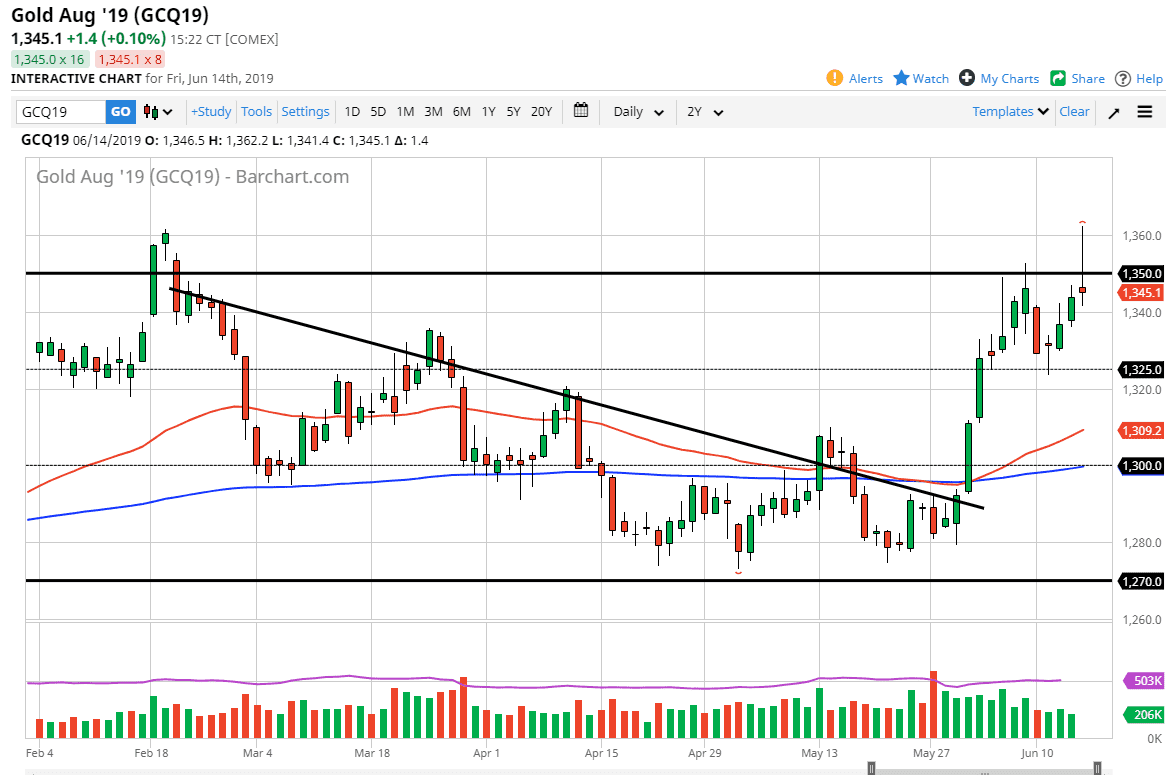

Gold markets surged higher to kick off the Friday session after initially dipping just slightly at the open. As traders continue to be very concerned about global growth and probably more importantly global risk appetite due to tariffs and trade wars, the market shot through the much ballyhooed $1350 level. In fact, we got as high as $1360 or so, and then got absolutely slammed when the COMEX open pit traders got on board.

Once we got into the heavy volume session, gold got slammed. The US dollar strengthened in general, and although the stock market held up fairly well, the reality is that money started flowing out of other currencies such as the Euro, and into the greenback. That almost always works against the value of gold and other precious metals, which of course we had seen a major reversal in the silver market as well.

At this point, if we break down below the massive shooting star for the trading session on Friday, then it opens up a move down to the $1325 level. I would anticipate that we could see a little bit of a rally right away though, especially if there is problems out there when it comes to headlines in the news. Remember, we have an entire weekend to read the Twitter feeds. I would be rather shocked if there weren’t some type of headline to trade off of.

To the upside, if we break above the top of the candle stick then we could go as high as the $1375 level, which is the next major area of interest. I think it would not be surprising at all to see this market simply consolidate between the $1350 level and the $1325 level yet again.