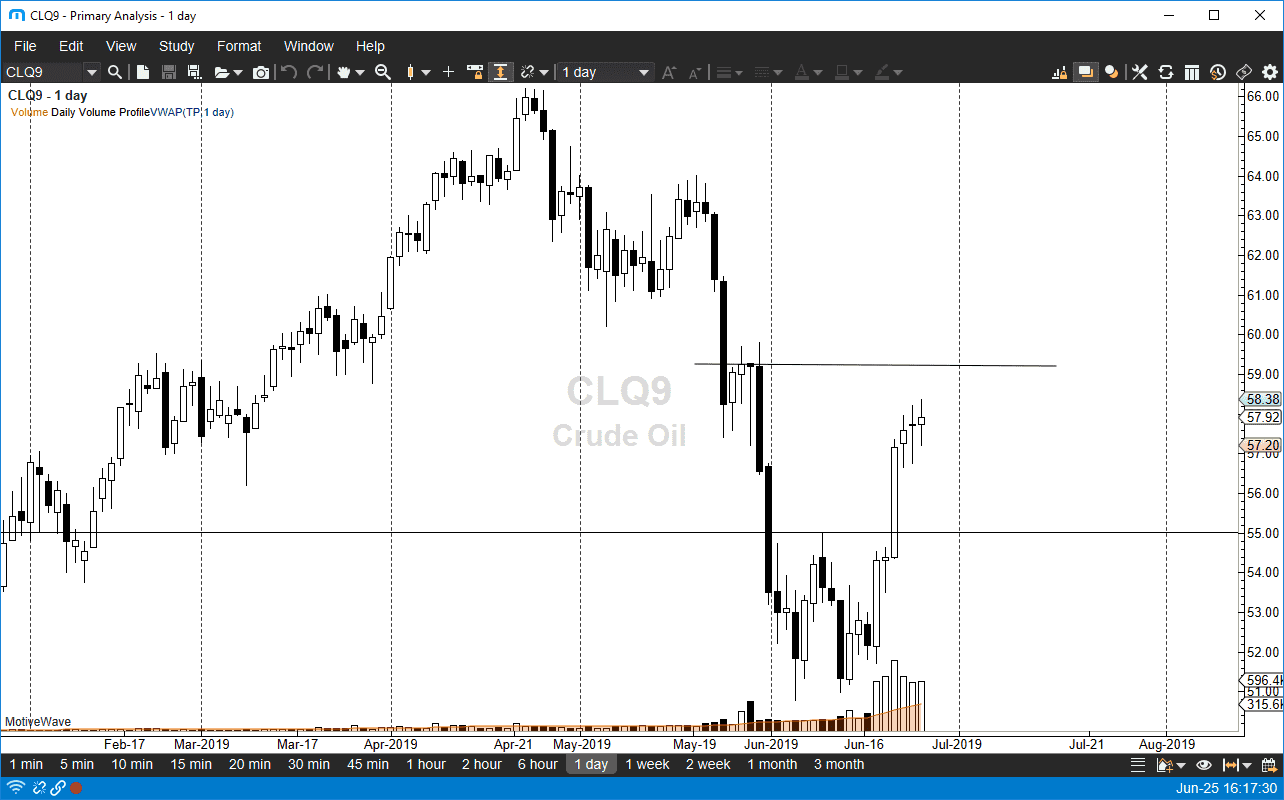

WTI Crude Oil

The WTI Crude Oil market went back and forth during the trading session on Tuesday, showing signs of indecision. We are a bit overextended though, so it’s not a huge surprise to consider that the market may be taking a bit of a break. We have a lot of different things going on at the same time, not the least of which of course is going to be the Iranian intentions. We also have the Federal Reserve working against the value of the US dollar so it should not be a huge surprise that we have seen a bit of bullish pressure.

Just below, you can see that the W pattern has been formed and triggered, but at this point it’s likely that we still have another dollar or so to go to the upside, which is the $59 level, a perfect measurement from the W pattern. Short-term pullbacks should continue to offer buying opportunities with $55 being especially supportive.

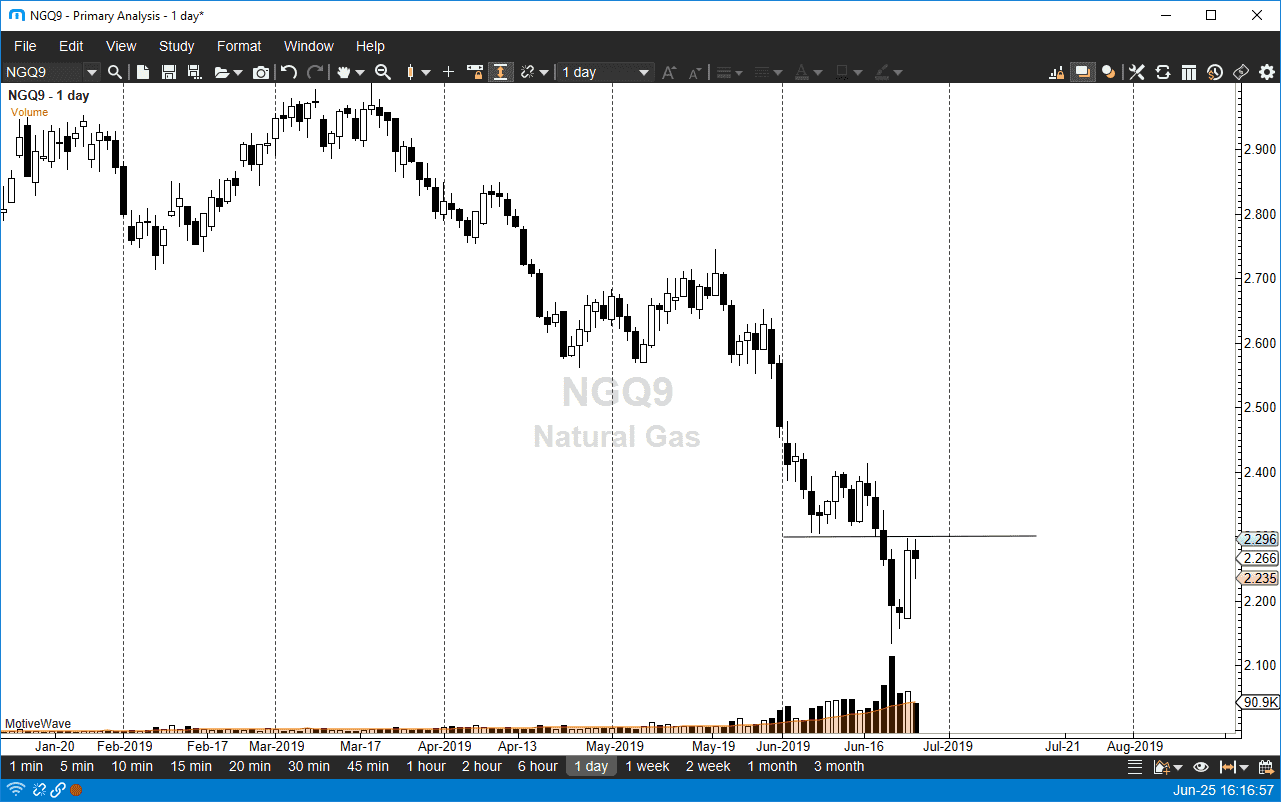

Natural Gas

Natural gas markets continue to be a bit noisy, as we fell during the trading session but turned around to show signs of life. The $2.30 level should cause significant resistance so I think at this point it’s very unlikely that the market will break above there quite easily, but even if we did I think there is a lot of resistance extending all the way to the $2.40 level, so at this point I’m simply looking for exhaustion to take advantage of as we are in a huge downtrend and at this point it’s very likely it will continue due to the time of year that we are currently in. I’m simply looking for opportunities to sell at higher levels.