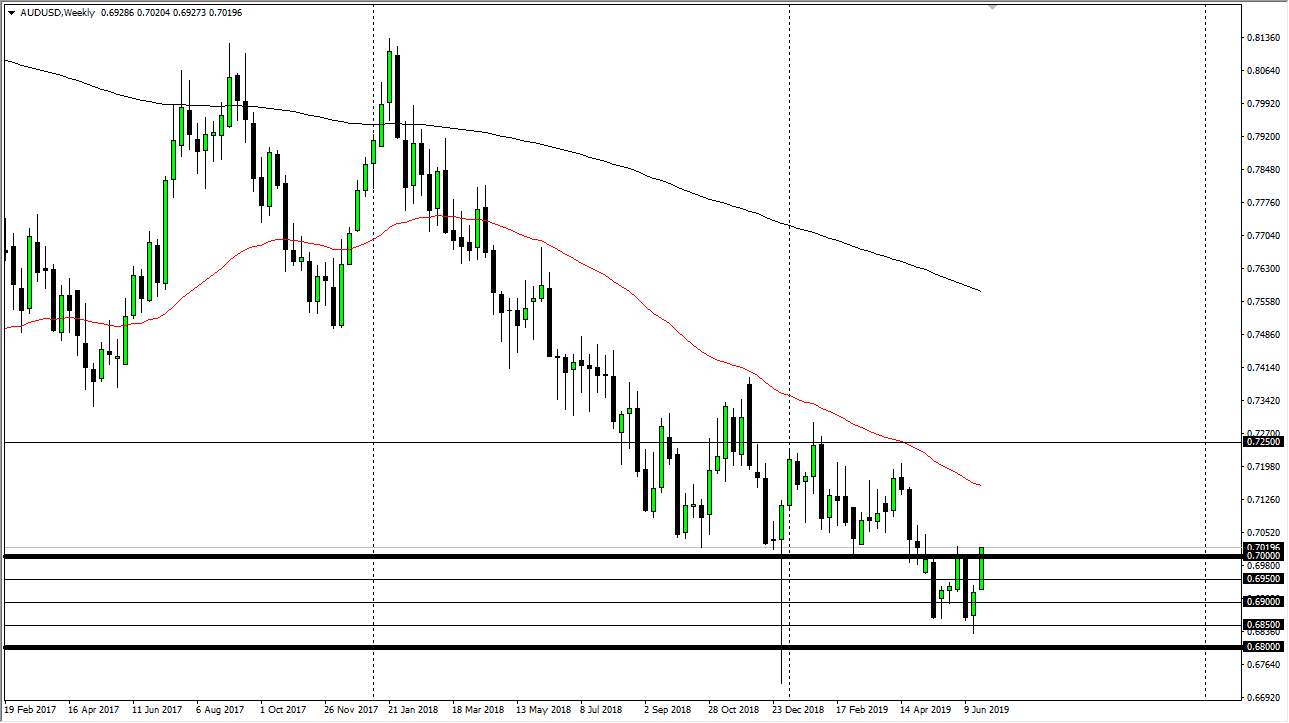

AUD/USD

The Australian dollar had an extraordinarily bullish week as it looks like we are trying to form a bottom. With the Federal Reserve looking to cut interest rates down the road, it makes sense that perhaps other currencies rally against the greenback. The Australian dollar has been extraordinarily beaten down and could rally if there’s some type of good news between the Americans and Chinese over the weekend at the G 20 summit. However, if things sour, this market will turn right back around and drift into consolidation.

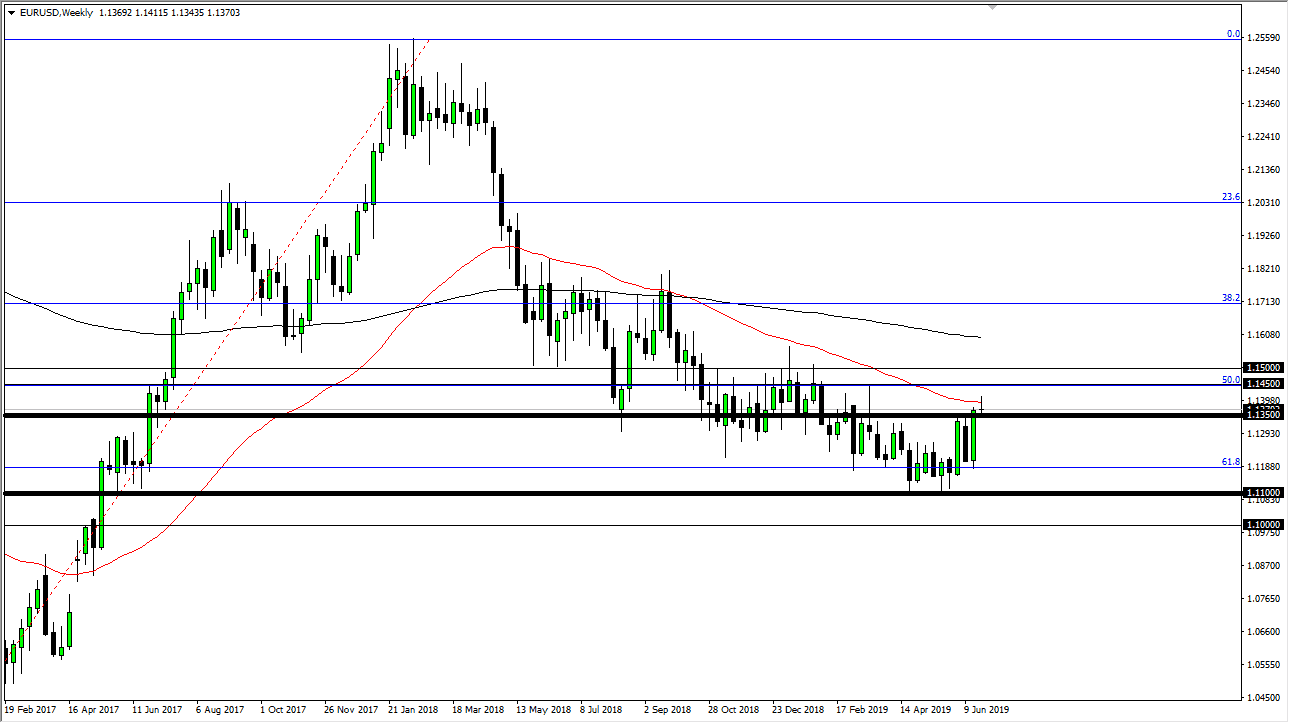

EUR/USD

The Euro went back and forth during the week, as we continue to dance around the 200 day EMA. However, on the weekly chart we are forming a bit of a shooting star so it’s possible we may get a pullback. If we do get a pullback I think there are plenty of buyers underneath though, as the Federal Reserve is going to work against the value of the US dollar by cutting interest rates. The question now is whether or not we get good news out of the G 20. In fact, that’s going to be the case for almost all currency pairs involving the US dollar.

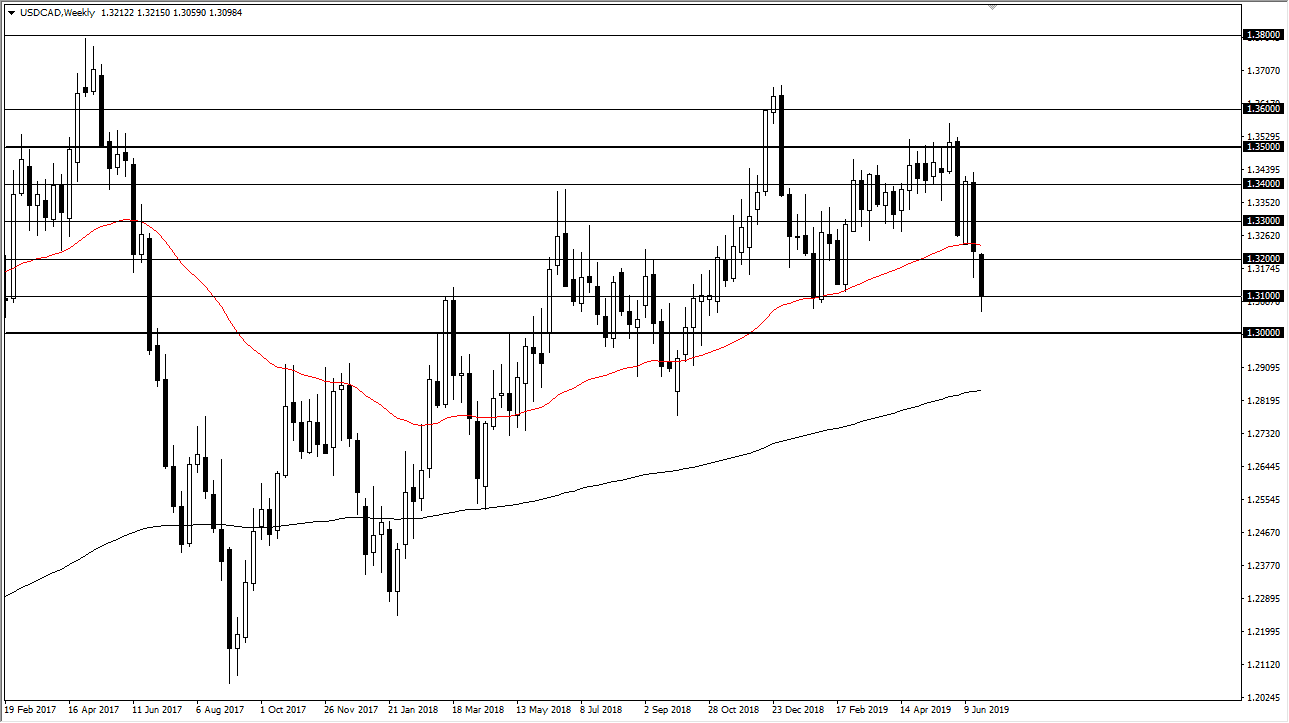

USD/CAD

The US dollar has broken down against many other currencies around the world, including the Canadian dollar. We you don’t see on this weekly chart is that there was a major hammer formed at the 1.31 level on the daily chart. This is also an area that has offered support previously. Because of this, I would anticipate some type of bounce but if we do break down below the bottom of the weekly candle stick we will probably go looking towards 1.30 level underneath. Pay attention to oil, if it pulls back then that could give a little bit of a boost for this market.

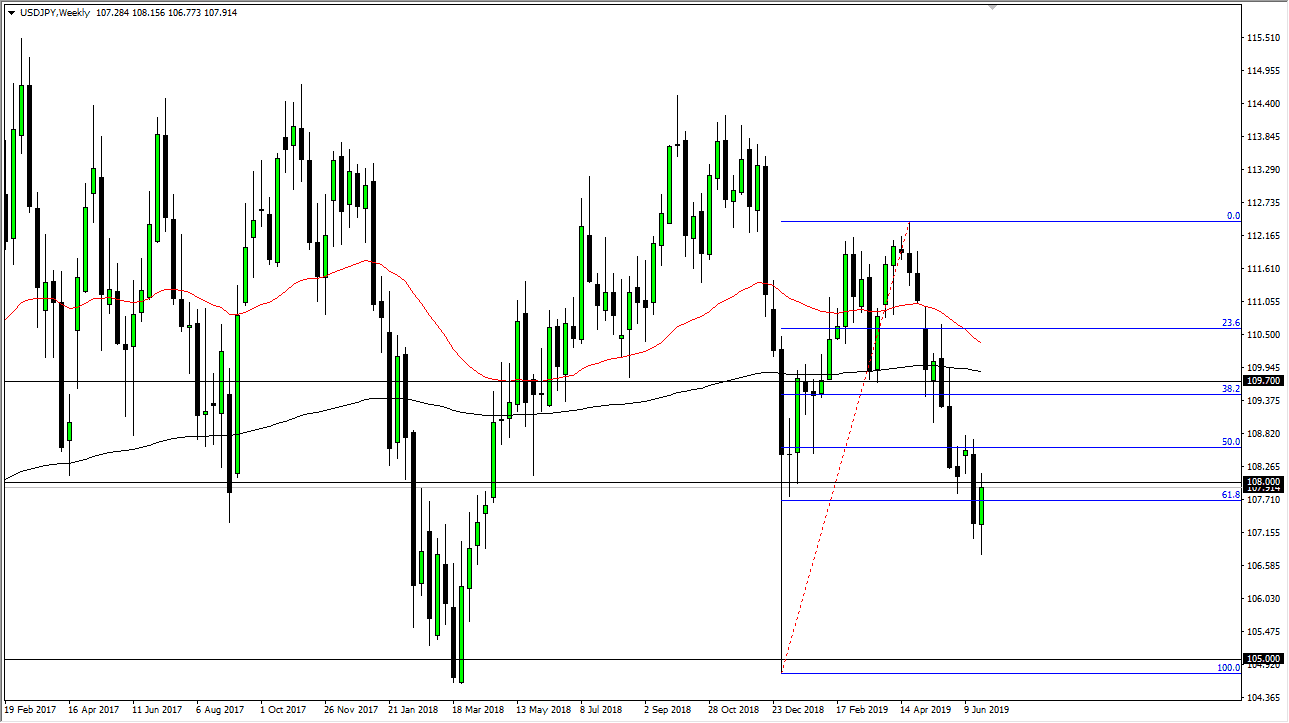

USD/JPY

The US dollar has made a significant recovery against the Japanese yen during trading this week, and now it looks as if the ¥108 level is going to offer a bit of resistance. If we can break above the top of the candle stick, then the market goes looking towards the ¥108.70 level. However, if we were to break down below the bottom of the candle stick for this past week, we would probably go down to the ¥105 level. This will move almost exclusively based upon the results of the meeting between the Americans and the Chinese.