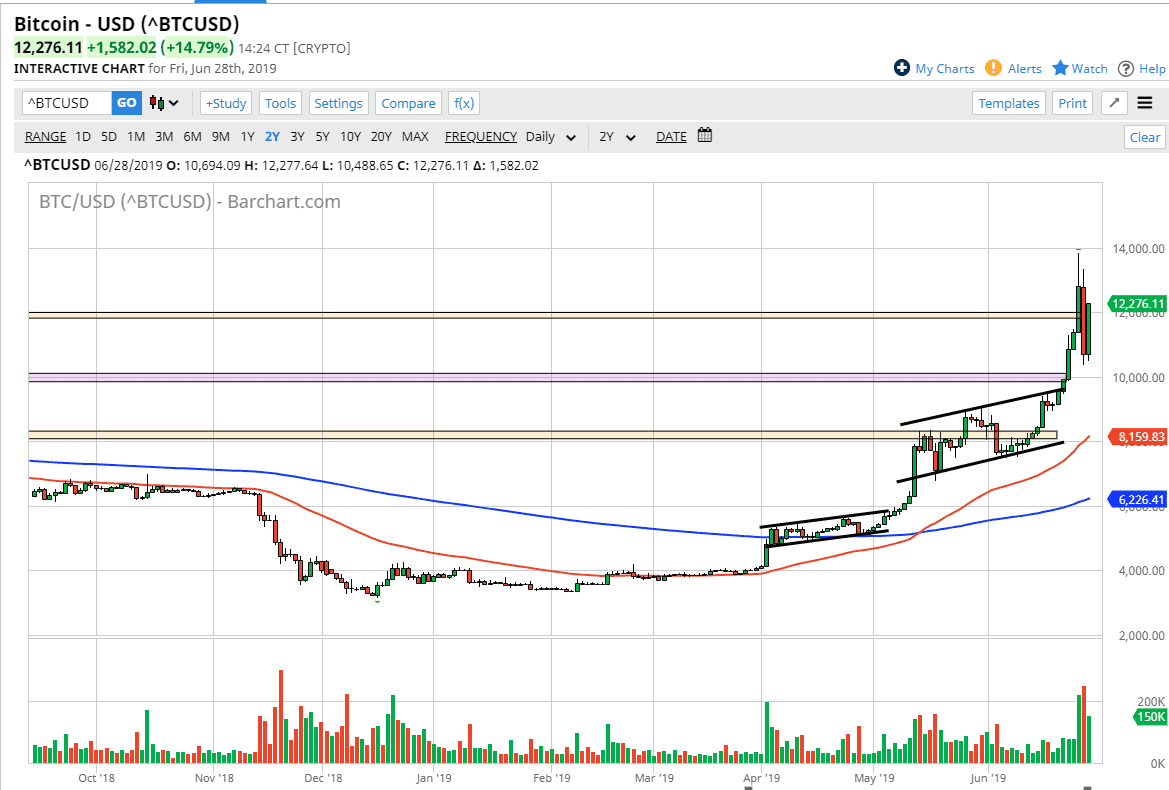

Bitcoin rallied significantly during the trading session on Friday, gaining roughly 15% by the time the market started to close. That being the case, we are seated extraordinarily high amount of volatility at this point, and I think that the market is getting way ahead of itself in both directions. This is a very difficult market to be involved in unless you are either a long-term trader or trading small positions.

With that in mind up taking a look at the market from a longer-term standpoint and I recognize that there is a definite bullish slant to the market, but ultimately this market suggests that we are going to see a lot of noise in this area. However, there are lower highs over the last three days so I think that we still have a bearish issues ahead of us. With that being the case, the market is simply come too far too quickly so look at short-term pullbacks as potential buying opportunities and as I previously mentioned, $10,000 could be an area of value. We didn’t quite get down there but certainly tried to make it happen.

With the meteoric rise of Bitcoin recently, it has attracted a lot of attention. That’s a good and a bad thing when it comes to this market, because it isn’t necessarily the most liquid out there. However, if we were to break down below the $10,000 level we could see value hunters come in as well. In other words, I have no interest in shorting this market but I do think that we will get a pullback in order to take advantage of. Once we do, then I think the next target would be the $14,000 highs again, and then possibly the $15,000 level after that. As things stand right now, I have no interest in shorting.