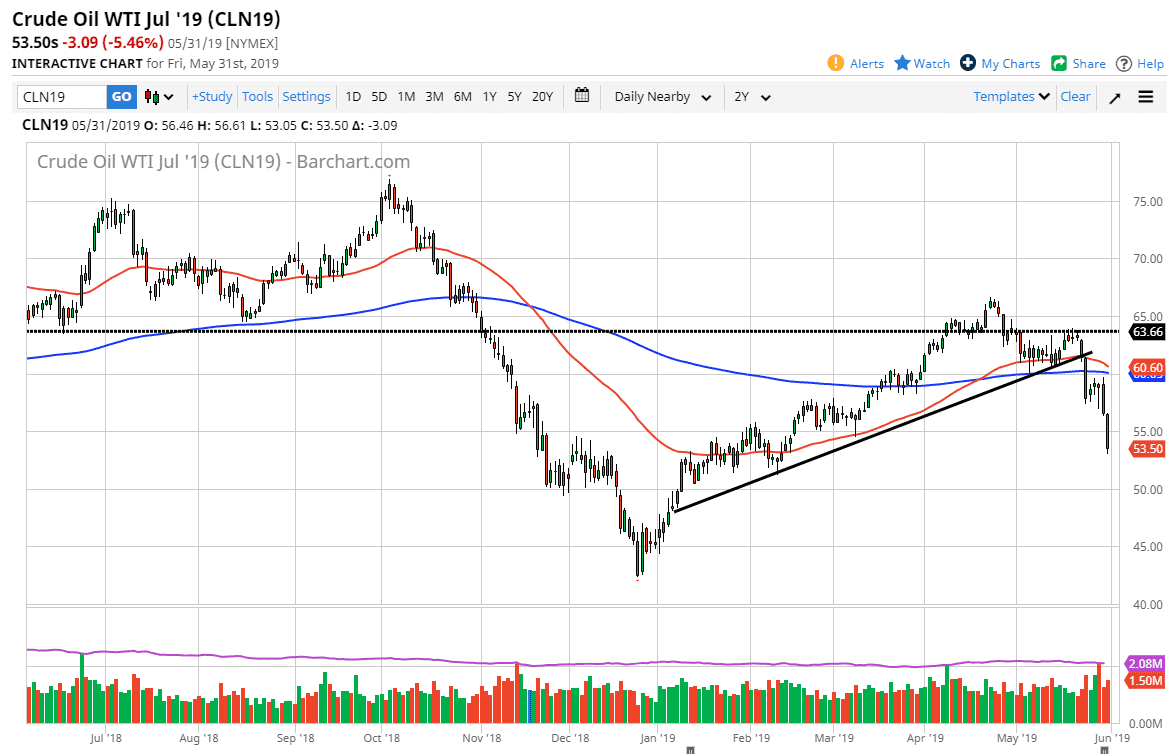

WTI Crude Oil

The WTI Crude Oil market broke down again during the day on Friday, slicing through the $55 level. That’s a large, round, psychologically significant figure, so it makes sense that we would target it. The fact that we sliced through it like it wasn’t even there of course is a very negative sign, and an inventory number that was a bit of a mess doesn’t help the situation either. Rallies at this point are to be sold, especially if we can get as high as $57.50. We continue to see a lot of concerns when it comes to global growth, so I’m a seller of signs of exhaustion on short-term charts. I anticipate that we will see crude oil go down to the $50 level given enough time.

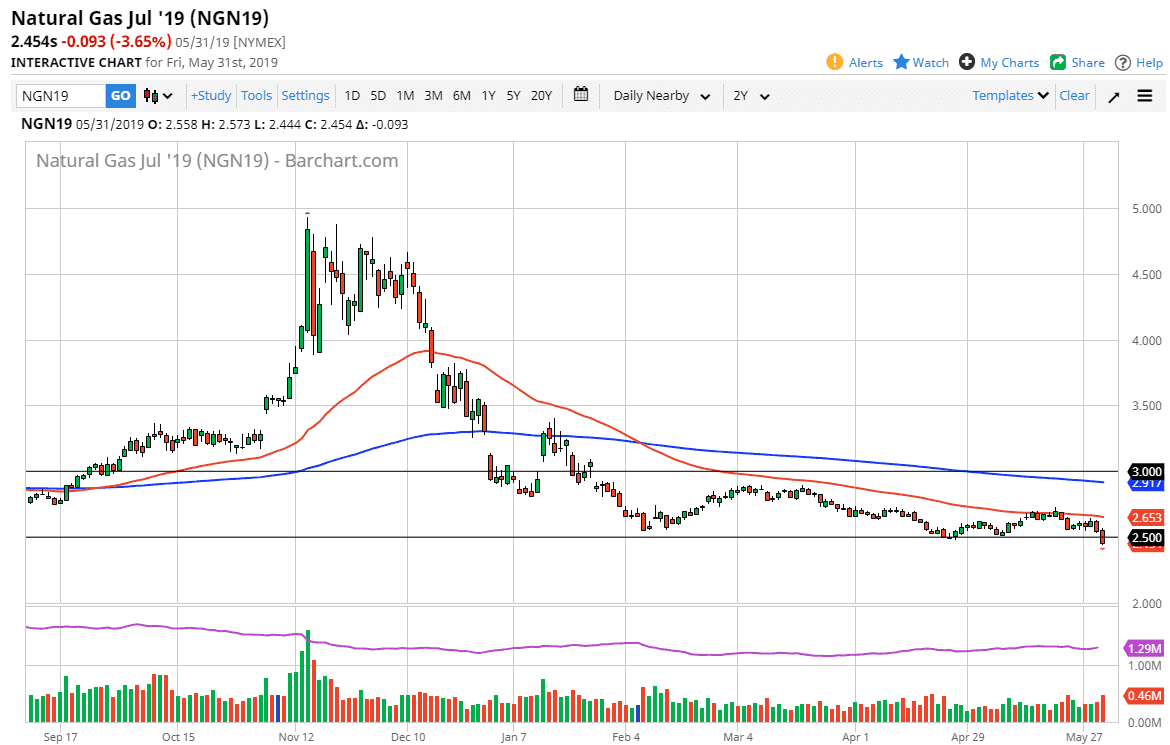

Natural Gas

Natural gas markets finally break down below the $2.50 level, and that of course is a very negative sign. That being the case, signs of rallies should be faded into and sold off as we continue to see natural gas markets plummet due to a lack of demand. This is a seasonally weak time of year anyway, and then on top of that we have a lot of concerns when it comes to global growth. If that’s going to be the case, natural gas demand will plummet over the next several months. I don’t how much further we can go though, because the $2.25 level should be support, not to mention the $2.00 level which is a huge round figure. Ultimately, fade short-term rallies and continue to do so until proven incorrect. To the upside, I anticipate that the $2.60 level is not going to offer a temporary ceiling.