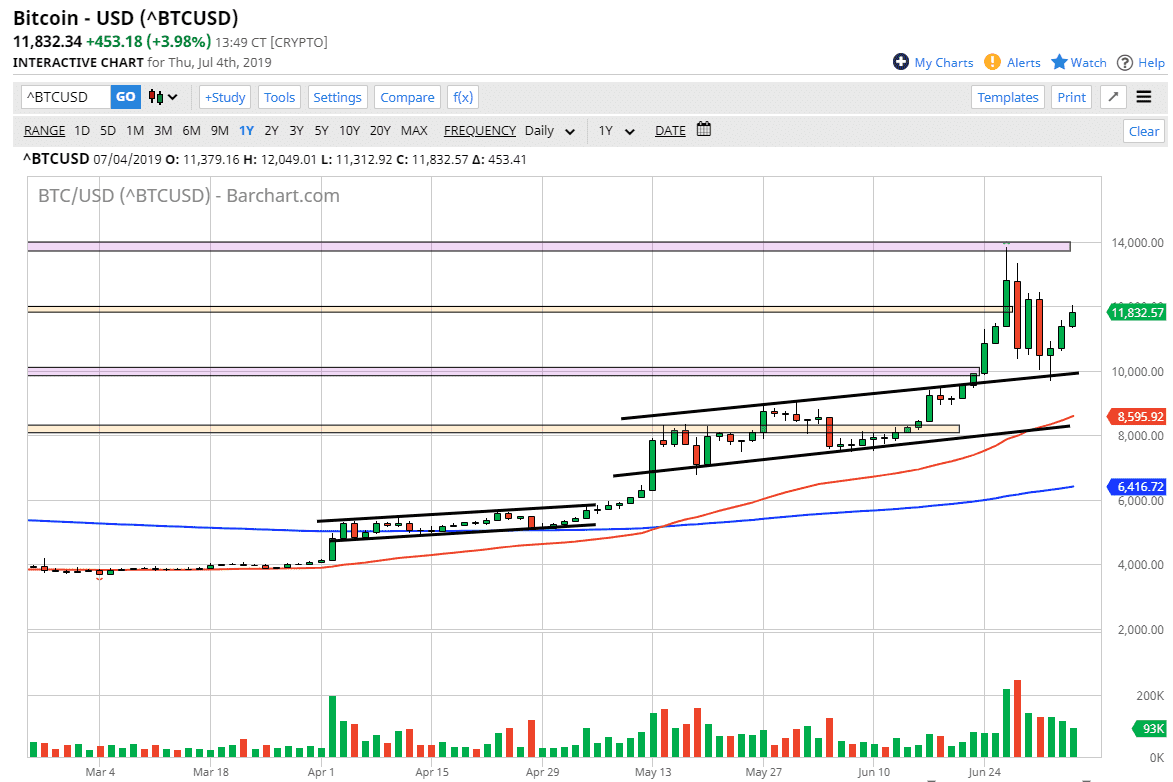

Bitcoin markets rallied again during the trading session on Thursday, which would have been very thin trading due to the Independence Day holiday in the United States. Ultimately, the market looks likely to try to go higher based upon the last couple of the days, as we reached towards the $12,000 level.

As a review, you will see that the Tuesday session initially poked below the $10,000 level, before bouncing significantly to form a hammer. That hammer of course is a very bullish sign as we are sitting on top of a major channel that had been a major feature of the market. Looking at this chart, you can see that we have tested this area and found it to be useful. The hammer is one of my favorite signals, the fact that we broke above there suggests that we were going to go higher and we have since seen that play out.

Going forward, the $12,000 level will cause a bit of resistance, but I do think that we break above there and go looking towards the $13,000 level, followed by the $14,000 level. Short-term pullbacks should continue to find plenty of support and the $10,000 level very well could be a floor in this market right now. Needless to say, if we were to break down below that level it would be very negative for this market and could send Bitcoin much lower.

Most crypto traders don’t pay attention to economic announcements, and much to their peril. The jobs figure comes out early Friday morning, and that of course will dictate with the Federal Reserve does next. Most people believe that they are going to cut interest rates and that has been a driver of the US dollar to the downside, helping crypto. However, if the jobs number causes a bit of concern to those who are looking for dovish central bank actions, that could throw this market into a little bit of disarray.

Longer-term, the 50 day EMA is turned to the upside and it looks as if we will continue to go higher. Short-term pullbacks may be in the cards here, but I think that will just simply offer an opportunity for value hunters to come in and pick this market up. Just make sure that you keep in mind that around 8:30 AM New York time on Friday, we could see a sudden spike in one direction or the other. However, it should not change the overall trend.