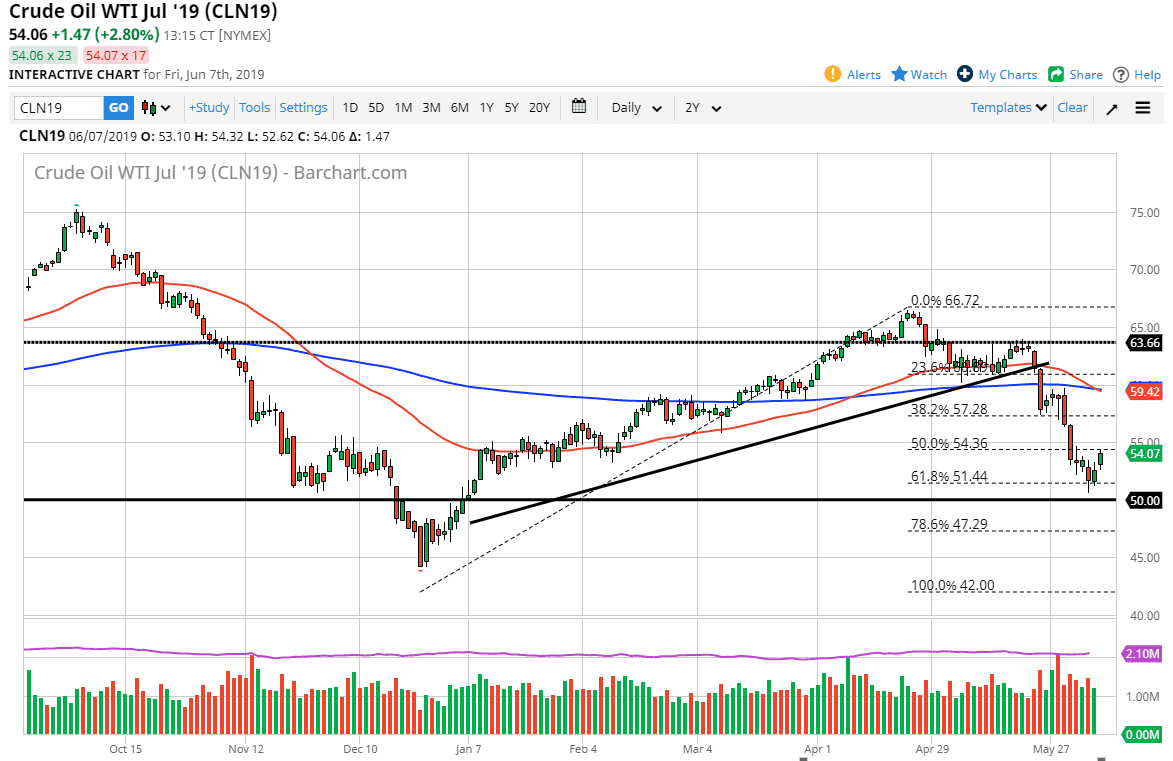

WTI Crude Oil

The WTI Crude Oil market gap higher on Friday to kick off the session and continue to go even higher. With that, we broke above the $54 level and it now looks as if we are trying to bottom. Beyond that, the weekly candle stick is a hammer so that of course is very bullish. Ultimately, this is a market that is going to target the $55 level. If we can break above there, the market very likely will go looking towards the $57.50 level, and perhaps even higher than that.

To the downside, the $50 level looks very likely to be massive support, and a break down below there would of course be very negative. Crude oil markets are oversold, so I think it’s only a matter of time before we get a bit of a correction and perhaps an oversold bounce.

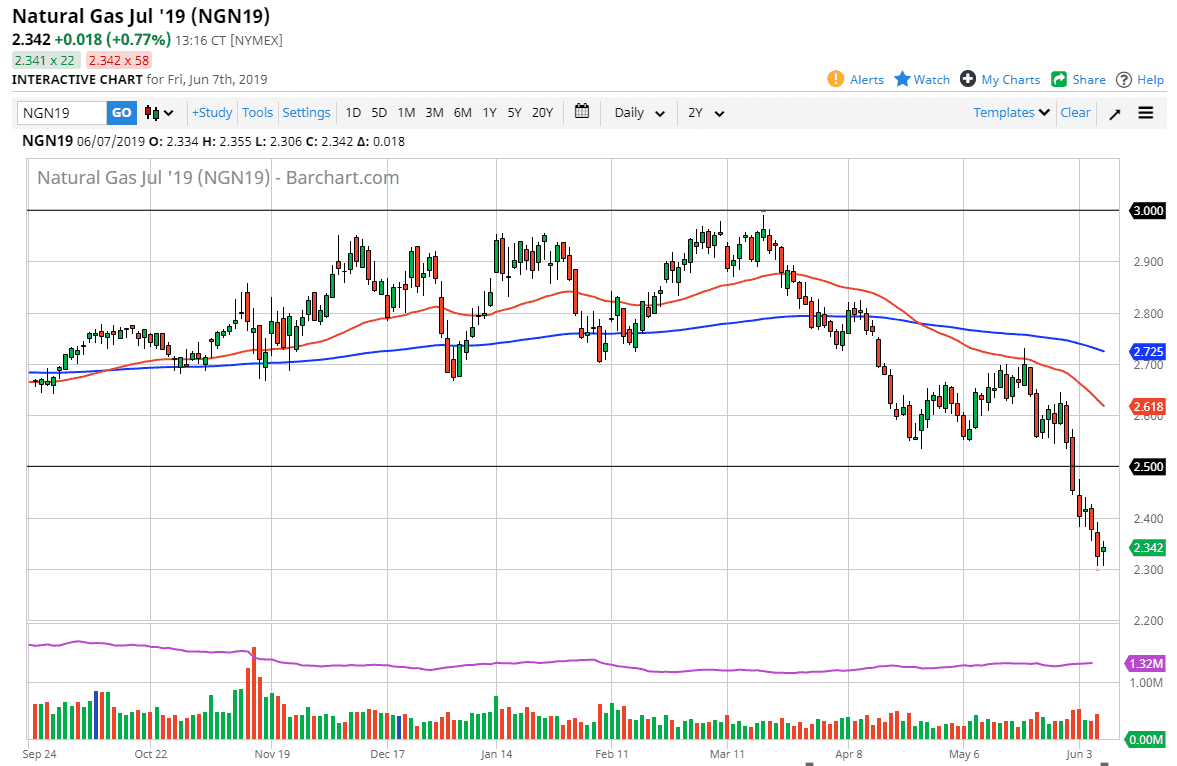

Natural Gas

Natural gas markets also bounced a bit during the day on Friday, as we continue to see negativity in the market overall, but we may have gotten ahead of ourselves. At this point in time I believe that the $2.50 level should be significant resistance, and if we break above there I think there is even more resistance above at the $2.60 level. Signs of exhaustion should be sold into, as this is a marketplace that is oversold but has plenty of reasons to fall from here as there is a significant lack of demand and of course the fact that the northern hemisphere will be warming up, therefore there will be much demand for heating.

There are also concerns about global growth in general, so that could have a bit of detrimental influence on the natural gas markets as well. With that in mind, I’m looking to fade rallies.