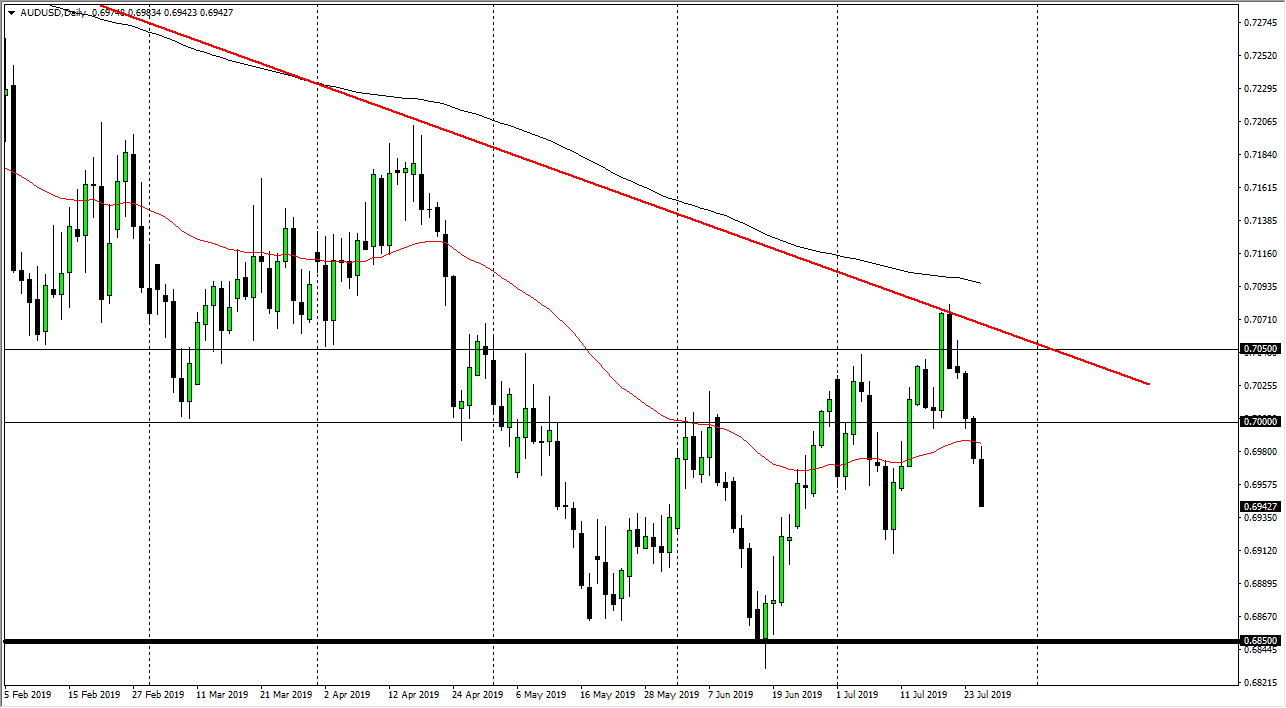

The Australian dollar has fallen again during the trading session on Thursday, as we continue to see a lot of volatility when it comes to the antipode currencies. The market is now significantly below the 50 day EMA and it looks likely to test the most recent low before this last leg. In other words, things may be changing before our very eyes.

Looking at this chart, we did rally pretty significantly to smash into the downtrend line, and then over the last several days have fallen like a rock. The previous low has not been violated yet, but it certainly looks as if we are going to have a serious go at it. While I do like buying the Australian dollar longer-term, I recognize that now is probably not the time. I am waiting for signs of strength, but quite frankly it just hasn’t showed up. The US/China trade relations are probably a bit too sour for this market to continue to rally at this point.

If we were to break down below the bottom of the most recent low, near the 0.69 handle, then I think that there is everything into disarray. We are certainly pressing the issue right now, so I think it’s probably best to leave the Aussie alone for the next 24 hours or so.

Headlines can and will come out to throw the Aussie around, not the least of which will come out of Beijing or Washington. Beyond that though, we also have the Federal Reserve that looks very likely to cut interest rates, so at this point I do believe that the Australian dollar is trying to find some type of bottom, but this is almost always a very noisy thing. With that in mind, it comes down to a lot of longer-term money being able to come in, buy the currency, and simply sit and wait for the fundamental analysis to show itself in the technical analysis. Longer-term I do think that we will eventually look at this range as the bottom of the market in the beginning of the uptrend, but the question is whether or not you can trade in this type of environment and protect your trading capital to take advantage of this. As a result, I have been buying this pair occasionally in 1/10 the size that I normally trade in and simply add or subtract in order to keep a “core position” going. If we were to break down below the 0.68 level though, that would be a huge “flush” in the Aussie.