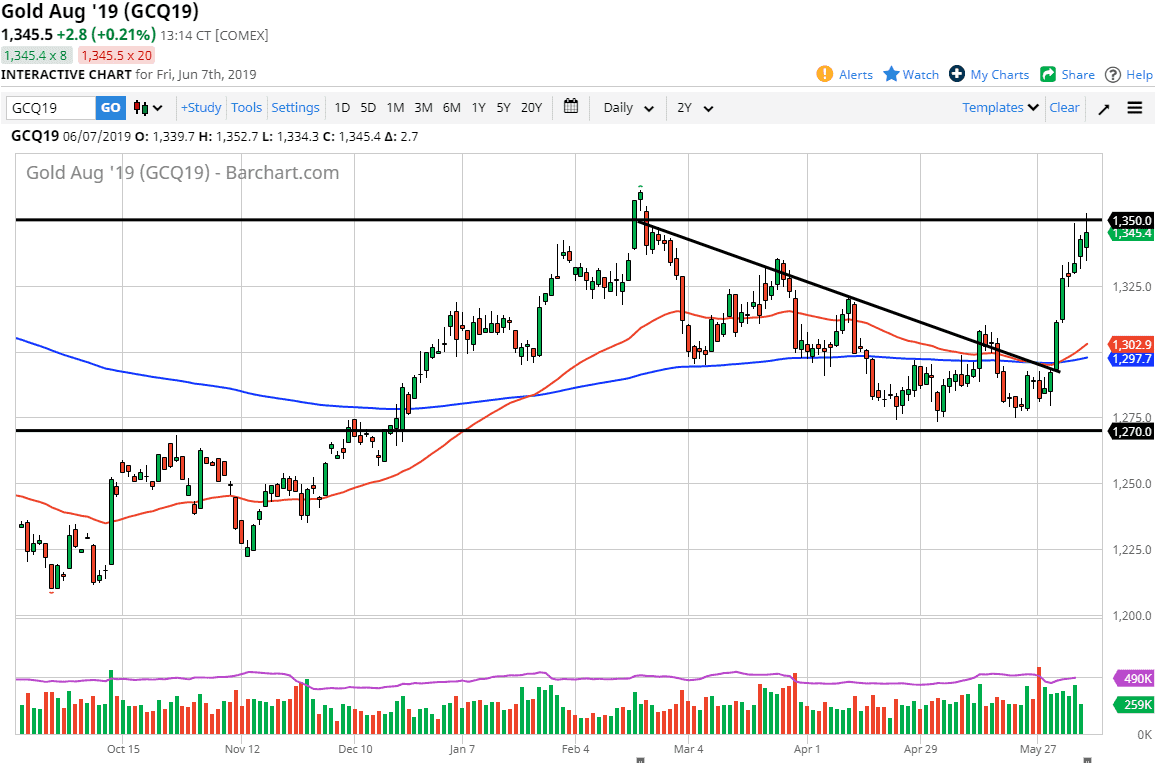

Gold markets went back and forth during the course of the trading session on Friday, breaking above the vital $1350 level. By piercing that level, we have tested a major resistance barrier. By pulling back we have seen quite a bit of a reaction, and it now looks very likely that we are going to continue to struggle to go higher.

This of course makes sense, because there has been a lot of trading action above there, and what we need to think about now is whether or not this was simple profit taking ahead of the weekend, or if we won’t be able to break out to the upside. With that in mind, we need to treat this as a bit of a binary trade, meaning that it’s either one direction or the other. The easiest way to do that is to buy this market on a breakout above the top of the range for the day, which would be more of a “buy-and-hold” situation. To the downside, if we break down below the bottom of the range for the session, it’s very likely that we could pull back towards the $1325 level.

After that, we could go down to the $1300 level after that. The 50 day EMA is sitting around that area as well, so at this point it’s likely that we should see a significant move, but we won’t know until we get a break of the Friday range. It wouldn’t be much of a surprise to get a pullback, as we have gotten a bit overbought and overextended at this point in time. Keep in mind that the Federal Reserve monetary policy has given this a bit of a boost, so we will have to wait and see how that works out over the longer-term.