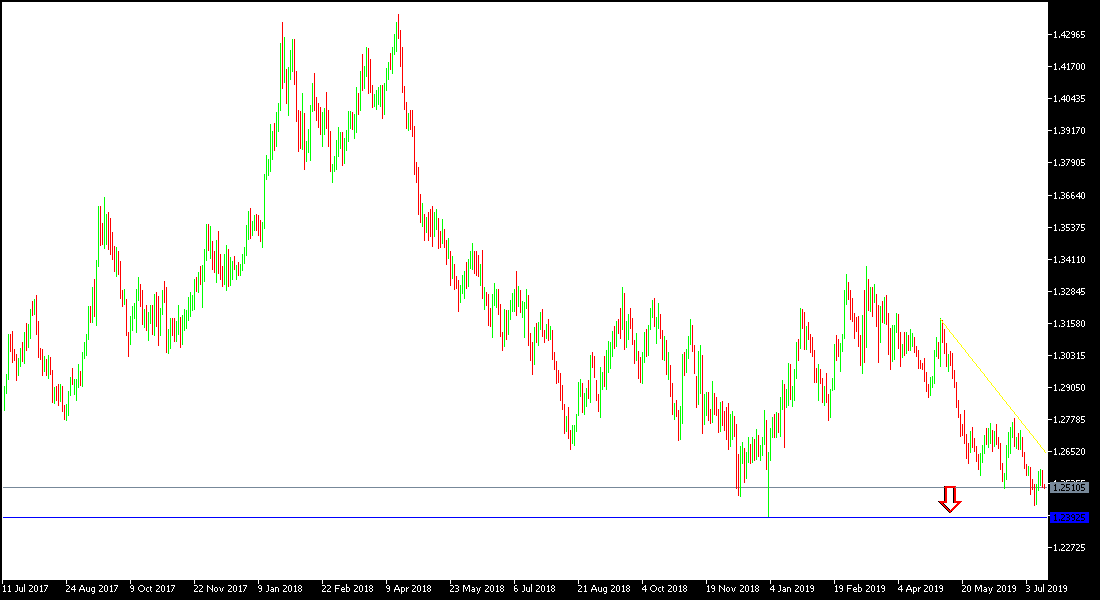

The economic calendar today will highlight the results of jobs and wages data in Britain and the US retail numbers, which will have a strong effect on the GBP/USD performance. Traders are still fearful of buying the pound despite reaching historic buying levels for the its investors as fears of the Brexit are still on the rise, with the passage of time and the deadline for the final exit from the EU at the end of October. Even the successor to Teresa Mae is still unknown, so the chance to go out without an agreement looms, which is even more disastrous for the pound and the British economy. Over the past week, the pair has broken to the 1.2440 support level, the lowest level in six months, and stable around 1.2500 support at the time of.

On the other hand, the dollar is also under pressure, supported by the US central bank's assertion that they are ready to cut US interest rates as global trade tensions continue and concerns about the future growth of the global economy directly affect the US economic outlook. The Bank of England has always stressed that any shift in its monetary policy depends on the future of the Brexit.

Technically: GBP / USD still supports the downside and therefore the support levels of 1.2460, 1.2400 and 1.2330 remain the nearest targets for the pair, consolidating the strength of the current bearish trend. Upward, the correction will not be a strong without stability above 1.3000 psychological resistance. We still prefer to sell the pair from every ascending level, as it is still under threat of any negative developments for the future of Brexit.

On the economic data front: The economic calendar today will focus on the announcement of job numbers and wages from the U.K, and from the United States, retail sales, industrial production and comments by Federal Reserve Chair Jerome Powell.