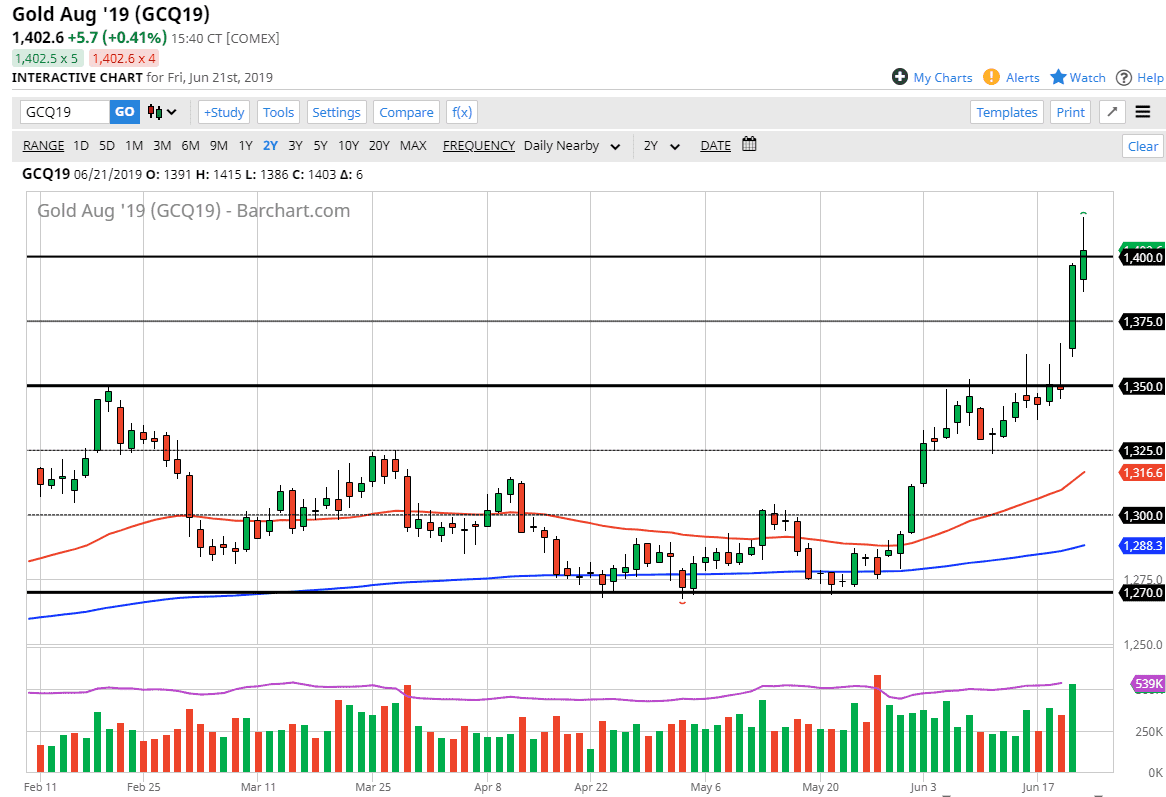

Gold markets broke higher during the trading session on Friday, breaking above the crucial $1400 level. That being said we did sell off quite drastically, and now it looks as if we are closing just above there, but it isn’t exactly the most bullish of candlesticks. That being said, only a fool would try to short this market.

I think that we could see a little bit of a pullback, especially if we get some type of “risk off” event. Markets don’t move in one direction forever so the patient trader is going to make a lot of money if they can wait for value to come back into the gold market. Beyond that, pay attention to the various levels underneath in $25 increments as they tend to offer technical support and resistance. I like the idea of buying gold as it gets cheaper, because the Federal Reserve is of course looking to cut interest rates later this year.

By breaking above the top of the massive shooting star from Wednesday, we absolutely crushed any longer term resistance. That doesn’t mean that we will pull back, and quite frankly we need to because we had gotten far ahead of ourselves. At this point I believe that the $1350 level is going to be massive support and essentially the “floor” in the market. As long as we can stay above there I don’t have any interest in trying to short this market. Beyond that, you can also see that there was a lot of noise between the $1350 level in the $1325 level under there, so really there’s no reason to be shorting this market. Yes, somebody will get cute out there and short this market on the pullback, but that is a good way to lose money over the longer-term.