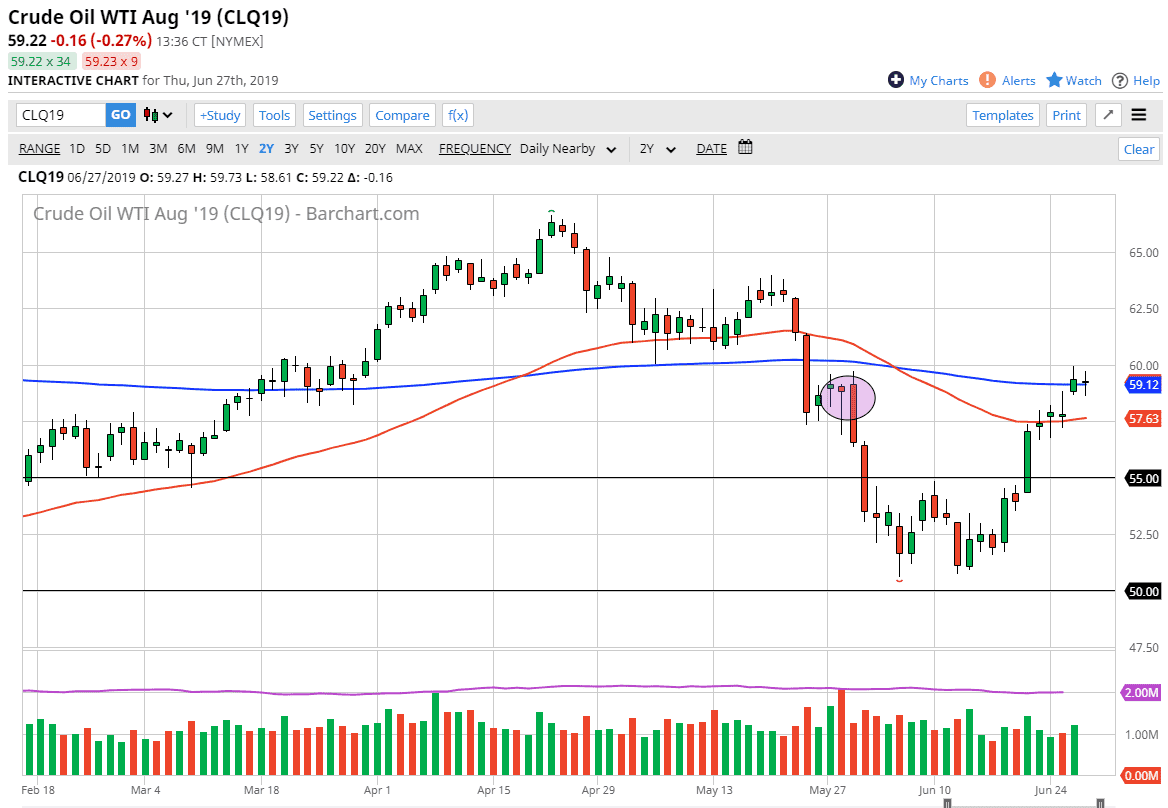

WTI Crude Oil

It’s difficult to imagine that the crude oil markets will do much during the day on Friday, because we are heading into the G 20 summit. Not that the G 20 summit means much anybody but the fact that the Americans and the Chinese are going to get together and speak will have a lot to do with what happens in the financial markets in general, this one won’t be any different. Beyond that, the $60 level above offers a massive resistance, so I think at this point it’s likely that we are going to see sellers in that area, just as we will have buyers underneath the candle stick for the day as there is a gap. This is a market that you probably should avoid until Monday morning unless we break the $60 level which would be extraordinarily bullish.

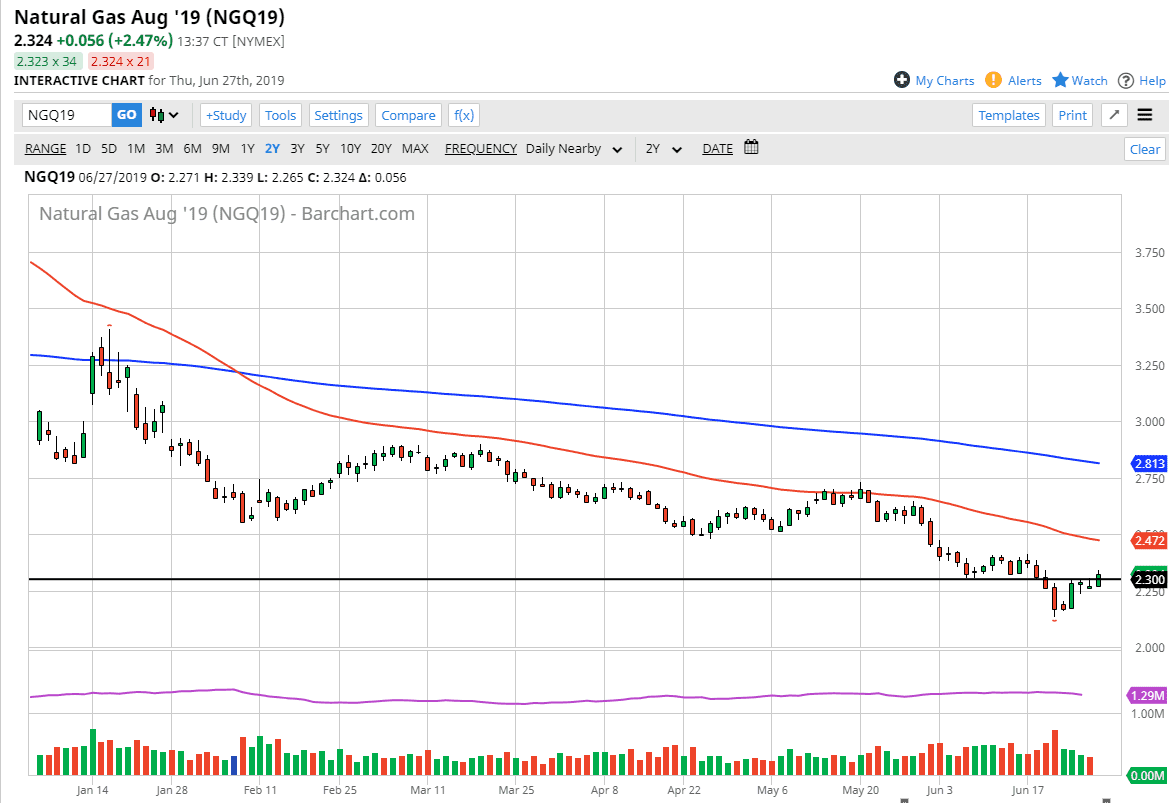

Natural Gas

Natural gas markets rally during the day, breaking above the $2.30 level. There is a significant amount of noise just above here all the way to the $2.40 level though, so I think we are going to continue to see issues here. But frankly, this is a commodity that I think offers plenty of selling opportunities if you are patient enough. Right now we don’t have much in the way of technical indicators that tell us it’s time to start selling other than the fact that we are in the resistance area. The inventory number was “less bad” than anticipated during the day, so that of course has given us a little bit of a lift. I believe this is short-term at best, so at this point it’s just a matter of looking for signs of exhaustion on shorter-term charts that you can sell as we are months away from serious demand.