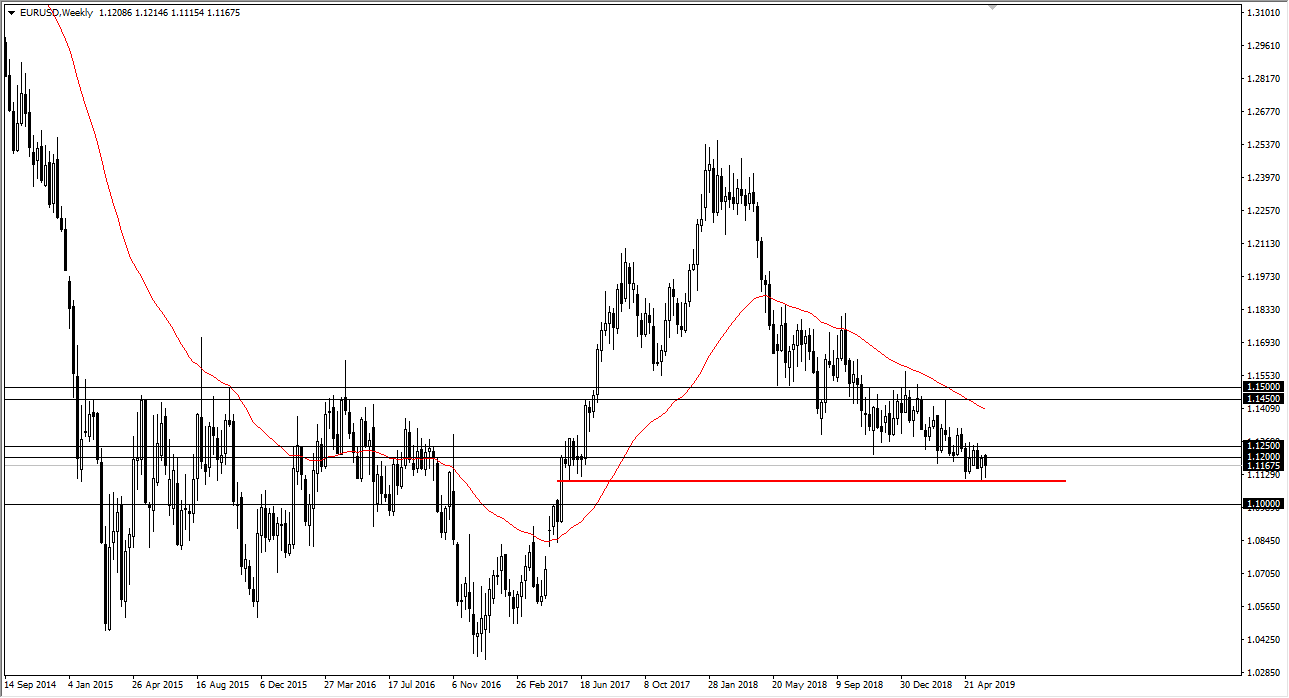

EUR/USD

The Euro fell during most of the week but found enough support at the 1.11 level to turn around and form a bit of a hammer. This hammer was preceded by another one, so it looks as if the market is continuing to try to build a bit of a base. I believe that there is significant support from the 1.11 handle down to the 1.10 level underneath. That doesn’t mean that it’s going to be easy to buy this pair, but I do think short-term dips continue to offer value.

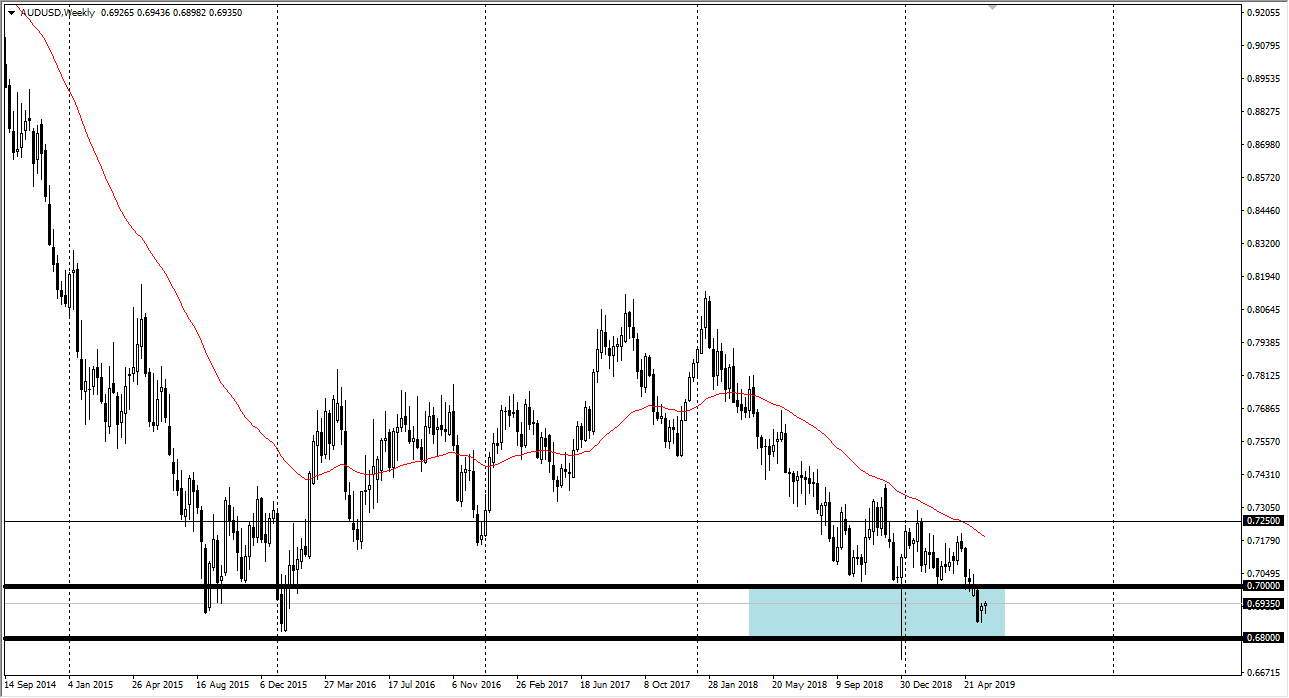

AUD/USD

The Australian dollar initially fell during the week, but just as it did last week, the buyers jump in and turned around to form a bit of a hammer. For me to hammers in a row is a pretty significant sign, so it’s very likely that the Aussie will would try to reach towards the 0.70 level above. A break above that level could open the door to the 0.72 handle. All things being equal though we are essentially in a major consolidation zone that could be the beginning of a “floor” in the Aussie.

The biggest problem here of course is the US/China trade relations which are getting worse. If we can get some type of forward progress in that scenario, the Australian dollar will more than likely be one of the first places you are going to be putting your money for a returned.

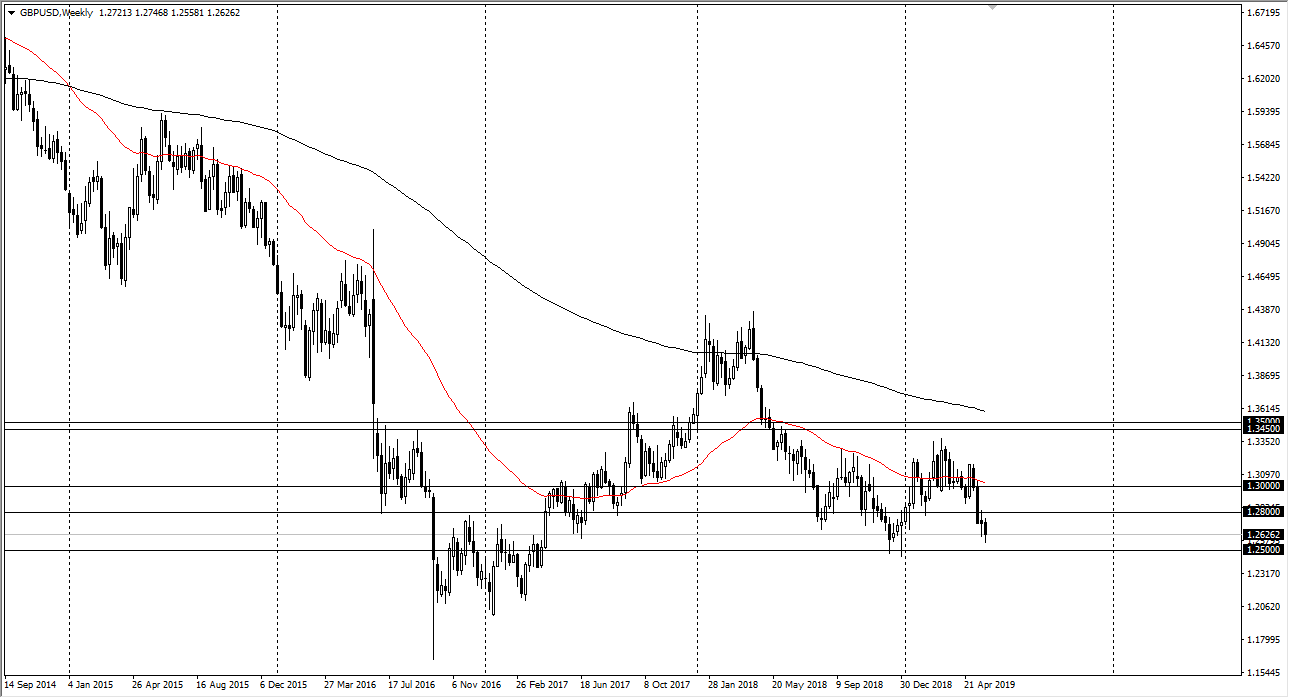

GBP/USD

The British pound fell a bit during the week but did start to stabilize towards Thursday and Friday. The 1.25 level underneath is major support based upon previous action, so it would not surprise me at all to see more of a “by on the dips” mentality over the next week or so. Don’t get me wrong, I’m not willing to throw a lot of money into this pair but it certainly looks as if it is approaching an area where value hunters are willing to step in and try to pick it up.

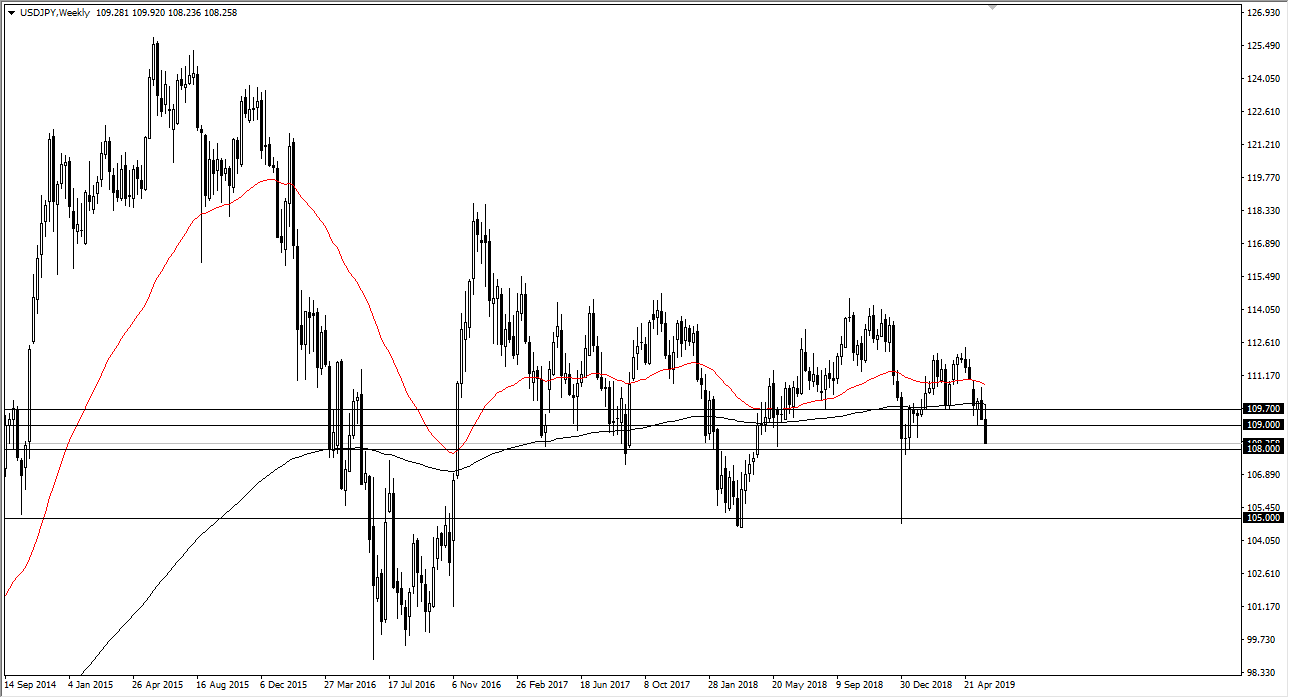

USD/JPY

The US dollar initially tried to rally during the week but collapsed against the Japanese yen on Friday. The fact that we are closing at the very bottom of the weekly candle does in fact suggest that we are going to continue to go lower. I anticipate that rallies that show signs of exhaustion, especially near the ¥109 level, could be a nice opportunity to short this market. The alternate scenario is that we simply fall through the ¥108 support level, opening up the door to the ¥105 level.