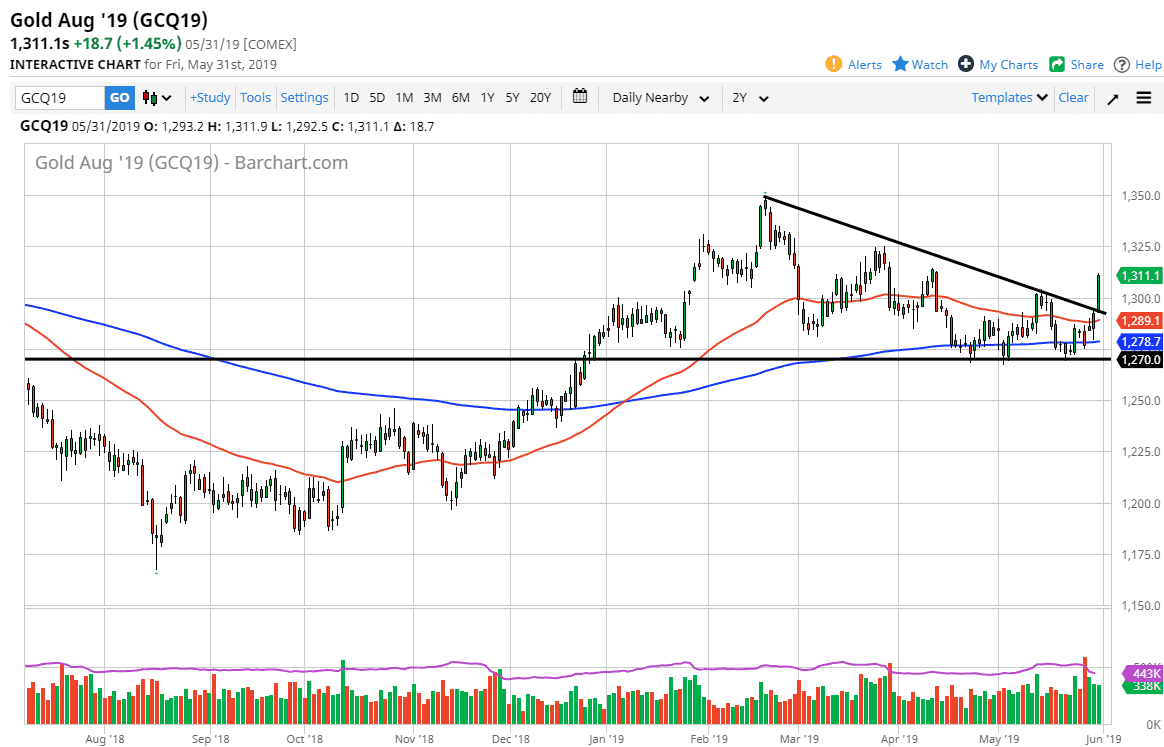

Gold markets exploded to the upside during the day on Friday, reaching above the downtrend line that has been so prevalent on the daily chart. I initially thought that the market was going to break down significantly, as we had formed what looks to be the beginning of a descending triangle but did not break through the support level. At this point, the fact that we have negated this pattern is a good sign for the market and now we typically will go to the top of the triangle. In other words, we should then go looking to the $1350 level given enough time.

The fear of a global slowdown and of course a lot of economic negativity has people looking to pick up gold to preserve wealth. While the US dollar has strengthened, Friday did see a little bit of a turnaround as perhaps the market is going to shun US assets in favor of things like gold or perhaps the Japanese yen.

To the upside, I see the $1315 level as being the initial resistance barrier, followed by the $1325 level, and then the target of $1350. I don’t know if we can break above there, but if we do it’s very likely that we go to the $1400 level. To the downside, if we turn around suddenly there is the 200 day EMA which seems to have offered enough support for the market to turn around and show signs of life. The blue moving average is down at the $1270 level, so it’s obvious that we have a bit of a floor in that general vicinity. Buying dips will probably be the way to go, at least for the next couple of weeks as I suspect that the global economic conditions will probably deteriorate, not to mention the geopolitical ones.