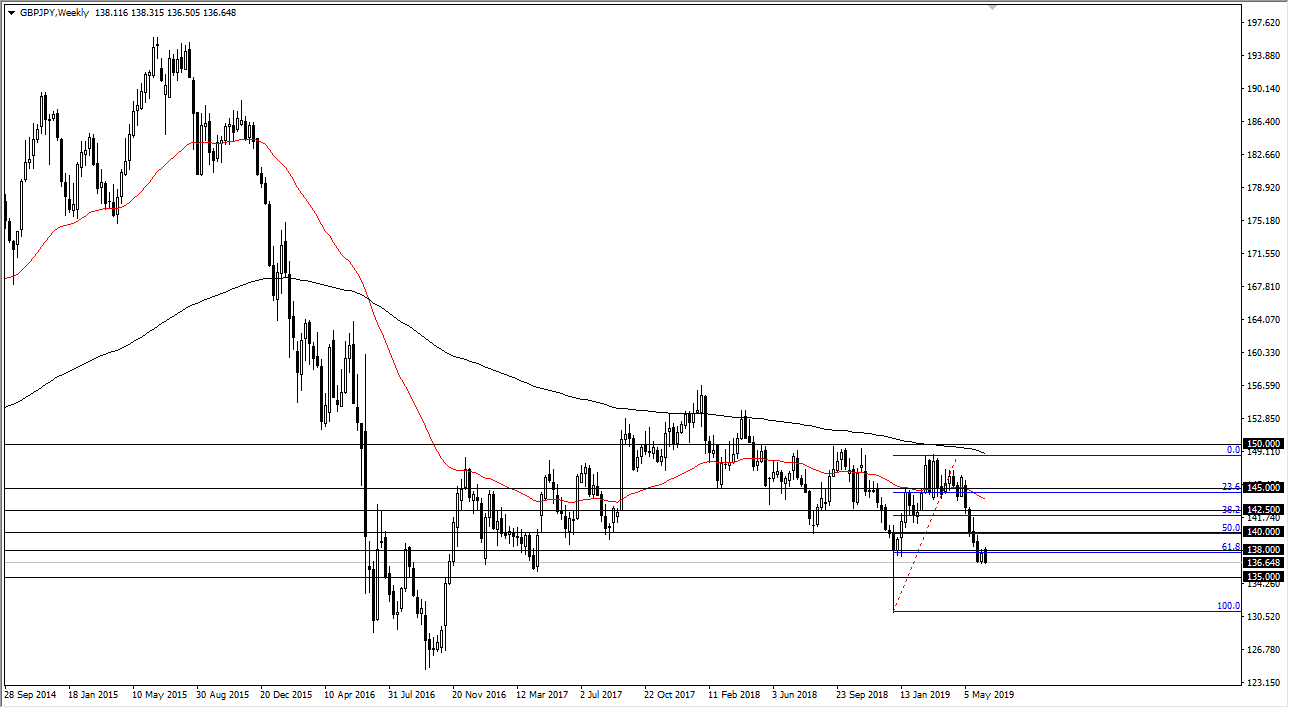

GBP/JPY

The British pound fell hard against the Japanese yen again during this week, as we continue to see a lot of risk when it comes to global markets. It makes sense that the Japanese yen gains against the British pound because not only is this a wrist sensitive pair, but we also have the Brexit going on. Based upon the candlestick that formed this past week, it’s likely that we could see more bearish pressure. If we break down below the lows of the candle stick for this past week, it’s more than likely going to send this market looking towards the ¥135 level.

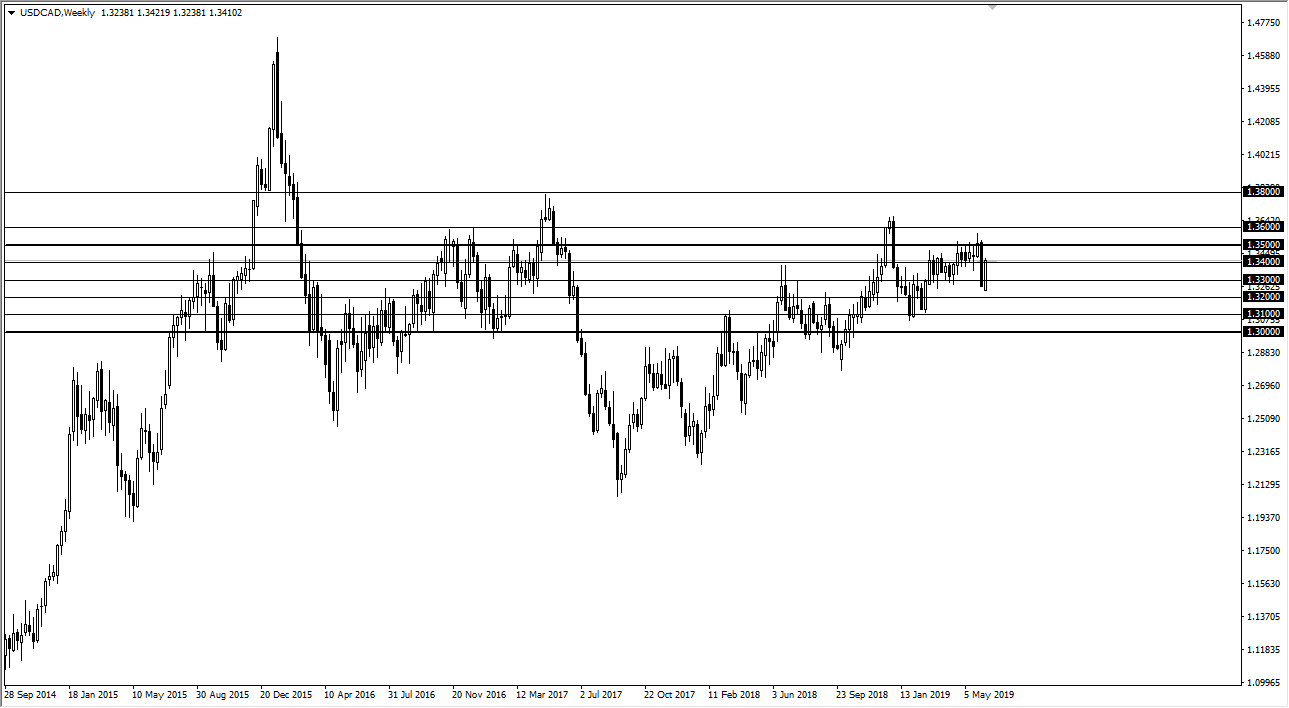

USD/CAD

The US dollar rallied quite nicely against the Canadian dollar, which I find interesting considering that oil sold off and then bounced rather well. By doing so, at this point it’s likely that we will continue to see a lot of volatility but the 1.35 level above is going to be a difficult level to break above. At this point, I think we may see a little bit of bullish pressure, but I don’t think that we break above here unless there is some type of serious change in attitude in the crude oil market. I anticipate a short-term bounce, and then selling off to continue to consolidate between the 1.33 level on the bottom and the 1.35 level on the top.

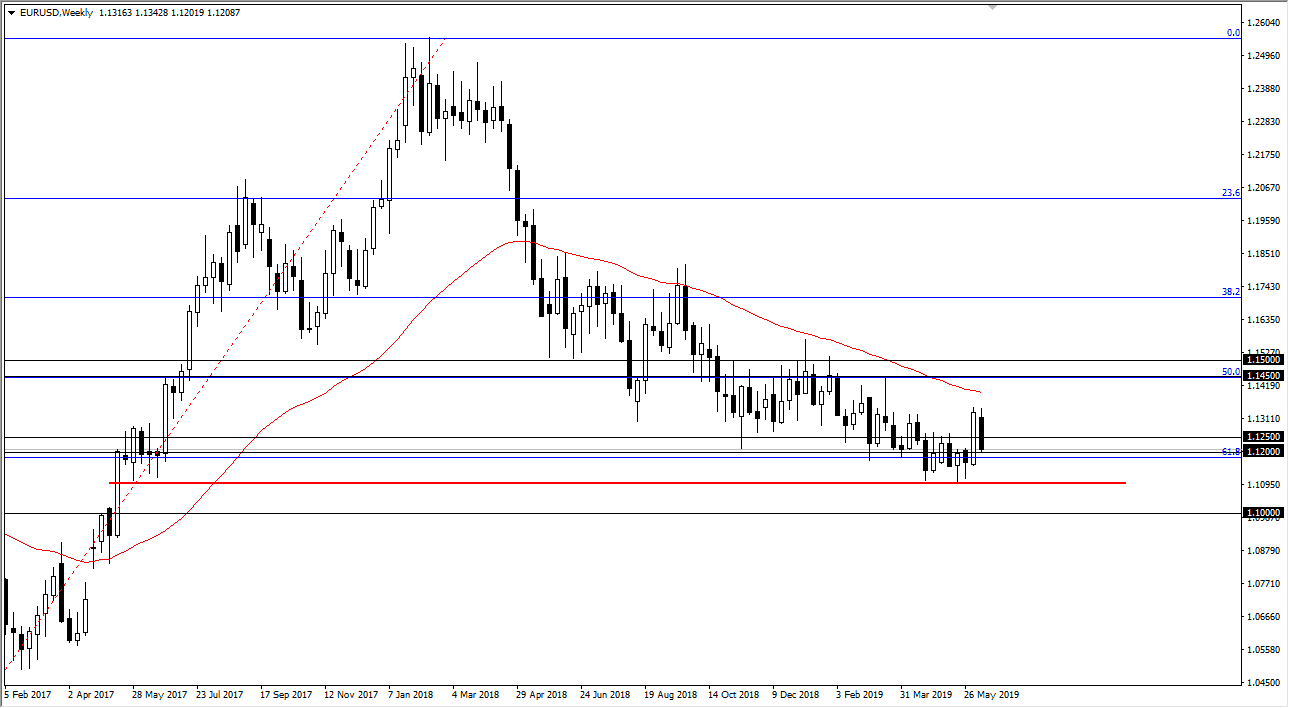

EUR/USD

The Euro initially tried to rally during the week but struggled to keep gains and then ended up falling back towards the 1.12 level as well. At this point, it’s very likely the buyers will come in and try to pick this market up, but it’s going to be difficult and I think it’s a lot of back-and-forth action that we have ahead of ourselves but I still think there is a bit of a floor just below and extending to the 1.11 handle.

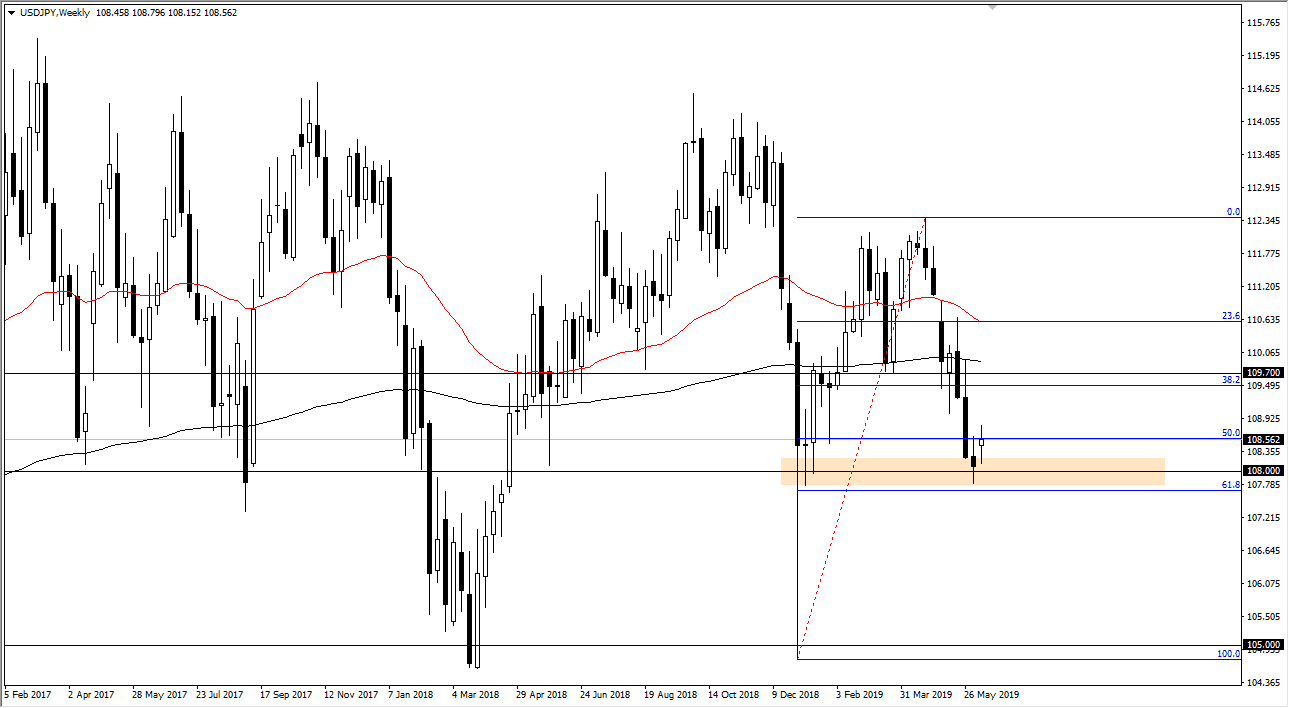

USD/JPY

The US dollar gapped higher to kick off the week against the Japanese yen and then went back and forth several times. Ultimately, it’s likely that we have filled the gap and that buyers will be looking to pick it up. If the S&P 500 rallies, the US dollar will rally against the Yen, perhaps reaching towards the ¥109.70 level if we can break above this past week’s range. On the other hand, if we break down over there we could test the 61.8% Fibonacci retracement level underneath.