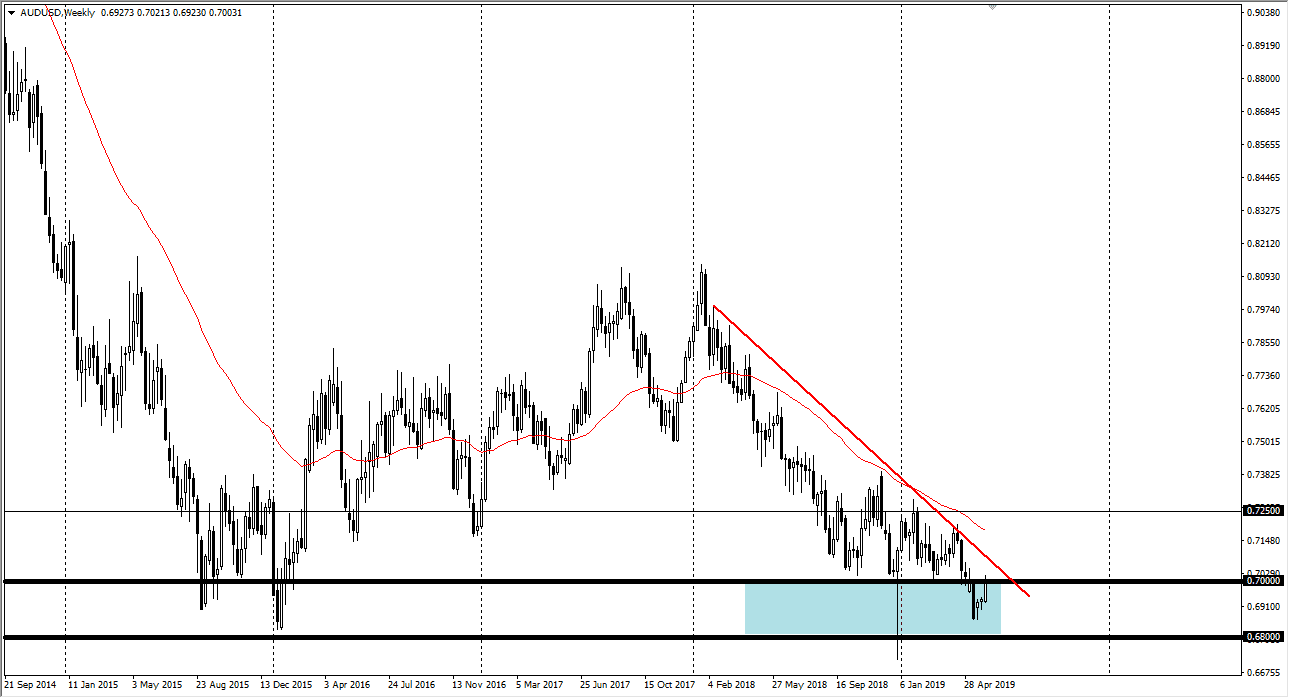

AUD/USD

The Australian dollar has rallied during the week, slamming into the 0.70 level. At this point, the market has shown a proclivity to sell if the US dollar in general, and the Australian dollar may be a beneficiary of this overall attitude. That being said though, there is a downtrend line above that could cause a lot of resistance as well. Because of this, although I think that we may get a bit of a bounce but given enough time I’m sure the sellers will come back out.

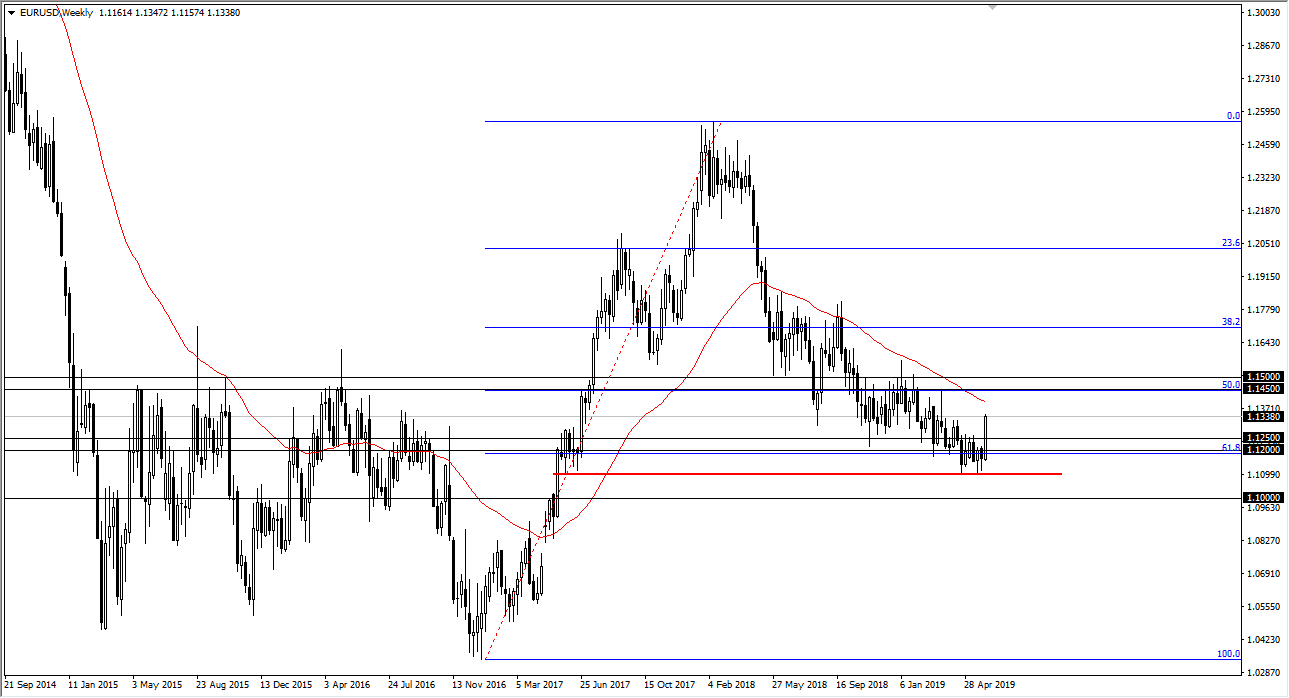

EUR/USD

The Euro rallied significantly during the week, breaking above the 1.13 level in a strong sign of bullish pressure. Ultimately, the market looks as if it is trying to change its overall direction, and I think short-term pullbacks are going to offer buying opportunities now that we have seen this bullish turnaround and of course the Federal Reserve stepping away from its tight monetary policy.

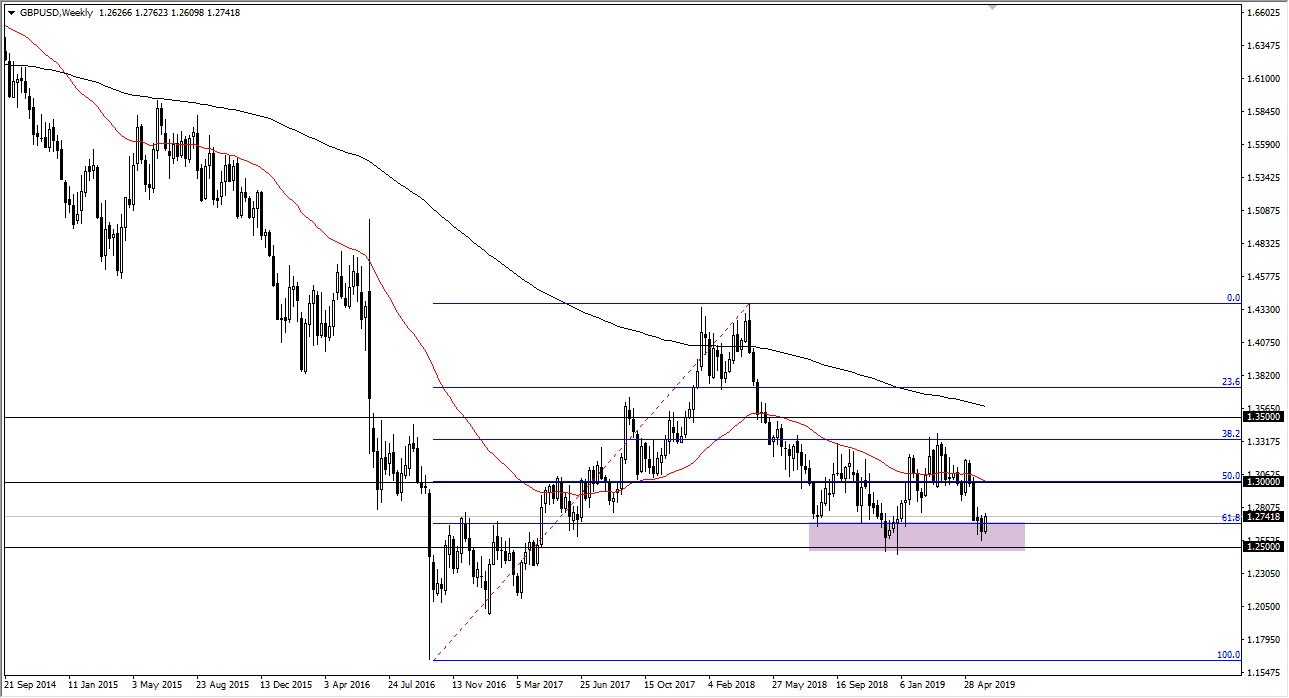

GBP/USD

The British pound rallied during the week, breaking above the 1.27 level, and it looks as if we are going to go to the 1.28 level, then possibly the 1.30 level after that. This is an area that would cause quite a bit more psychological resistance, but it does look as if the British pound is trying to find its footing in this area. The 1.25 level underneath is massive support, so I think it’s only a matter time before buyers would come back at this point. That being said, there is a bit of a headwind due to the Brexit nonsense going on. In the short term though, it’s very likely we see buyers.

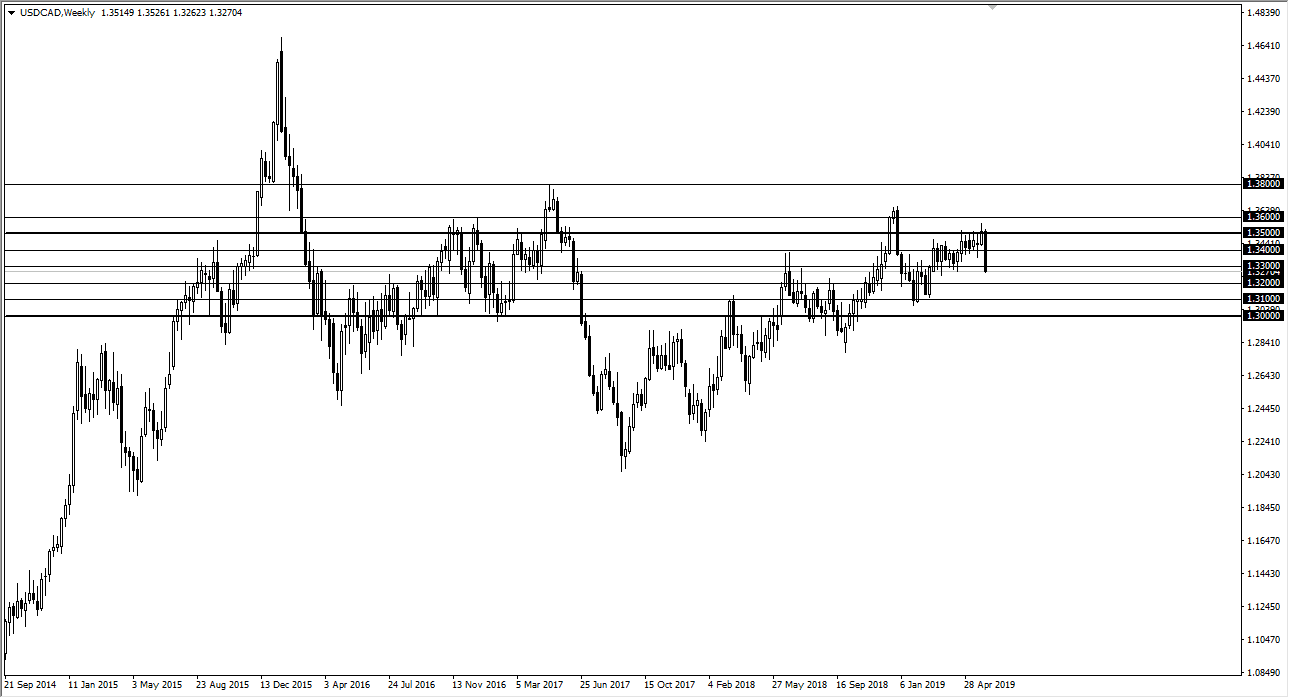

USD/CAD

The US dollar has sliced through a couple of round figures against the Canadian dollar during the week, slicing through the 1.33 handle. Because of this, and the fact that the crude oil market looks ready to bounce, I suspect that we continue to see selling pressure and rallies at this point will probably be sold into.