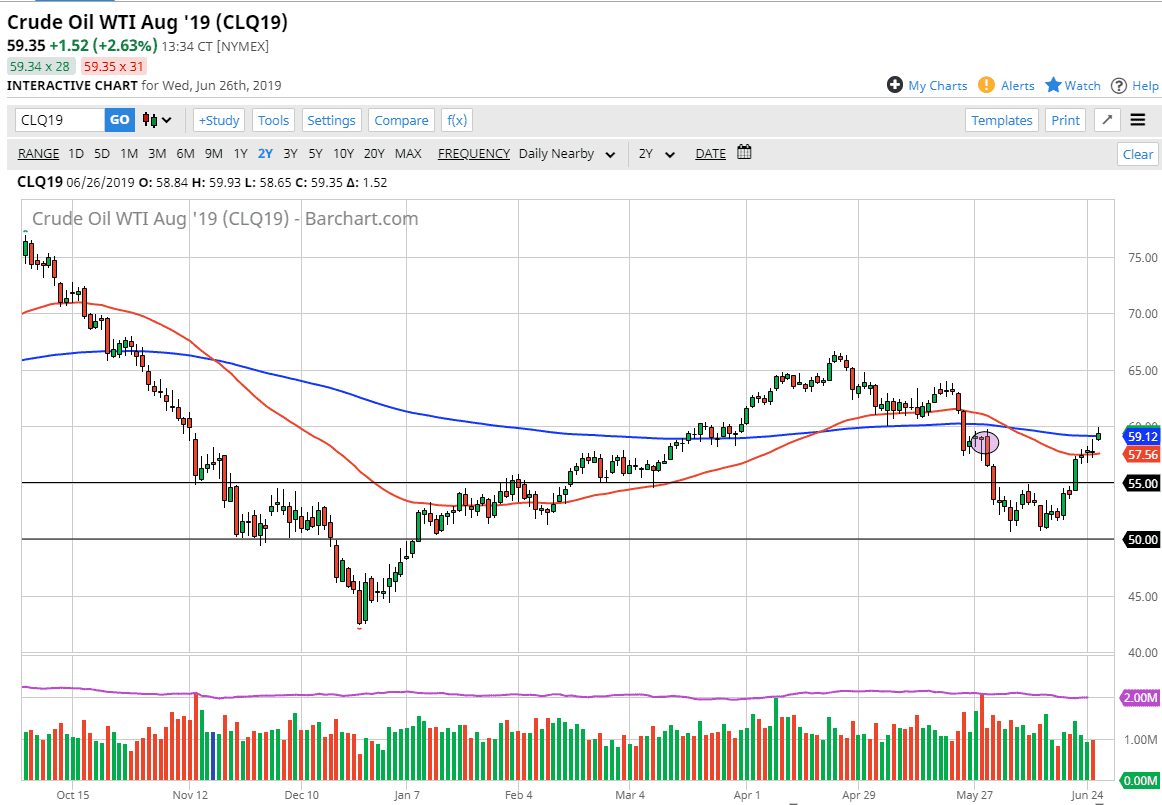

WTI Crude Oil

The WTI Crude Oil market rallied a bit during the trading session on Wednesday, reaching towards the crucial $60 level before pulling back. At this point it looks as if the 200 day EMA is going to offer a significant amount of resistance, and I think that a short-term pullback makes quite a bit of sense. Quite frankly, we have moved rather rapidly to the upside after what had been a very negative market. Keep in mind that a lot of this comes down to US/Iran tensions, and if those suddenly dissipate, it’s very likely that oil will get hammered. The fact that we pulled back so aggressively from the $60 handle suggests to me that we are at the very least going to get a short-term pullback. I believe that the 50 day EMA near the $57.50 level and the $55 level both offer significant support levels.

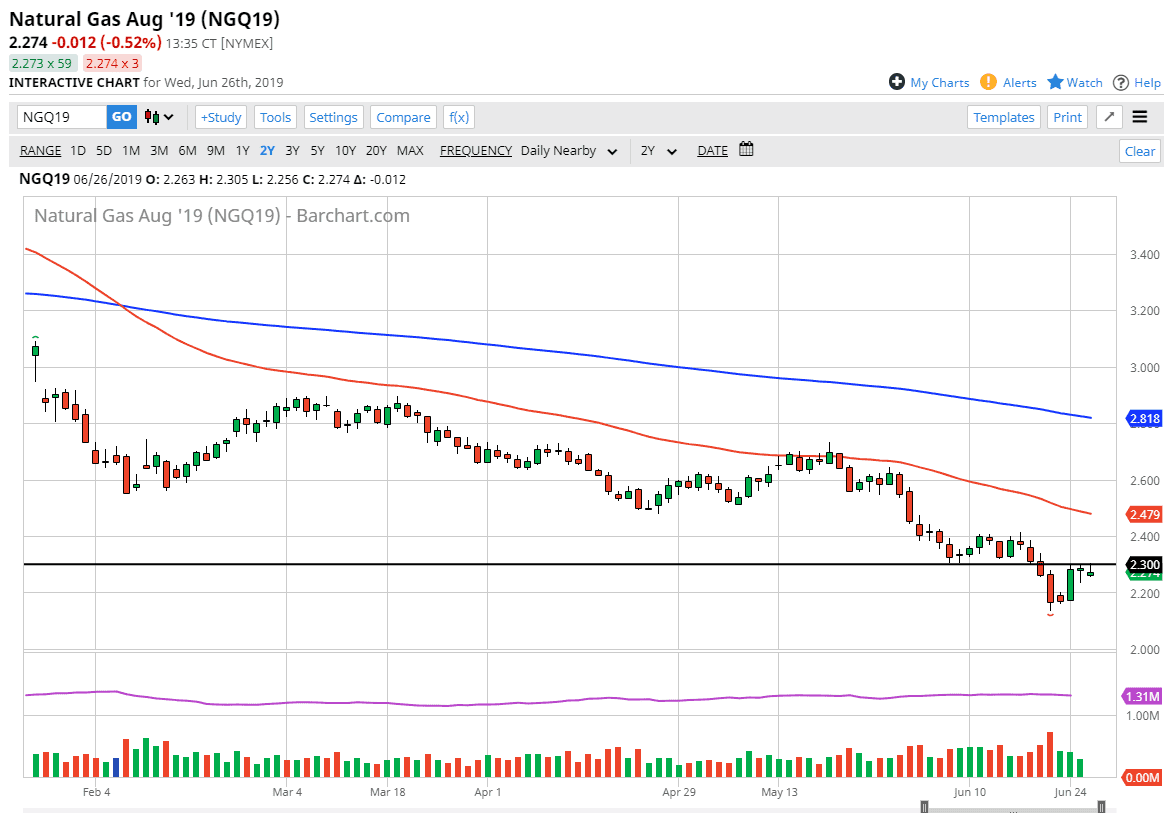

Natural Gas

Natural gas markets tried to rally during the trading session on Wednesday but found the $2.30 level to be too resistive again. That was an area that was significant support in the past so it makes sense that it would be significant resistance here. I anticipate that fading rallies will continue to be the way to go in the natural gas markets, so by all means what we are looking is an opportunity to sell at this high level. Even if we break above the $2.30 level, I think that there is plenty of resistance all the way to at least the $2.40 level to keep this market down.

With all of that I look for short-term selling opportunities to take advantage of in what has been an obviously bearish market. This is probably the worst time a year for natural gas in general, so all of this lines up quite nicely.