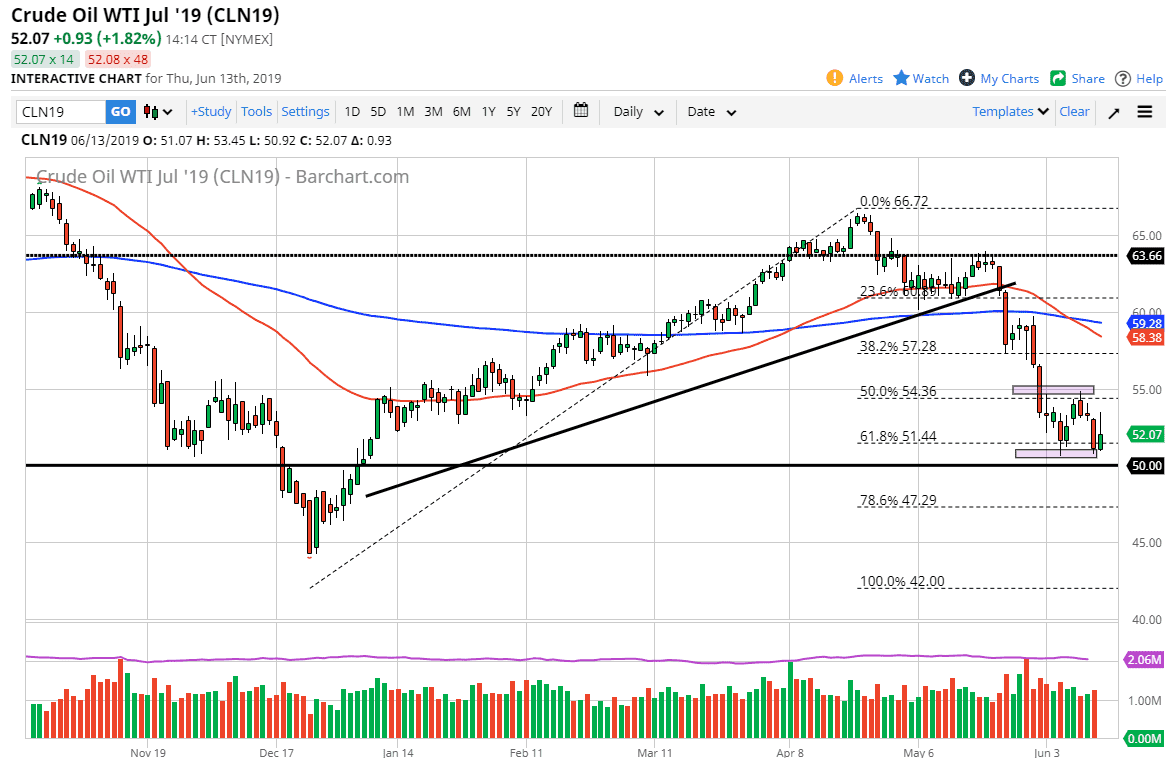

WTI Crude Oil

The WTI Crude Oil market rallied significantly during the trading session on Thursday as we got wind that the attack on those couple of oil ships in the Gulf of Oman happened. With that, oil spiked as there are a lot of concerns about Middle East tensions, but later in the day we gave back quite a bit of the gains. With that in mind, I do believe that it was the excuse we were looking for to take advantage of, but at this point we have given back quite a bit of the gains. By doing so, I think we are trying to build a bit of a base overall. The weekly candle stick from last week was a massive hammer, with the $50 level underneath offering a lot of support. I do believe that this pullback could give us a buying opportunity, but if we were to break down below the $50 handle, this market unravels rather significantly.

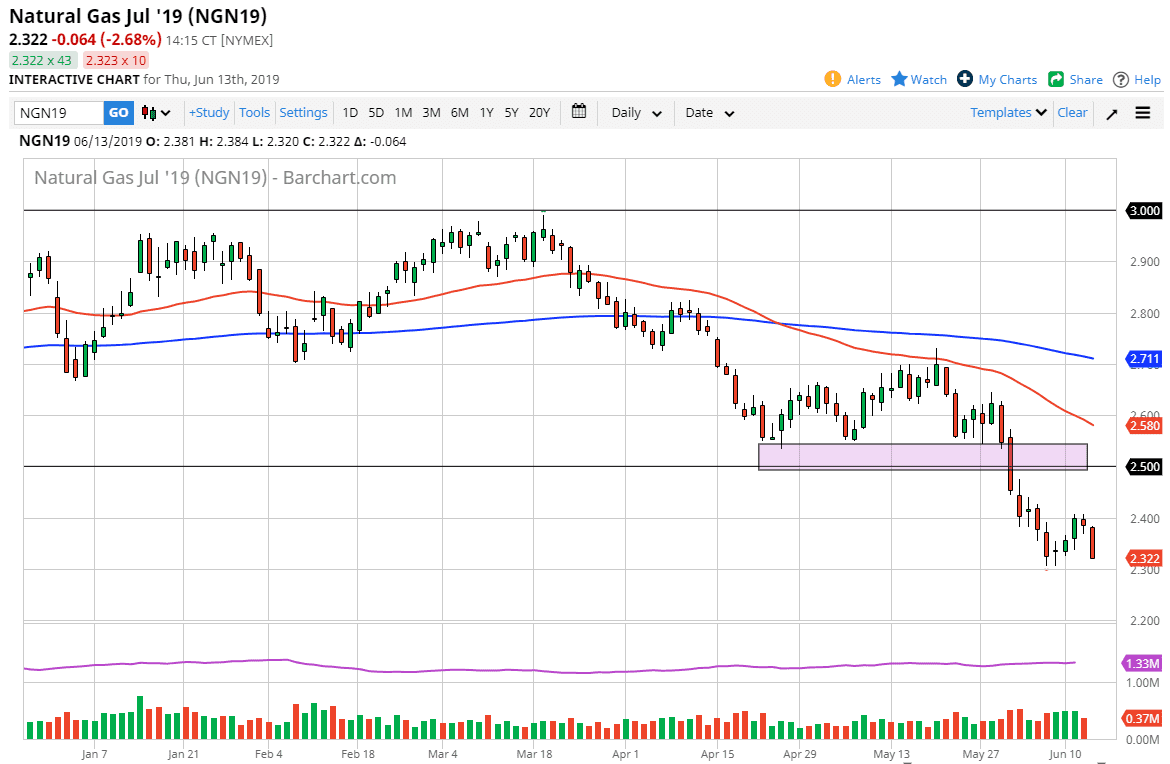

Natural Gas

Natural gas markets fell again during the trading session on Thursday, as we have seen such a nasty move lower. At this point, it looks as if the $2.25 level will probably be targeted, and then the $2.00 level. In general I believe that this market has been oversold for some time so it makes sense that we could see a bit of a bounce. I’m waiting to see significant bullish pressure give way to a bit of exhaustion so I can take advantage of the overhead mass of selling near the $2.50 level. Any signs of exhaustion that I will jump all over and push this market back down. I have no interest in buying until somewhere around November when the van picks up natural gas again.