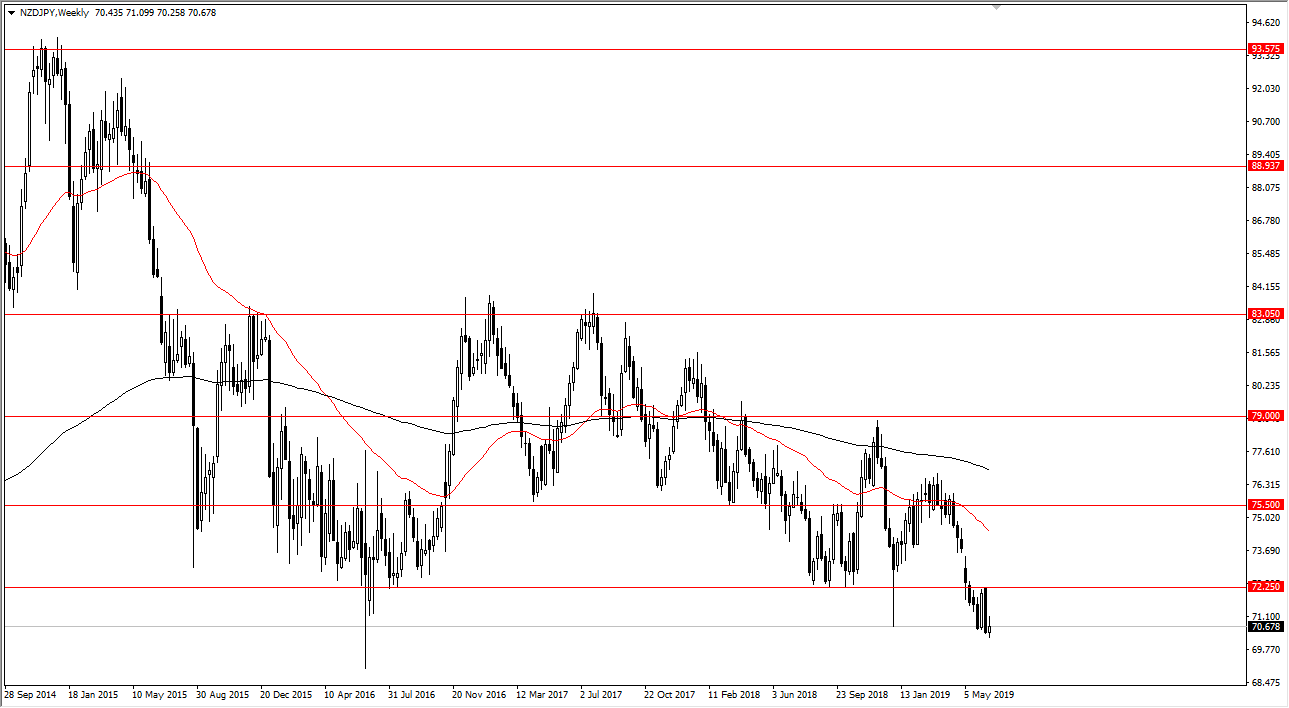

NZD/JPY

The New Zealand dollar tried to rally during the week but gave back quite a bit of the gains. That being the case, the fact that although we formed a white candle, the reality is that the extraordinarily bearish candle stick from last week was wiped out and it now looks as if any rally between here and ¥72.25 is a selling opportunity as we are very likely to continue to go lower. That being the case, I have no interest in trying to fight the trend and will look for selling opportunities.

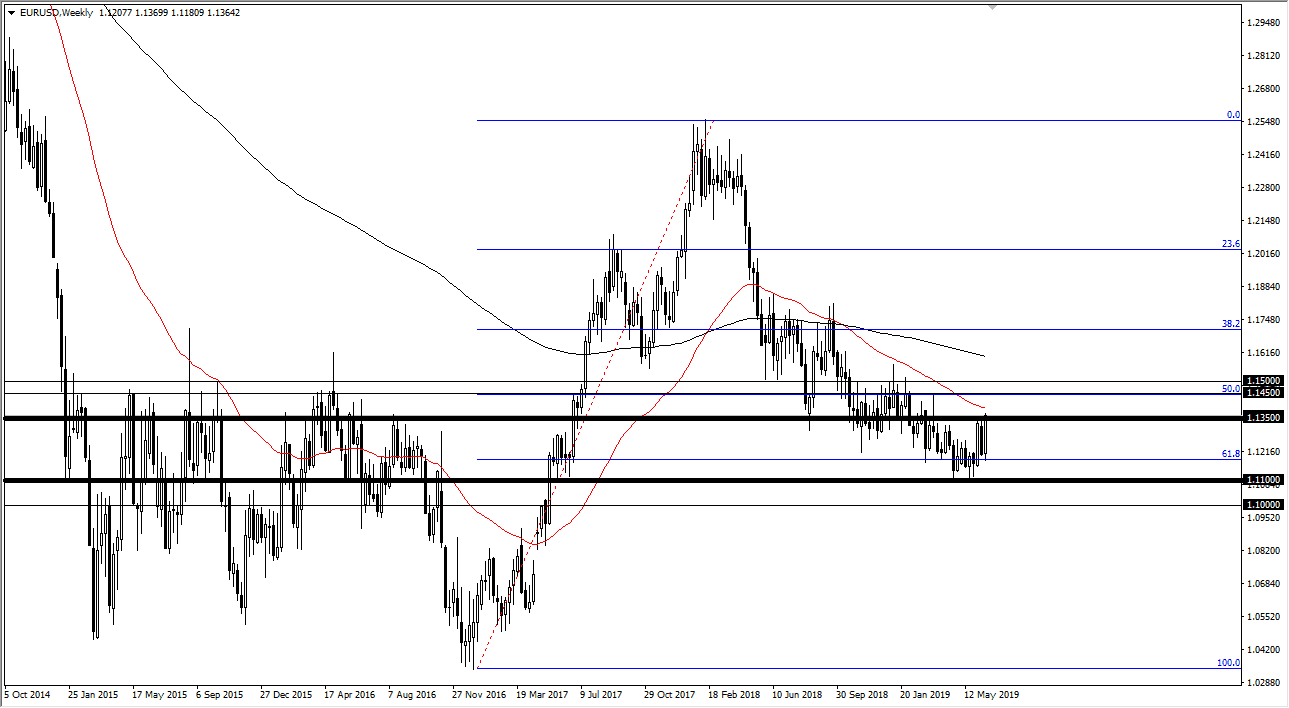

EUR/USD

The Euro initially pulled back during the week but found enough support at the 61.8% Fibonacci retracement level to break higher. Beyond that, the Euro has broken above the 1.1350 level, which of course is a very bullish sign. That being the case though, I think there is a lot of noise between here and 1.1450. Because of this I think that short-term pullbacks will probably continue to offer a nice buying opportunities.

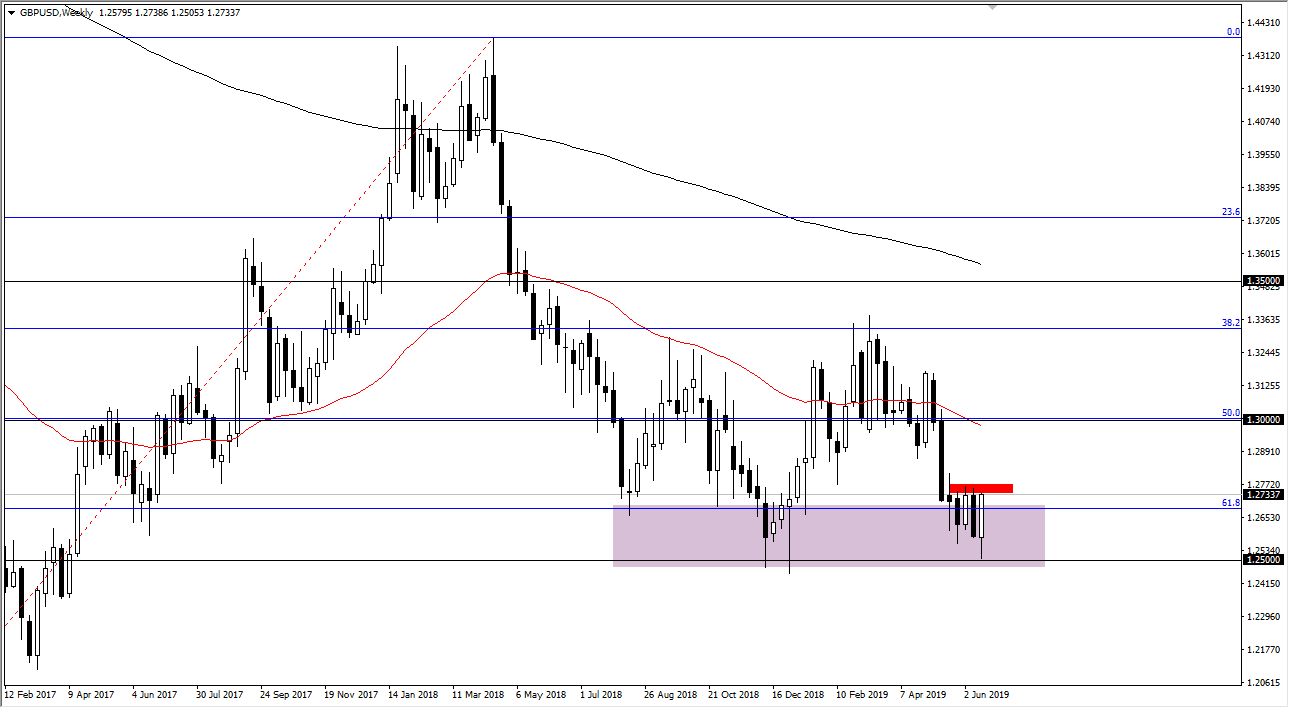

GBP/USD

The British pound initially fell during the week but has found enough support at the 1.25 level to turn things around and reach towards the crucial 1.2750 level. If we can break above the 1.28 level, then it’s very likely that the market should then go to the 1.30 level after that. Looking at this candlestick, it could be a bit of reversal and I am starting to think that perhaps we are more or less in a situation where we are trying to bounce around between the 1.25 level on the bottom and the 1.33 level and the top. That being said, I think one thing you can count on is a lot of volatility.

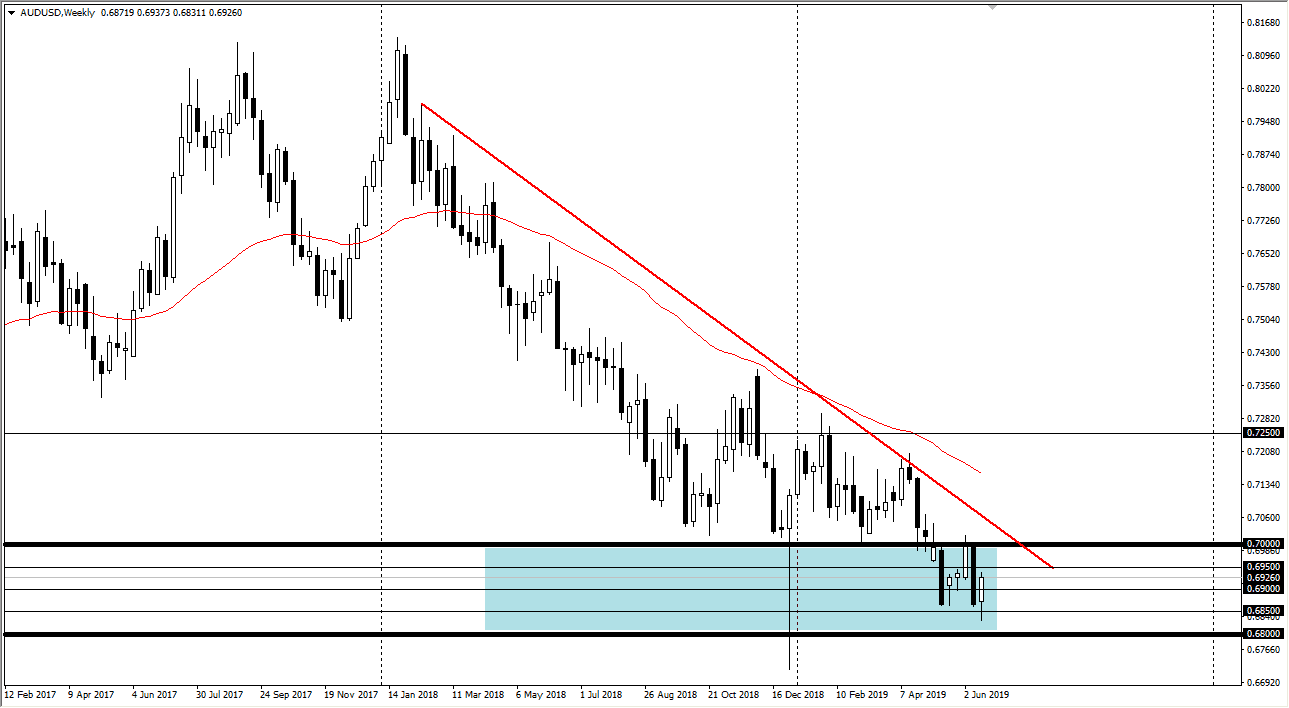

AUD/USD

The Australian dollar has rallied a bit during the week but we are still very much in the consolidation area that we have been in for some time. The 0.68 level underneath is massive in its support for the market, just as the 0.70 level above is massive resistance. That is a market that is held hostage by the US/China trade talks, so will have to wait and see how that plays out, as the market will go higher or lower depending on how those talks go. At this point, you are probably better off avoiding this pair, or assuming that we are going to bang around back and forth.