The GBP/USD pair rallied significantly during the trading session on Thursday, wiping out a lot of previous resistance due to the fact that the Iranians are willing to come to the table with some type of an agreement. Beyond that, the UK parliament also suggested that they weren’t going to allow a no deal Brexit, but that’s a song that we’ve heard before. This is a market that continues to be very volatile, and I think rallies still offer plenty of selling opportunities.

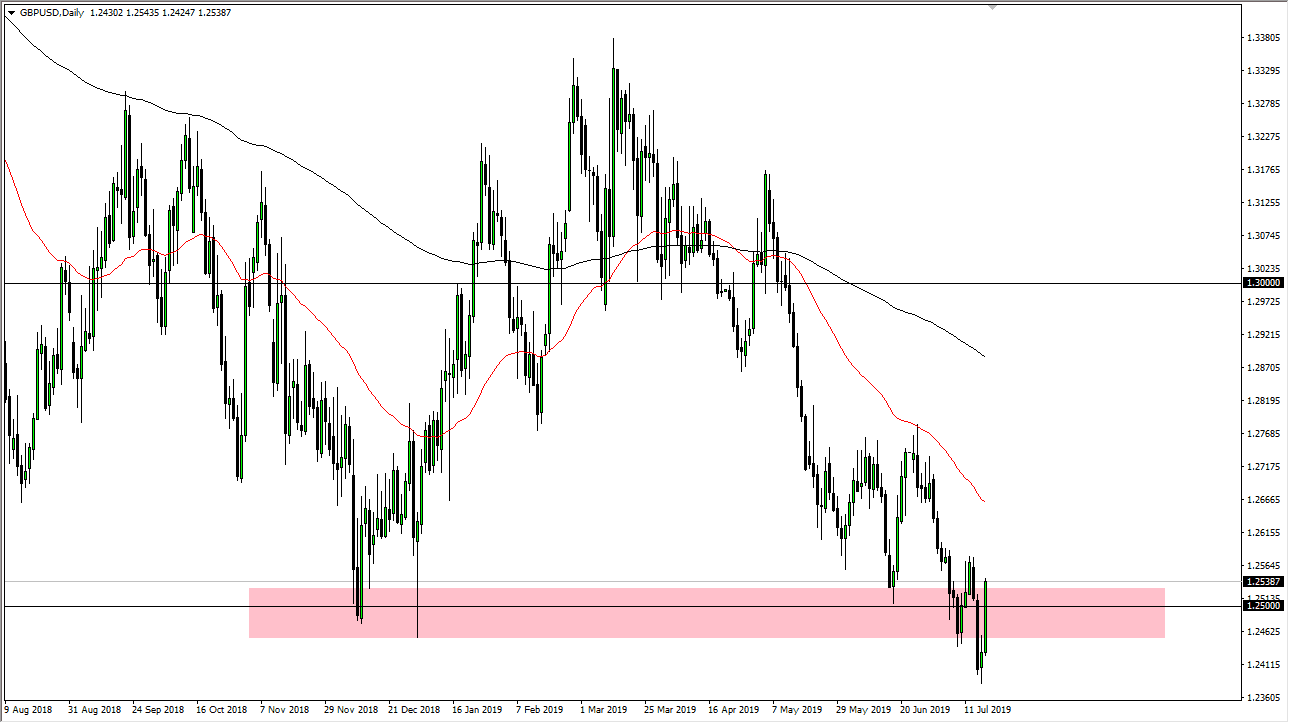

I’ve recently stated that the 1.25 level should be resistive, but clearly that has been broken. That being said, I also recognize the 1.2550 region to be resistance, and beyond that I see the 1.2750 level resistance as well. Beyond that, the 50 day EMA is likely to continue to drive lower. Looking at signs of exhaustion is what we are waiting for on short-term charts. Regardless what happens in the short term, buying the British pound is very difficult. Even if you have an exhaustive candle stick on a short-term chart that you short and it doesn’t work out for you, the reality is there so much resistance between here and the 1.2750 level that it’s only a matter time before the sellers get their way.

The only thing that’s helping this pair is the fact that the Federal Reserve is looking to cut interest rates, and of course the “risk on” move after the Iranian announcement. Quite frankly, none of this “news” is anything new. These are all things that we’ve heard before, and at the end of the date has very little to do with what the currencies will do longer term. The trend is decidedly negative for a reason, and it’s only a matter of time before that takes precedence.

The length of the candle stick for the trading session does of course suggests that we probably have some more upward momentum, so we may not get a selling opportunity on Friday. However, I think it’s only a matter time before that happens so I will be watching for those signs to take advantage of. Ultimately this is a market that looks very likely to go down to the 1.2250 level, perhaps even the 1.20 level selling the rallies has worked for months, I don’t see that changing anytime soon based upon the slight news flow we had on Thursday.