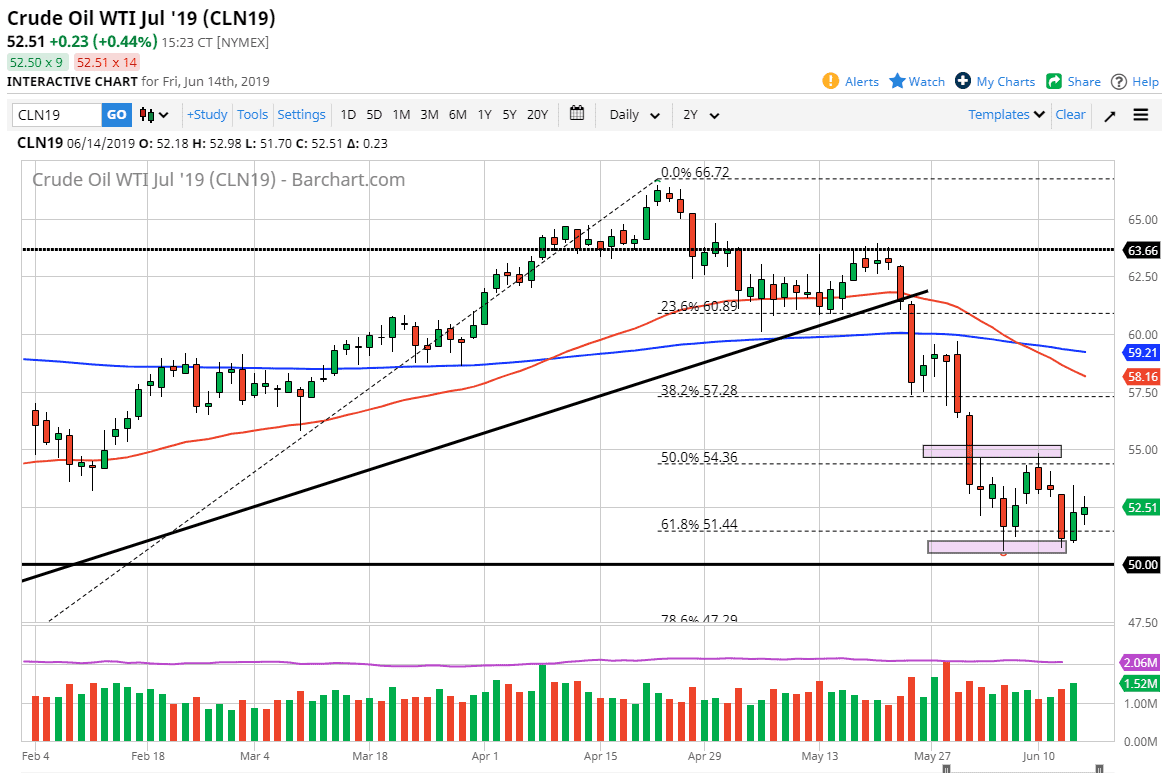

WTI Crude Oil

The WTI Crude Oil market was somewhat sideways during the trading session on Friday, which is interesting considering just how much is going on in the world that could influence price. After all, it’s been a scant 24 hours since traders have been reacting to the attack on a couple of oil tankers in the Straits of Hormuz. This of course ratcheted up tension and caused a major spike in the price of crude on Thursday. However, on Friday there was very little in the way of follow-through.

What this tells me is that the market is likely to continue to struggle, as there is a major problem with the man, and if global markets are starting to price in the idea of a slowing global economy, obviously demand will fall for this commodity. That being said, I think we continue to bounce around between the $50 level on the bottom, and the $55 level above. Right now we are essentially in the middle of that range, so it’s not worth trading.

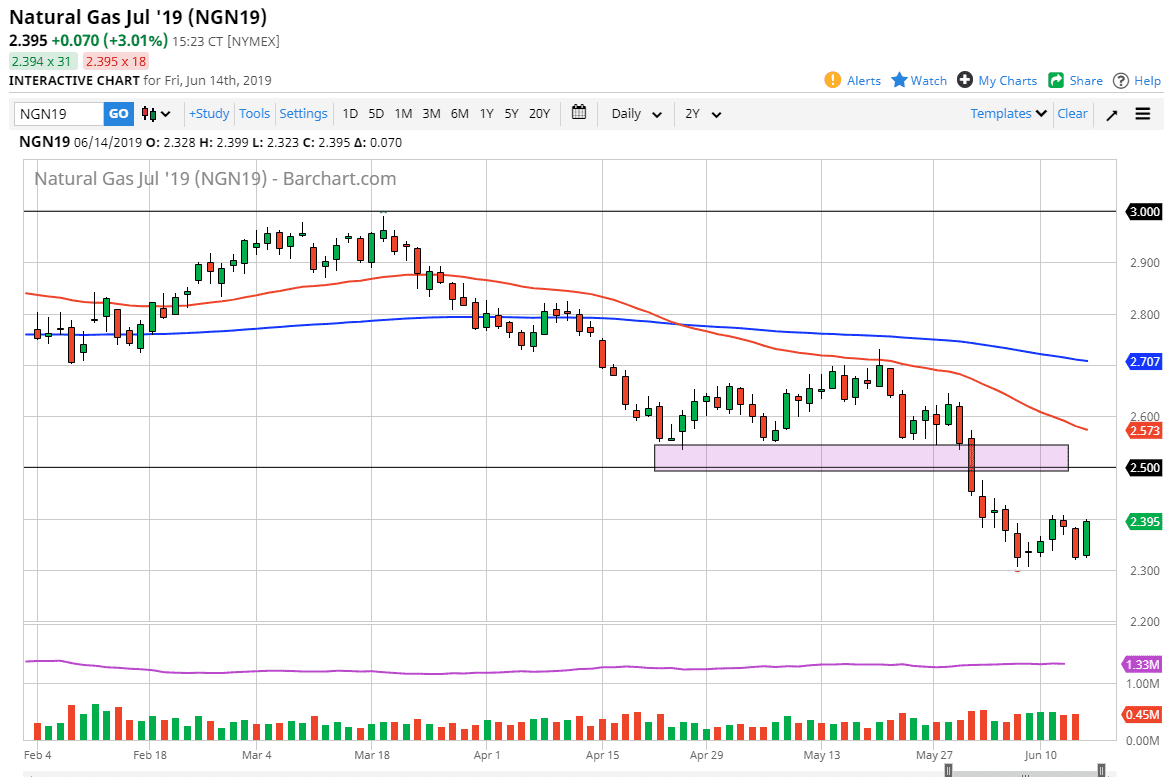

Natural Gas

Natural gas markets rallied a bit during the trading session on Friday, reaching towards the $2.40 level as we closed the week out. This is a very bullish looking candle stick and perhaps the beginning of a short-term reversal as we have seen the lot of bouncing around this week.

This has been a very negative market for quite some time, so therefore it’s not a huge surprise that we have struggled so much to go higher. However, there does come a time when markets are so oversold that you simply can’t continue to expect a lot of massive selling. However, what I expecting is a bit of a bounce and therefore an opportunity to short this market closer to the $2.50 level above.