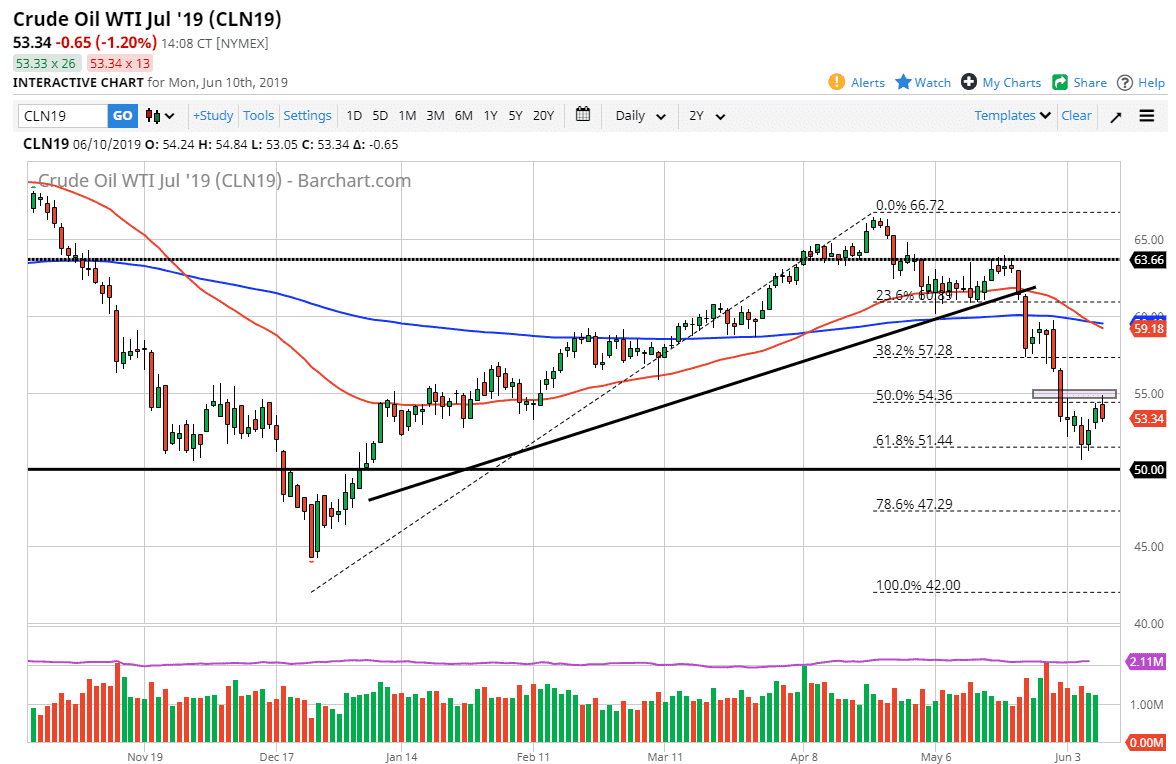

WTI Crude Oil

The WTI Crude Oil market initially rallied during the open on Monday, reaching towards the $55 level. There was a lot of resistance just below there, so we dropped rather significantly. At this point, it is an area that will need to be overcome for the buyers to lift the market. The candle stick from last week was a massive hammer, which of course is a very bullish sign. At this point, as soon as we clear the $55 level, I think that the buyers will push towards the $57.50 level, and then perhaps the $60 level after that. In the short term, I think that the buyers will continue to defend the psychologically important $50 level. With that in mind I’m looking for short-term buying opportunities. However, if we were to break down below the $50 level, the bottom could fall out of this market.

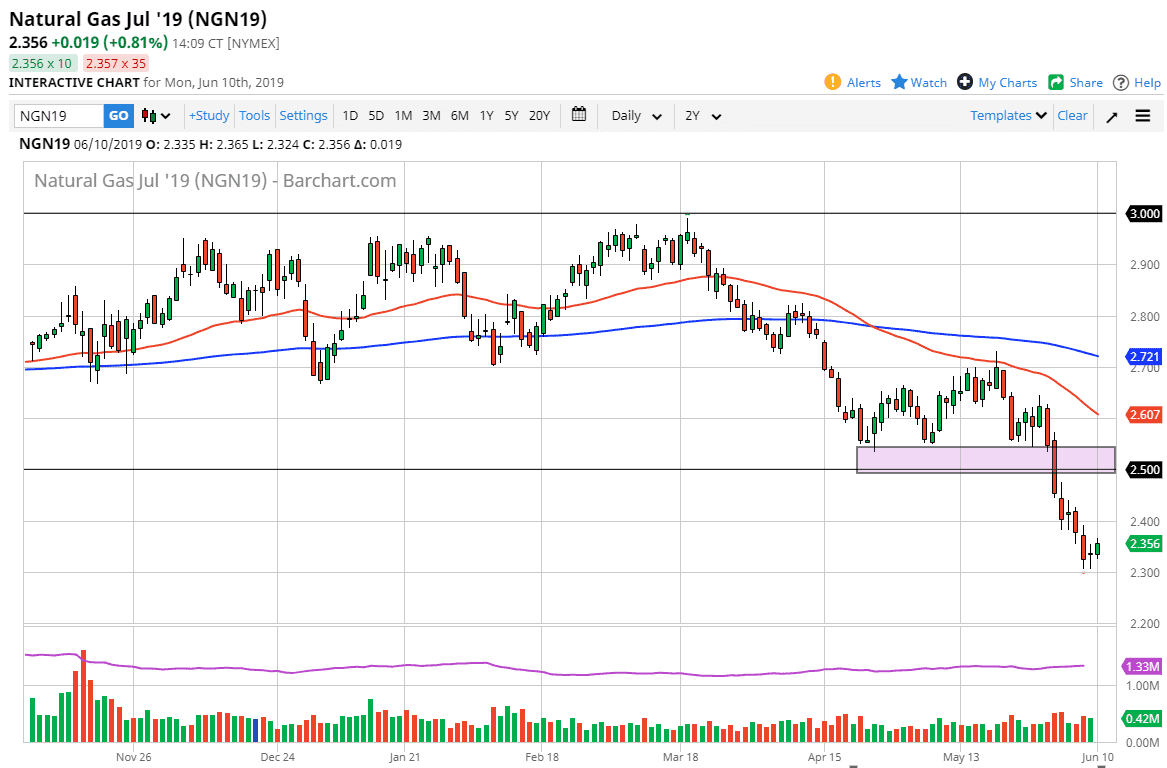

Natural Gas

Natural gas markets rallied a bit during the trading session on Monday, in a slight attempt to stabilize the market. The $2.30 level underneath should be supportive, but at the end of the day I think we are oversold so I think a bounce is probably coming. The $2.50 level above should be resistance, as it was massive support in the past. At this point in time, it’s very likely that we will see a lot of selling pressure once we get there, not to mention at the $2.60 level above there which is the 50 day EMA.

I do believe that we will go down to the $2.25 level, possibly even the $2.00 level. Any bounce that we get from here that show signs of exhaustion should be an opportunity to start selling yet again as we are most certainly in a bearish time of year in a very bearish market.