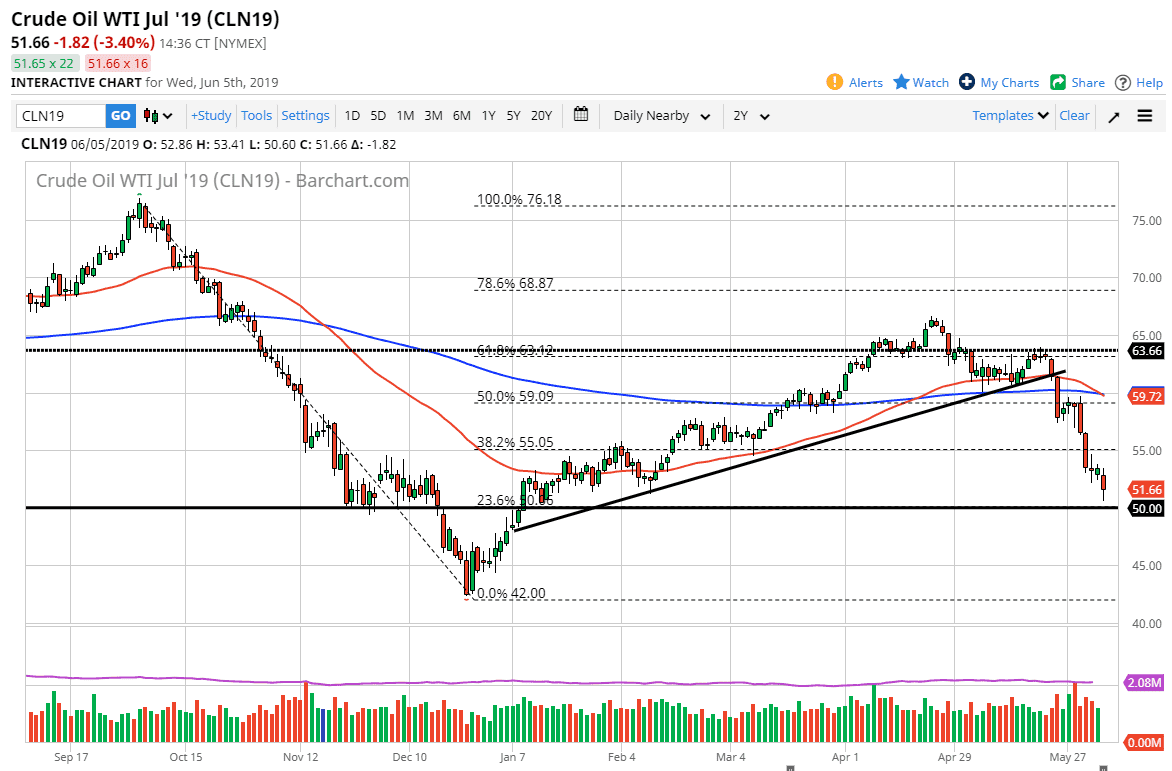

WTI Crude Oil

The WTI Crude Oil market fell rather hard during the trading session on Thursday as we continue to get horrible inventory figures. As it looks like the demand for crude oil is falling, people begin to worry about things like global growth, and whether or not we could be seeing a procession. At this point, the $50 level underneath should be massive support, as it is a large, round, psychologically significant figure. It is also significant support as well, so at this point it makes sense that we would continue to see a lot of interest in this area.

We have bounced significantly, so at this point it’s likely that we could get a little bit of follow-through but ultimately this will probably be a selling opportunity. In fact, I don’t think much changes until we can break above the $55 level, something that it is quite a bit higher from here.

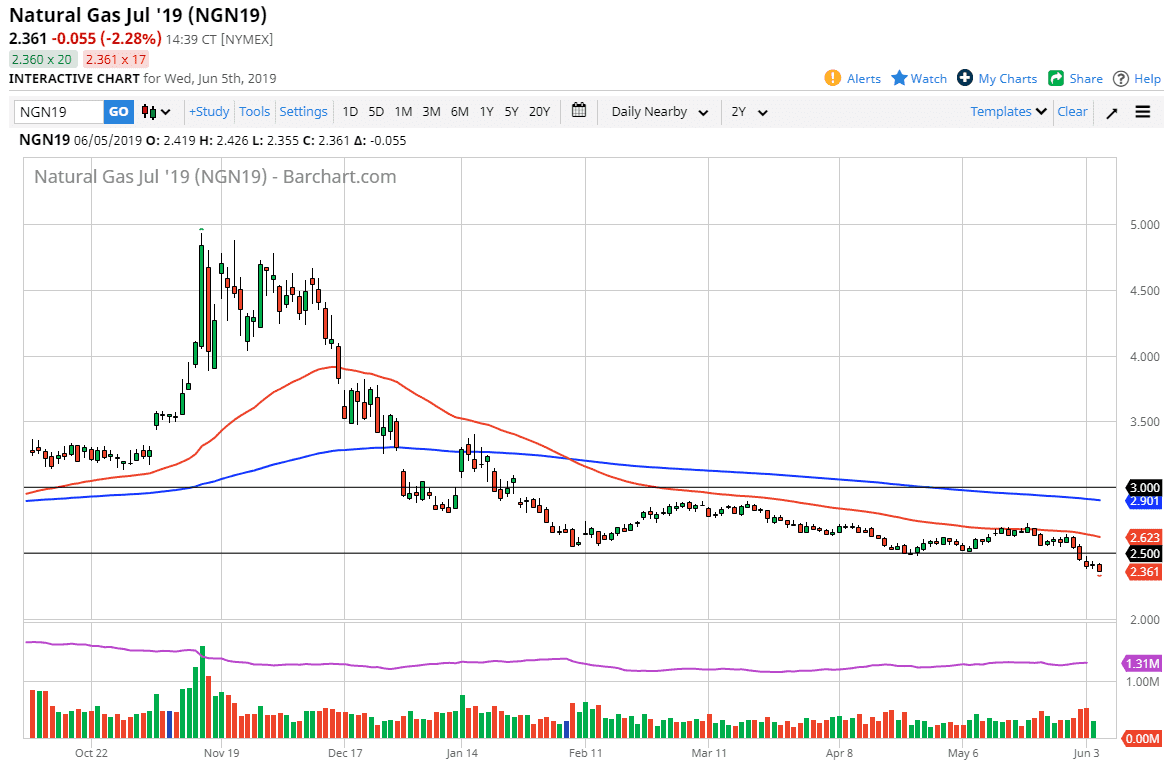

Natural Gas

Natural gas markets broke down a little bit during the trading session on Wednesday, as we continue to see extraordinary weakness in the natural gas markets. At this point, it should be obvious that we are very bearish, and that the overall demand to supply ratio is out of balance. I would be looking for selling opportunities near the $2.50 level, and then again at the $2.60 level. I have no interest in trying to go long of this market, because it is the wrong time of year to expect bullish pressure. After all, the northern hemisphere is now entering the hottest months of the year, so therefore demand is going to plummet. Beyond that, we are concerned about global demand, so with that it’s likely that we will continue to see rallies sold until we reach towards the $2.25 level or possibly the $2.00 level.