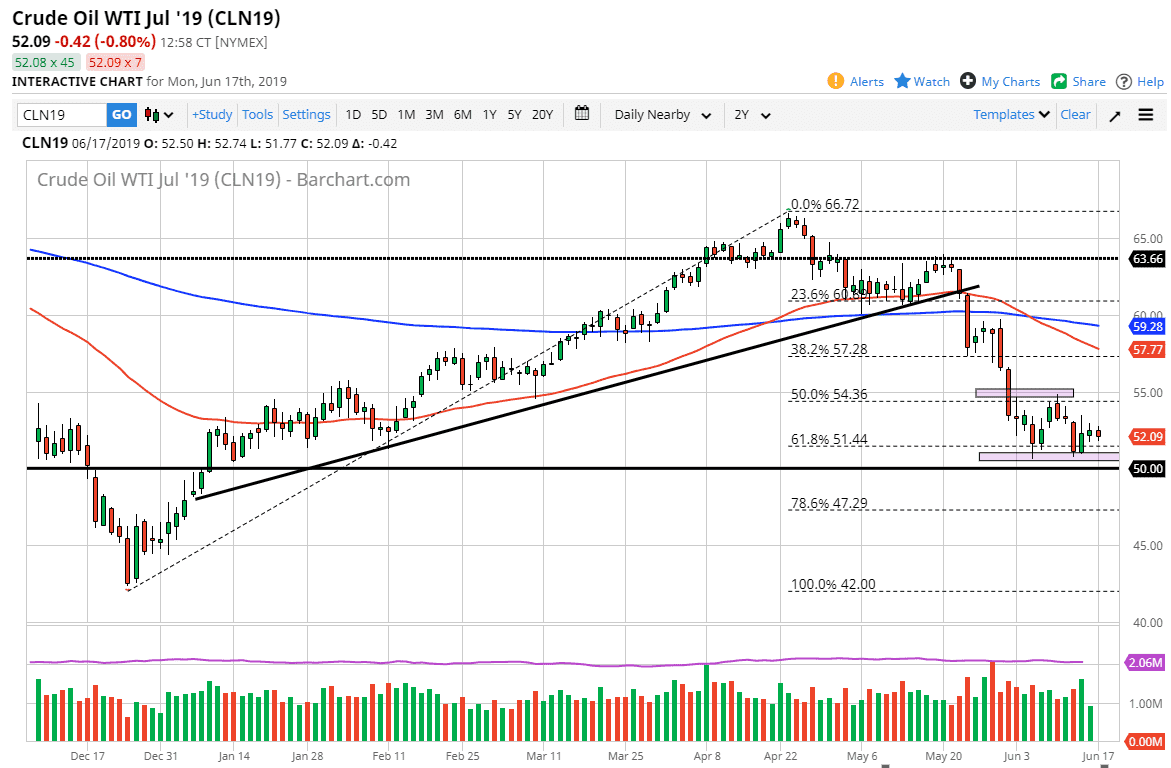

WTI Crude Oil

The WTI Crude Oil market initially tried to rally during the day on Monday but gave back the gains as we continue to grind sideways overall. This is a market that is currently stock in a significant consolidation area, awaiting the results of the FOMC Statement. This of course makes sense, as the Federal Reserve will dictate what happens with the US dollar, which of course will influence what happens with the commodity markets such as crude oil.

That being said, we know that there is a certain amount of supply/demand issues. If the US dollar rolls over, then it’s very likely that we could get a bit of a boost because of currency alone. At this point, $50 below is massive support, just as the $55 level above is massive resistance. As we are bouncing around in this area, it makes sense to wait for more of a fundamental reason to break out. In the short term, I would expect to see the support hold.

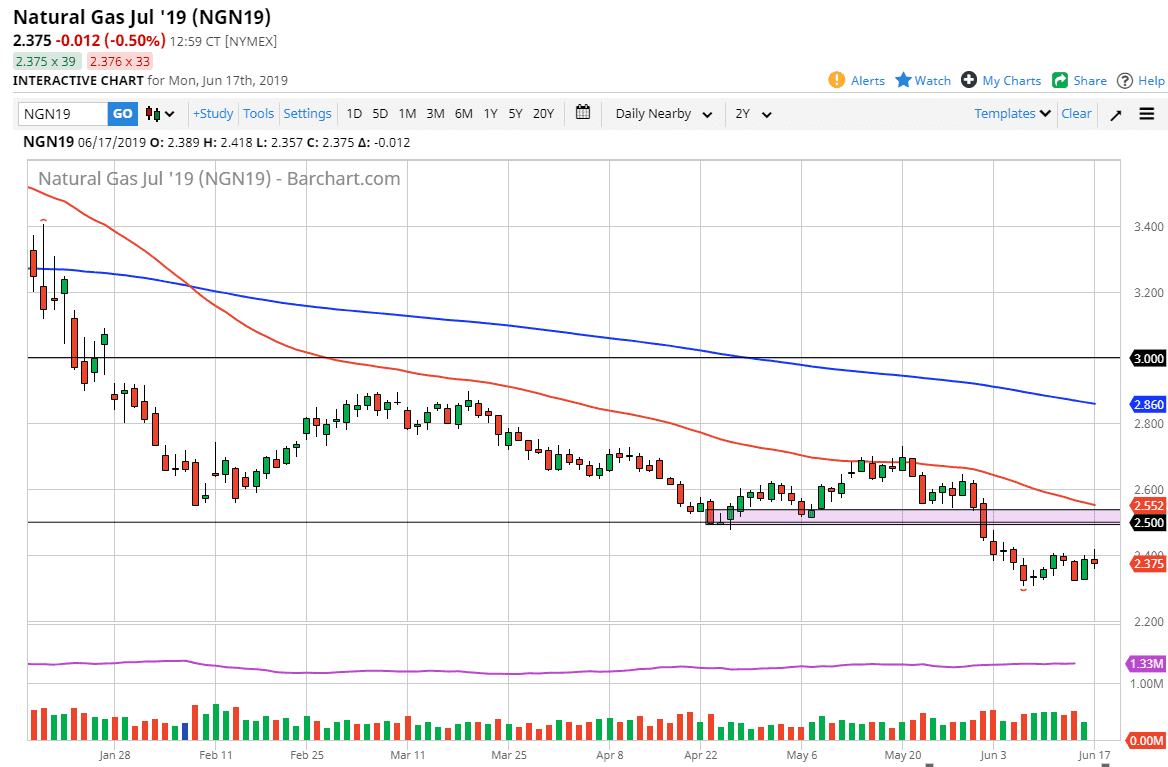

Natural Gas

Natural gas markets went back and forth during trading on Monday, as we continue to bounce around the $2.40 level. That being said, I still like the idea of waiting for rallies that I can sell. This will be especially true near the $2.50 level which has been important more than once. The 50 day EMA sits just above there as well, so it’s very likely that there will be plenty of reasons for sellers to attack at that point.

It’s going to continue to be a very negative market, so if you are patient enough you should be able to take advantage of rallies that show signs of exhaustion as the oversupply of natural gas continues to be a major issue. In fact, there’s no point in trying to buy this market until we hit the fall season.