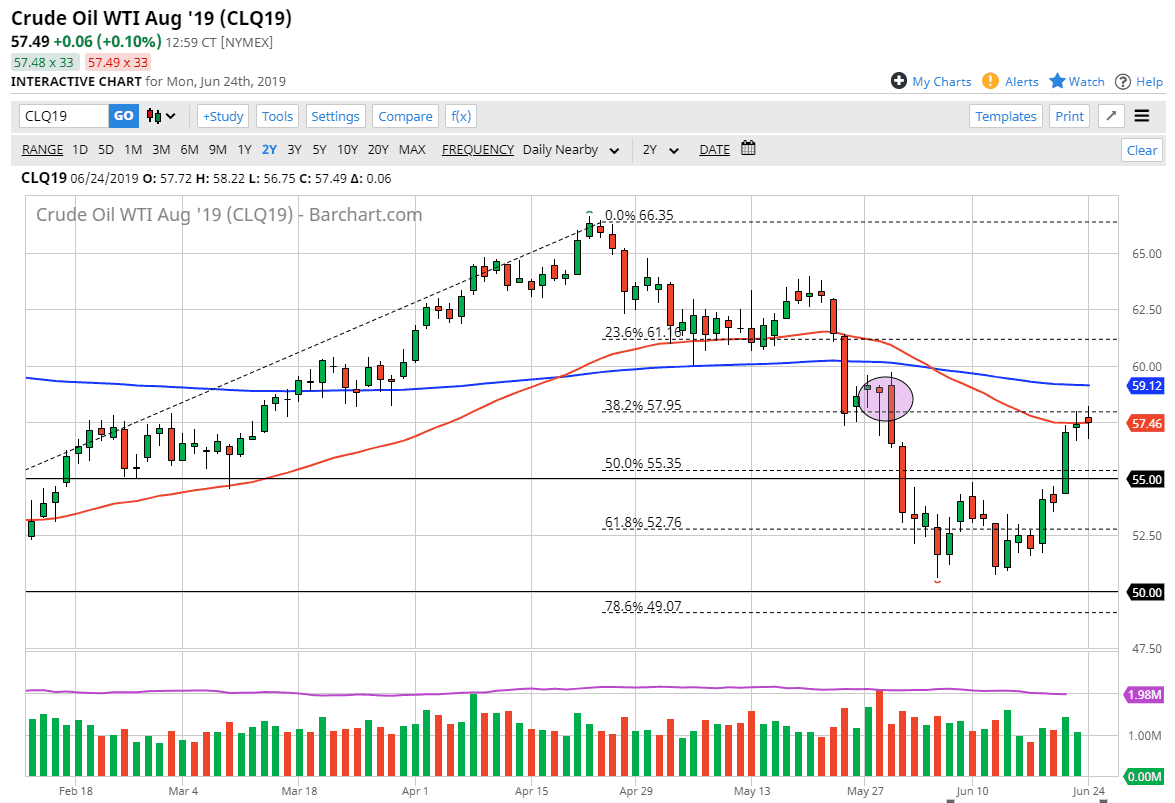

WTI Crude Oil

The WTI Crude Oil market has gone back and forth during the trading session on Monday, as we go back and forth at the 50 day EMA, an area that of course will attract a lot of attention. Looking at this chart, I have an ellipse marking where we broke down from, so it makes sense that we would have a bit of trouble in this general vicinity. At this point, the $59 level was the target based upon the “W pattern” that we have carved out in the market, so that’s a reasonable place to see the market struggle. The 200 day EMA is just above there as well, so I think that’s where the party stops, at least in the short term.

The Iranian situation with the Americans of course will continue to put a little bit of a floor in the oil market, but I think one of the bigger deals is going to be the lower interest rate coming out of the Federal Reserve driving the value of the US dollar down. Both of those reasons have push the market higher, so I think at this point we need to pull back. I believe that the $55 level underneath is massive support.

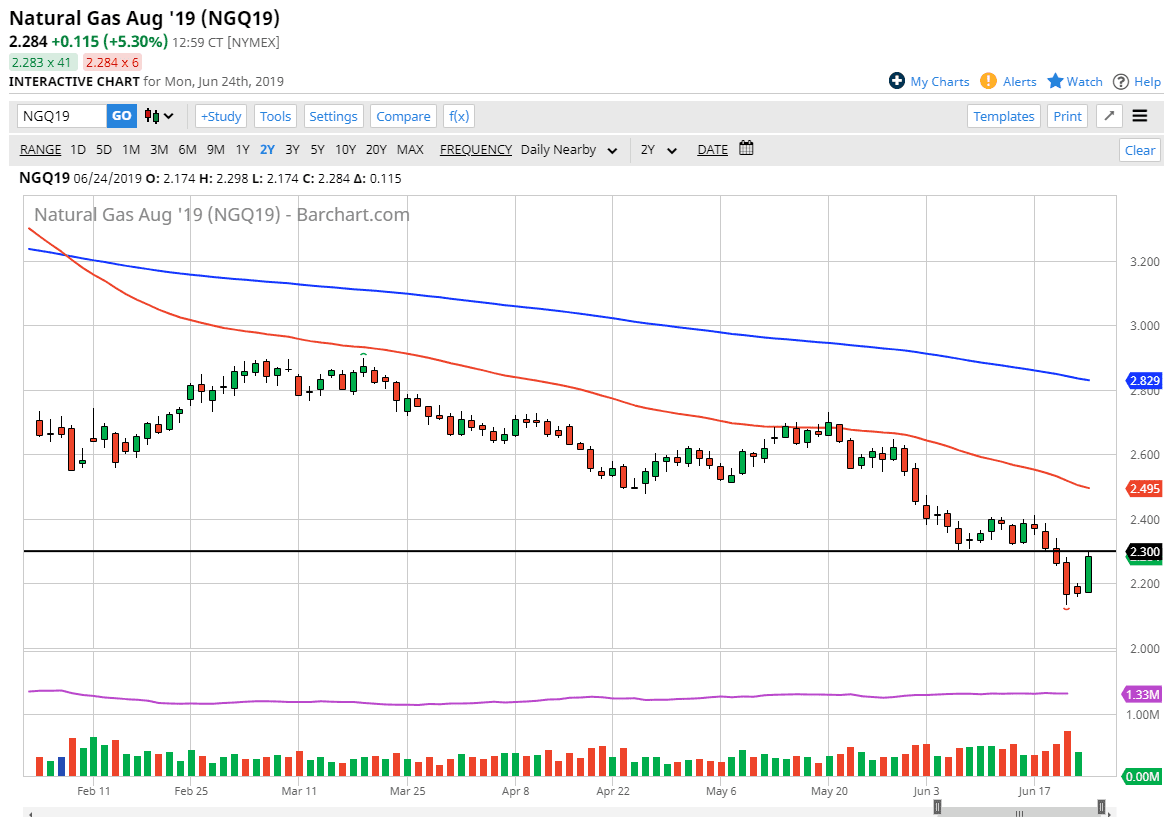

Natural Gas

Natural gas markets have rallied significantly during the trading session on Monday, reaching towards the $2.30 level. That’s an area that was a significant support level, so the fact that we reached towards that area and stopped tells me that there is still plenty of selling pressure in that area, so I think at this point signs of exhaustion will be sold in this market as we are too far oversupplied. Overall, this is a market that you sell every opportunity you get between now and Fall.