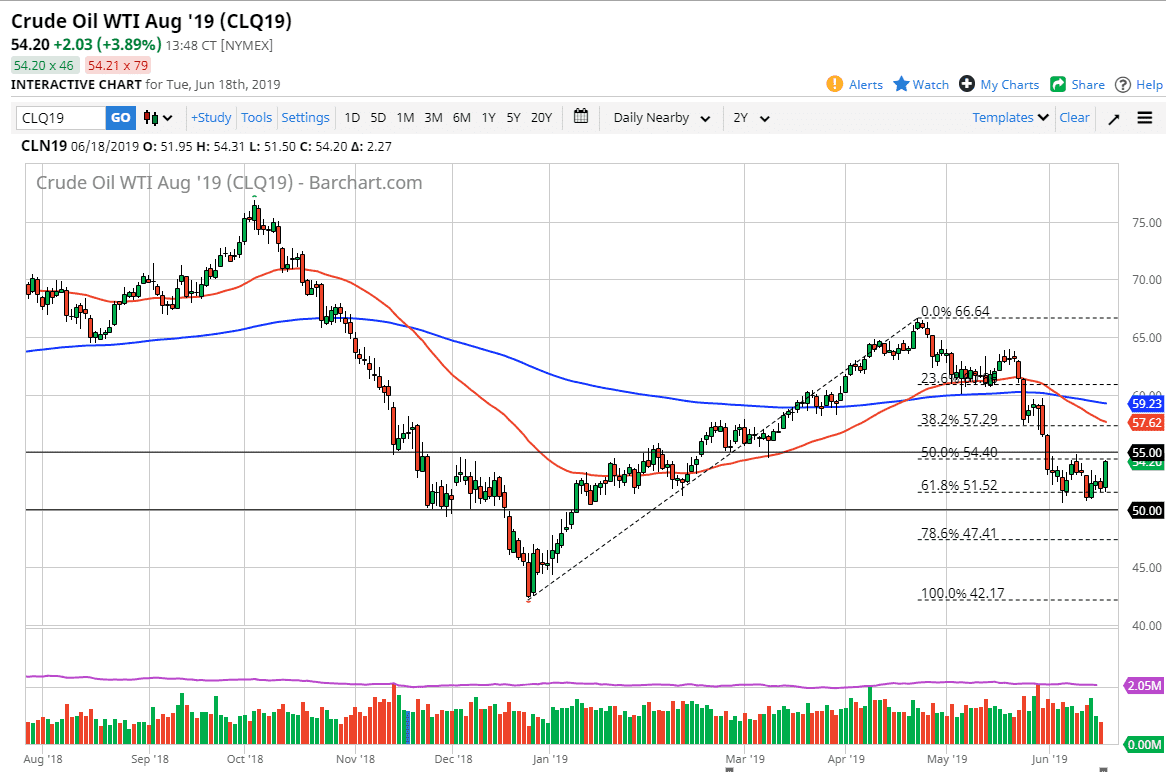

WTI Crude Oil

The WTI Crude Oil market took off to the upside during the trading session on Tuesday, as the ECB suggested more quantitative easing is on the way. Beyond that, the Federal Reserve is very likely to see the same thing on Wednesday, so therefore if we continue to see fiat currency is weekend, and perhaps central banks looking to stimulate, the idea is that perhaps crude oil will get some type of demand boost.

That being said, if we can break above the $55 level, it opens the door towards the $57.50 level. After the big move that we had made during the session on Tuesday, it’s impossible to buy the market here, at least not until we clear the $55 barrier. Short-term charts may offer selling opportunities, but at this point I think we are essentially consolidating and waiting to see what happens next.

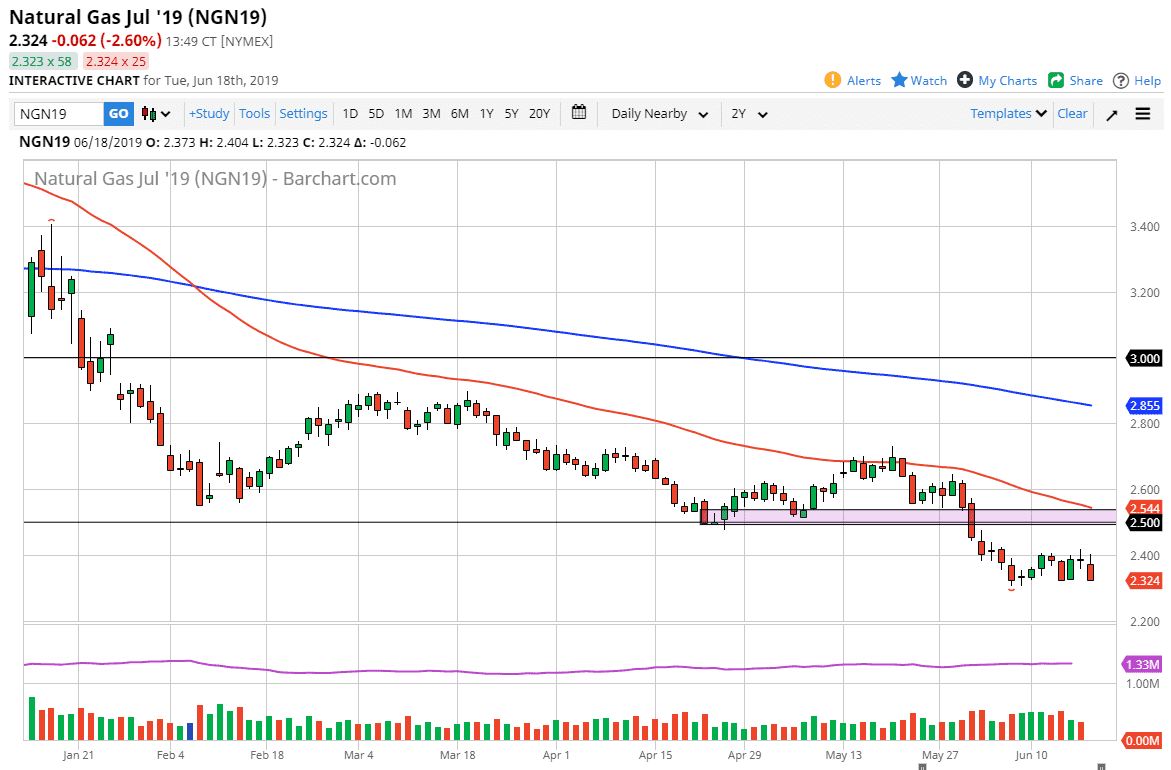

Natural Gas

Natural gas markets initially tried to rally during the trading session on Tuesday but found the $2.40 level to be far too expensive. That resistance to turn the market around to reach down towards the $2.32 level. That being said, I think that you need to wait for short-term rallies to start selling. This really no other way to play this market than to simply fade rallies. At this point, we are at short-term support, and if we were to break down below the $2.32 level, then the market could break down towards the $2.30 level, possibly the $2.25 level.

The alternate scenario, and the one that I prefer, is that we sell rallies, especially near the $2.40 level. Breaking above there should send the market towards the $2.50 level which is even more attractive for selling as well. Simple exhaustion is what I’m looking for.