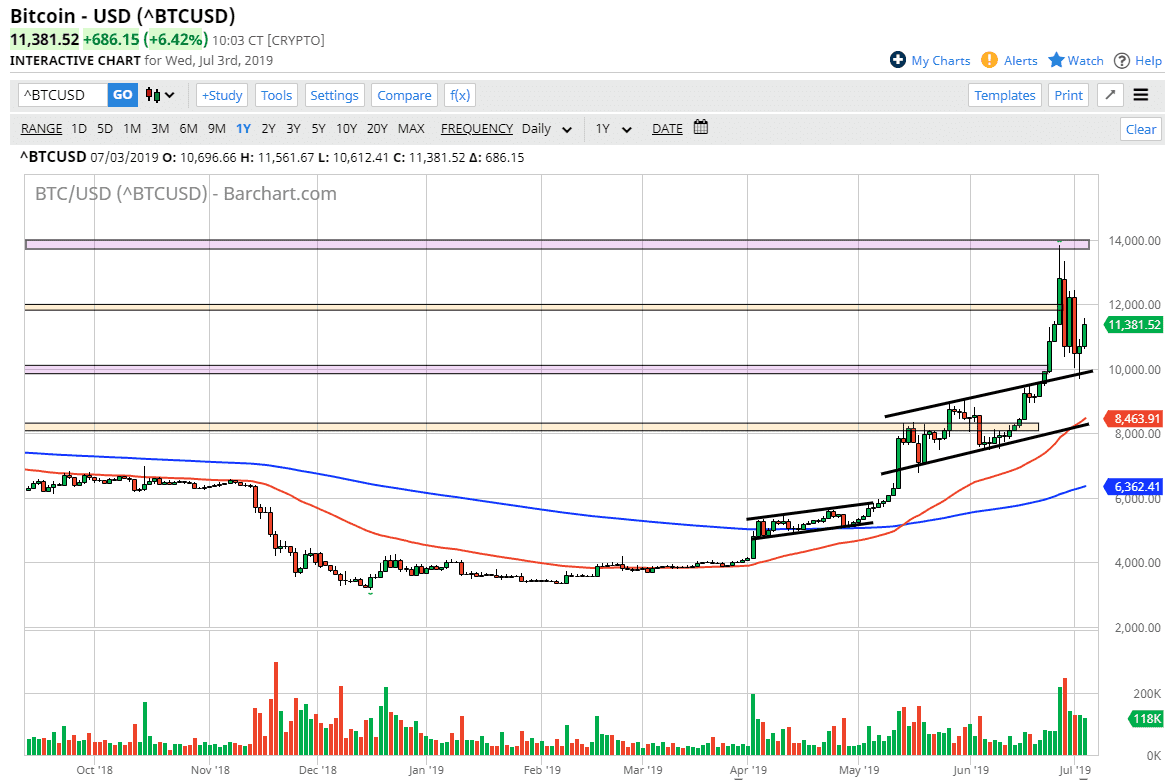

Bitcoin markets rallied during the trading session on Thursday, breaking the top of the hammer from the Tuesday session. The hammer on the Tuesday session was an excellent signal though, as we reached down towards the crucial $10,000 level which of course attracted a lot of attention being a large come around, psychologically significant figure. By bouncing the way they have, it shows that the bitcoin market participants are still very bullish, as we have bounced from a very obvious and significant technical level.

As you can see, I have drawn a significant uptrend channel that coincided with the $10,000 handle. That previous resistance should now be supported as we bounced quite hard. The hammer of course is a bullish sign, and the large, round, psychologically significant figure also attracts a lot of institutional attention. That being said, there is a lot of resistance above, but as we have been grinding back and forth over the last several days, it shows that these large round numbers mean less and less between here and $14,000 above. That being the case, I do think that we can reach towards the highs again and we are trying to build some type of bottoming pattern to shoot this market to the upside.

If we were to break down below the hammer from the Tuesday session, we could drop down to the 50 day EMA. That’s currently near the $8500 level, and the 50 day EMA has been crucial in the past, as it has offered significant support. Now that we are seeing the 50 day EMA tilt to the upside, it’s likely that the trend following participants will continue to look at pullbacks as value.

That being said, the $14,000 level above could be resistance, but I think it’s going to be somewhat short-lived. If we can break above that level, then the market will start his next leg higher. I would expect to grind higher though, because we had gotten a bit ahead of ourselves recently. Another thing that you can look at is the fact that the 50% Fibonacci retracement level has held at the $10,000 level, yet another reason to suggest that this market could go higher.

There is also the possibility that a lot of money is flowing out of China still, and bitcoin has been a vehicle to do such things. Beyond that, the US dollar has softened a bit as the Federal Reserve looks likely to cut interest rates, right along with other central banks around the world.