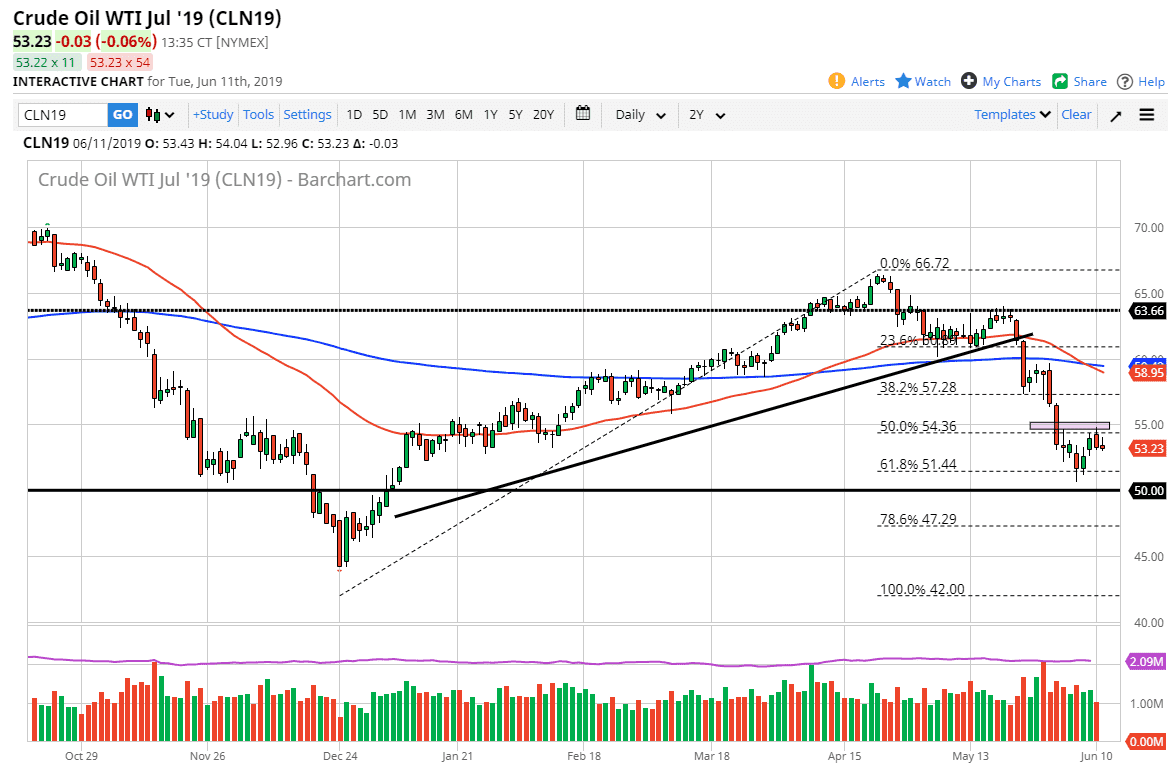

WTI Crude Oil

The WTI Crude Oil market shot higher initially to kick off the day on Tuesday, as we attempt to reach towards the $55 level, which of course is psychologically important. We have recently bounced though, so the question now is whether or not we are trying to build a base or are we going to break down? At this point, I suspect we are trying to build a bit of a base because we have sold off so significantly.

Looking at the chart, I think that if we can break above the $55 level on a daily close, then we can go much higher. Alternately, if we break down a bit from here I suspect that we will find quite a bit of buying pressure starting at about $51.50 or so. I believe at this point the $50 level is your “floor.” If we break down below there, this market unwinds quite drastically.

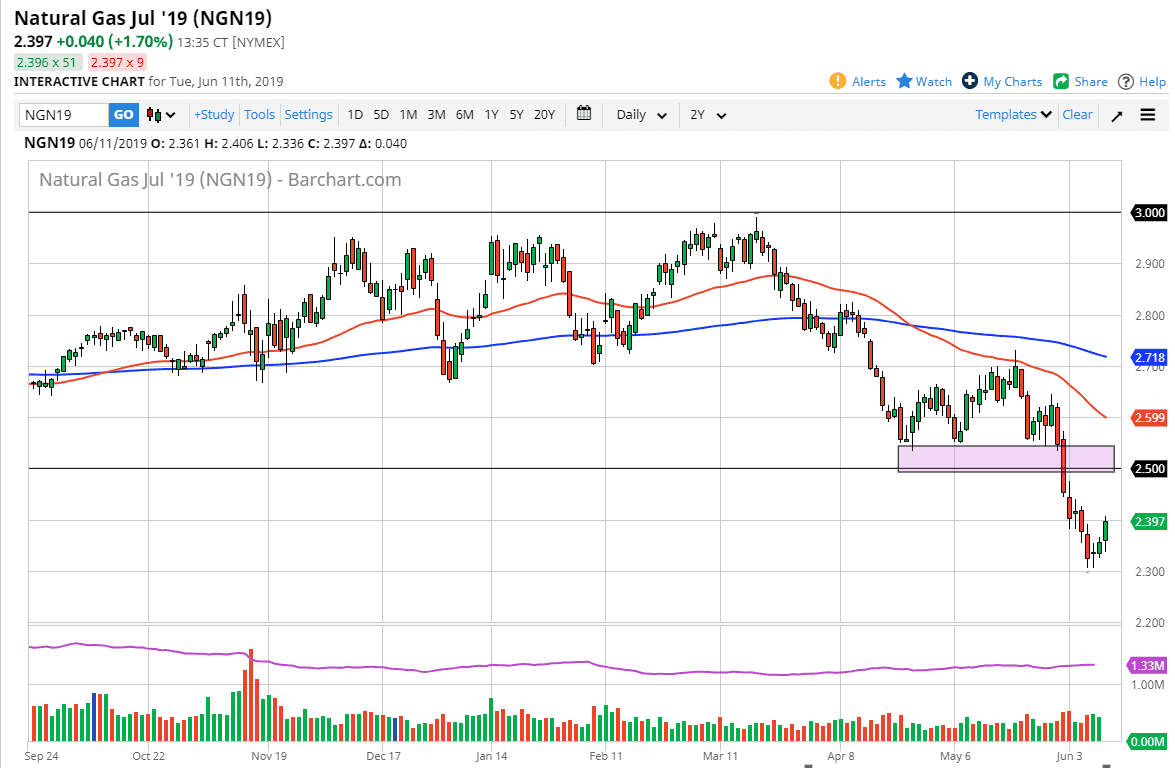

Natural Gas

Natural gas markets initially fell a bit during the trading session on Tuesday but then shot higher to reach towards the $2.40 level. Ultimately, I think we still have some room to go to the upside but I’m not willing to buy this market. I think waiting for some type bit of exhaustive candle in a higher level is probably the best way to go. The $2.50 level above is a previous support and should now be massive resistance. If that’s going to be the case, I think that it’s only a matter of time before we consider selling and I welcome this rally as an opportunity to sell from higher levels. I believe that there is resistance at the $2.67 level as well, as it features the 50 day EMA. I have no interest in trying to buy this market in the meantime though.